BMW 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

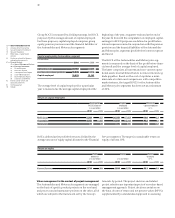

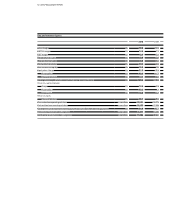

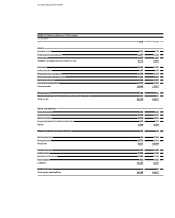

49 GROUP MANAGEMENT REPORT

Group Income Statement

in euro million

2010 2009

Revenues 60,477 50,681

Cost of sales – 49,562 – 45,356

Gross profit 10,915 5,325

Sales and administrative costs – 5,529 – 5,040

Other operating income 766 808

Other operating expenses –1,058 – 804

Profit before financial result 5,094 289

Result from equity accounted investments 98 36

Interest and similar income 685 856

Interest and similar expenses – 966 –1,014

Other financial result – 75 246

Financial result – 258 124

Profit before tax 4,836 413

Income taxes – 1,602 – 203

Net profit 3,234 210

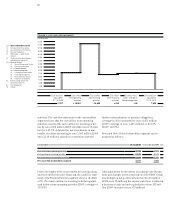

opportunities and risks. Internal project rates of return

and capital values (model rates of return in the case of

vehicle projects) are measured on the basis of cash flows.

Model rates of return are also compared with competi-

tive market values.

In this way, the amount a project will contribute to the

total value of the segment can be measured when the

project decision is taken. Targets and performance are

controlled on the basis of individual cash-flow-related

parameters.

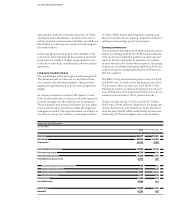

Long-term creation of value

The overall target set for earnings is continuous growth.

The minimum rate of return set for each line of busi-

ness

is used as the relevant

parameter. These periodic

targets are supplementary to project and programme

targets.

For all project decisions reached, the impact of cash

flows

on the model rate of return as well as the impact on

periodic earnings over the long term are documented.

The fact that the performance indicators are also taken

into account ensures consistency within the target and

management model. This approach allows an analysis of

the effect of each project decision on earnings and rates

of return. Multi-project planning data resulting from

these procedures allows ongoing comparison between

multi-period and single-period performance.

Earnings performance

The recovery on international car markets had a positive

impact on earnings in 2010. The BMW Group benefited

from its strong competitive position on international

markets, driven in particular by attractive new vehicle

models offered by the Automobiles segment. The easing

of pressure on international capital markets in 2010 also

helped to improve margins generated in the Financial

Services segment.

The BMW Group recorded a net profit of euro 3,234 mil-

lion (2009: euro 210 million) for the financial year 2010.

The post-tax return on sales was 5.3% (2009: 0.4%).

Earnings per share of common and preferred stock were

euro 4.91 and euro 4.93 respectively (2009: euro 0.31 for

common stock and euro 0.33 for preferred stock).

Group revenues rose by 19.3% to euro 60,477 million

(2009: euro 50,681 million). Adjusted for exchange rate

factors, the increase would have been 14.4%. Revenues

from the sale of BMW, MINI and Rolls-Royce brand cars

climbed by 24.2% due to higher sales volumes. Motor-