BMW 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

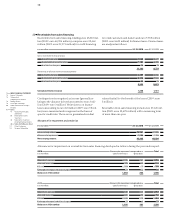

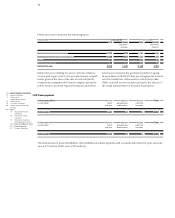

Germany United Kingdom Other

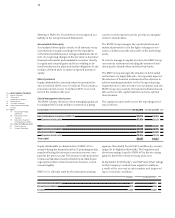

in % 2010 2009 2010 2009 2010 2009

Expected rate of return on plan assets 5.30 6.12 5.40 6.03 5.51 6.55

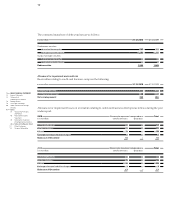

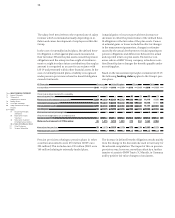

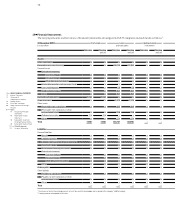

Germany

Defined benefit obligation Plan assets Net obligation

in euro million 2010 2009 2010 2009 2010 2009

1 January 4,619 3,848 – 3,144 –1,155 1,475 2,693

Expense from pension obligations and

expected return on plan assets 321 331 – 202 – 94 119 237

Payments to external funds – – –1,740 –1,642 –1,740 –1,642

Employee contributions 29 27 – 27 – 25 2 2

Payments on account and pension payments –119 –111 8 7 –111 –104

Actuarial gains (–) and losses (+) 441 522 –102 – 234 339 288

Translation differences and other changes 1 2 – –1 1 1

31 December 5,292 4,619 – 5,207 – 3,144 85 1,475

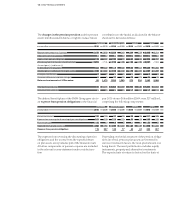

United Kingdom

Defined benefit obligation Plan assets Net obligation

in euro million 2010 2009 2010 2009 2010 2009

1 January 5,743 4,403 – 4,487 – 4,059 1,256 344

Expense from pension obligations and

expected return on plan assets 381 334 – 246 – 257 135 77

Payments to external funds – – –112 – 99 –112 – 99

Employee contributions 1 1 –1 –1 – –

Payments on account and pension payments – 282 – 264 282 264 – –

Actuarial gains (–) and losses (+) – 7 946 –110 – 40 –117 906

Translation differences and other changes 178 323 –138 – 295 40 28

31 December 6,014 5,743 – 4,812 – 4,487 1,202 1,256

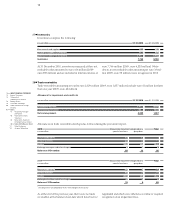

Compared to the expected return of euro 468 million

(2009: euro 370 million), fund assets actually increased in

the financial year 2010 by euro 695 million (2009: increase

in fund assets of euro 659 million) as a result of positive

market price developments, giving rise to actuarial gains

on fund assets of euro 227 million (2009: actuarial gains

of euro 289 million). The actuarial gains on fund assets

compare with actuarial losses of euro 459 million (2009:

actuarial losses of euro 1,464 million) on benefit obliga-

tions. The actuarial losses in 2010 arose mainly as a result

of the application of a lower discount rate in Germany.

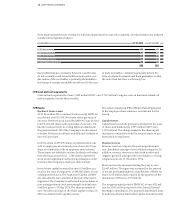

thespecific investment strategy applied to each individual

pension fund. This is determined on the basis of the rates

of return from the individual investment classes taking

account of costs and unplanned risks. This approach re-

sulted in the following expected rates of return on plan

assets (disclosed on the basis of weighted averages):

The level of the pension obligations differs depending

onthe pension system applicable in each country. Since

the state pension system in the United Kingdom only

provides a basic fixed amount benefit, retirement bene-

fits are largely organised in the form of company pen-

sions and arrangements financed by the individual. The

pension benefits in the United Kingdom therefore con-

tain contributions made by the employee.

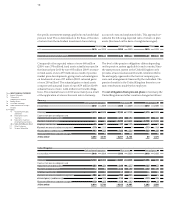

The net obligation from pension plans in Germany, the

United Kingdom and other countries changed as follows: