BMW 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

12 GROUP MANAGEMENT REPORT

12 A Review of the Financial Year

14 General Economic Environment

18 Review of Operations

41 BMW Group – Capital Market

Activities

44 Disclosures relevant for takeovers

and explanatory comments

47 Financial Analysis

47 Internal Management System

49 Earnings Performance

51 Financial Position

53 Net Assets Position

55 Subsequent Events Report

55 Value Added Statement

57 Key Performance Figures

58 Comments on BMW AG

62 Internal Control System and

explanatory comments

63 Risk Management

70 Outlook

Reorientation of purchasing and supplier network

functions

Increasing internationalisation and the growing com-

plexity prevailing on procurement markets as well as

within the production network prompted us to reor-

ganise the purchasing function in 2010 along the lines

oftechnological product groups. The main focuses of

thisstrategy are to concentrate responsibilities world-

wide and further improve our understanding of market

and technological developments.

Numerous model start-ups in 2010

The year 2010 saw a large number of model start-ups

within our worldwide production network. The BMW

Group again rose to the challenge of the various produc-

tion start-ups (the new BMW 5 Series, the new BMW6

Series in Germany, the 5 Series extended wheelbase ver-

sion in China and the new BMW X3 in the USA as well

asthe revised MINI in the UK) by involving the supplier

network at a very early stage. For the BMW 5 Series ex-

tended wheelbase version and the X3, local suppliers

were increasingly trained in advance in order to guaran-

tee the exacting quality requirements and standards de-

manded by the BMW Group right from the commence-

ment of production.

Activities on international procurement markets

Throughout 2010 we continued to expand our global

procurement activities for future vehicle projects. Apart

from Europe, our major sales markets in the NAFTA re-

gion and in Asia were the main areas of focus. As part of

the process of selecting suppliers, we have specifically

given priority to increasingly obtaining supplies for fu-

ture models (BMW X Series, MINI, BMW 1 Series) from

locally based suppliers in each of the production markets.

This strategy allows us to make better use of the inno-

vation potential, but also to generate cost benefits. At the

same time, purchasing in the relevant foreign currency

reduces the currency risk for both the BMW Group and

the supplier. The application of multi-currency ordering

across all regions is also helpful. This is a new approach

in the car industry, with ordering and invoicing of pro-

duction material executed in various currencies depend-

ing on the percentage of added value in each case.

Leader in productivity and technology in

CFRP production

The closer coordination of production and purchasing

activities for the plastic outer skin of the Megacity

Vehicle has enabled us to generate significant synergies

within the process chain. This enables us to decide,

quickly and competently, whether components should

be produced in-house or externally ordered. Expertise in

the areas of production, quality management and pur-

chasing are bundled appropriately, enabling us to achieve

better coordination with our suppliers.

The expansion of the CFRP production at the BMW

Landshut plant and the simultaneous commissioning of

facilities to produce carbon fibre layers marked the

beginning of preparations for the series production of

the Megacity Vehicle, scheduled for launch in 2013. The

Wackersdorf plant also supplies the textile carbon fibre

layers which are processed to make lightweight CFRP

body components at the Landshut plant. The vehicle will

be produced at the BMW Group’s Leipzig plant.

Cooperation arrangements expanded

The cooperation talks between BMW AG and DaimlerAG

concerning the joint purchasing of components are

making good progress. We have identified a double-digit

number of components that could be jointly purchased.

The cooperation arrangements only involve components

that do not contribute towards differentiating between

the two brands and which therefore have no impact on

competition. Plans are underway to extend the coopera-

tion arrangements step by step to cover a larger number

of parts and components.

Joint purchasing in China also presents excellent oppor-

tunities. The two companies intend to work together in

evaluating audit results and checking the qualifications

of suppliers.

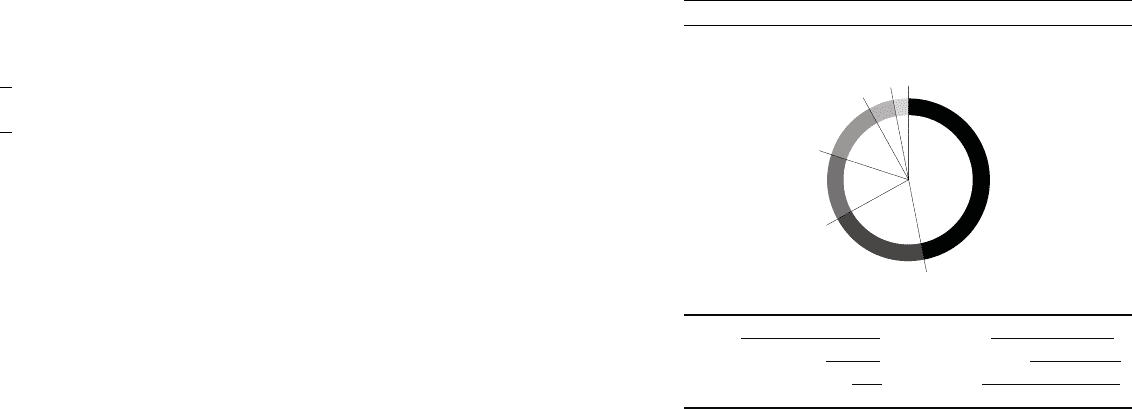

Regional mix of BMW Group purchase volumes 2010

in %, basis: production material

Germany 47 NAFTA 12

Rest of Western Europe 20 Asia / Australia 5

Central and Eastern Europe

13 Africa 3

Germany

Central and

Eastern Europe

Rest of Western Europe

NAFTA

Asia / Australia Africa