BMW 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

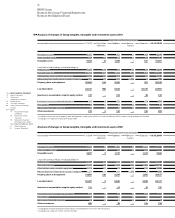

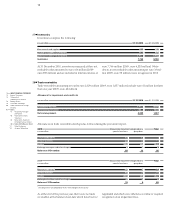

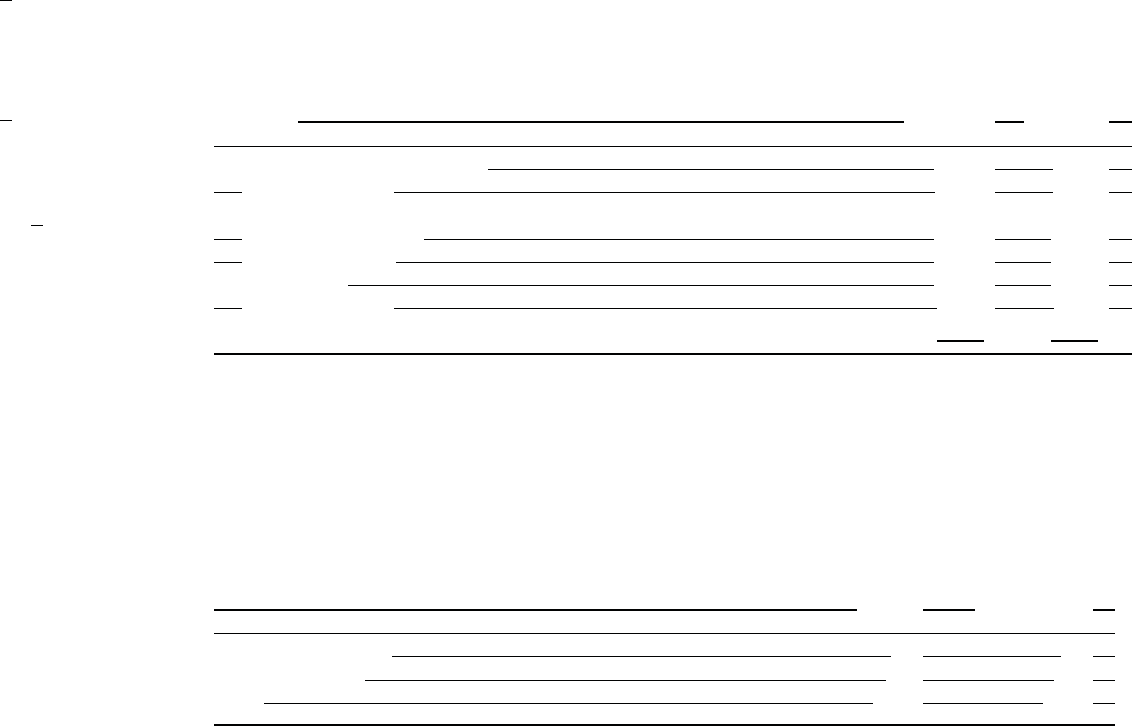

in euro million 31. 12. 2010 31. 12. 2009

Equity attributable to shareholders of BMW AG 23,074 19,902

Proportion of total capital 27.0 % 24.5 %

Non-current financial liabilities 35,833 34,391

Current financial liabilities 26,520 26,934

Total financial liabilities 62,353 61,325

Proportion of total capital 73.0 % 75.5 %

Total capital 85,427 81,227

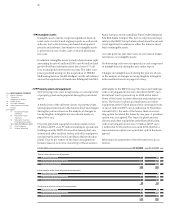

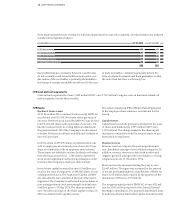

Moody’s Standard & Poor’s

Non-current financial liabilities A3 A –

Current financial liabilities P-2 A -2

Outlook stable stable

Meeting of BMW AG. It is therefore not recognised as a

liability in the Group Financial Statements.

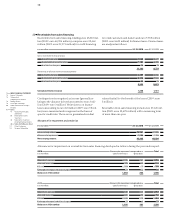

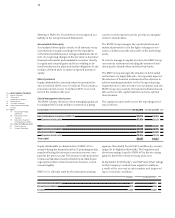

Accumulated other equity

Accumulated other equity consists of all amounts recog-

nised directly in equity resulting from the translation

ofthe financial statements of foreign subsidiaries, the ef-

fects of recognising changes in the fair value of derivative

financial instruments and marketable securities directly

in equity, and actuarial gains and losses relating to de-

fined benefit pension plans and similar obligations. It also

includes deferred taxes on items recognised directly in

equity.

Minority interests

Equity attributable to minority interests amounted to

euro 26 million (2009: euro 13 million). This includes a

minority interest of euro 16 million (2009: euro 6 mil-

lion) in the results for the year.

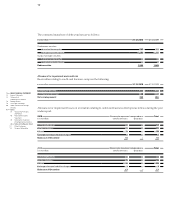

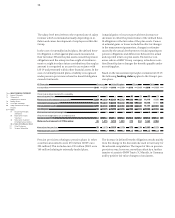

Capital management disclosures

The BMW Group’s objectives when managing capital are

to safeguard the Group’s ability to continue as a going

concern in the long-term and to provide an adequate

return to shareholders.

The BMW Group manages the capital structure and

makes

adjustments to it in the light of changes in eco-

nomic conditions and the risk profile of the underlying

assets.

In order to manage its capital structure, the BMW Group

uses various instruments including the amount of divi-

dends paid to shareholders and share buy-backs.

The BMW Group manages the structure of debt capital

on the basis of a target debt ratio. An important aspect of

the selection of financial instruments is the objective to

achieve matching maturities for the Group’s financing

requirements. In order to reduce non-systematic risk, the

BMW Group uses a variety of financial instruments avail-

able on the world’s capital markets to achieve optimal

diversification.

The capital structure at the end of the reporting period

was as follows:

Equity attributable to shareholders of BMW AG in-

creased

during the financial year by 2.5 percentage points,

mainly reflecting the increase in revenue reserves com-

pared to the previous year. The decrease in the proportion

of financial liabilities mainly reflects the fact that financ-

ing requirements for financial services business only in-

creased slightly.

BMW AG is officially rated by the international rating

agencies, Standard & Poor’s (S & P) and Moody’s, and ad-

judged

to be highly creditworthy. The long-term and

short-term ratings issued to BMW AG by the two rating

agencies have been robust for many years now.

In September 2010 Moody´s and S & P raised their ratings

for the Company’s outlook from negative to stable as

aresult of the recovery of sales markets and improved

macro-economic conditions.