BMW 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

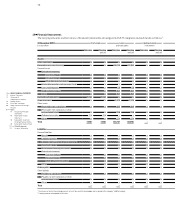

111 GROUP FINANCIAL STATEMENTS

Other

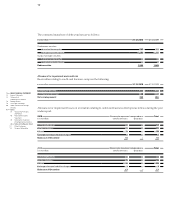

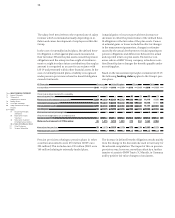

Defined benefit obligation Plan assets Net obligation

in euro million 2010 2009 2010 2009 2010 2009

1 January 569 537 – 346 – 277 223 260

Effect of first-time consolidation 1 – – – 1 –

Expense from pension obligations and

expected return on plan assets 70 62 – 20 –19 50 43

Payments to external funds – – – 35 – 54 – 35 – 54

Employee contributions 2 2 – 2 – 2 – –

Payments on account and pension payments –18 –19 15 15 – 3 – 4

Actuarial gains (–) and losses (+) 25 – 4 –15 –15 10 –19

Translation differences and other changes 53 – 9 – 33 6 20 – 3

31 December 702 569 – 436 – 346 266 223

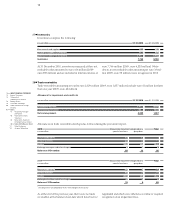

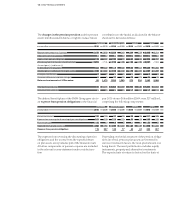

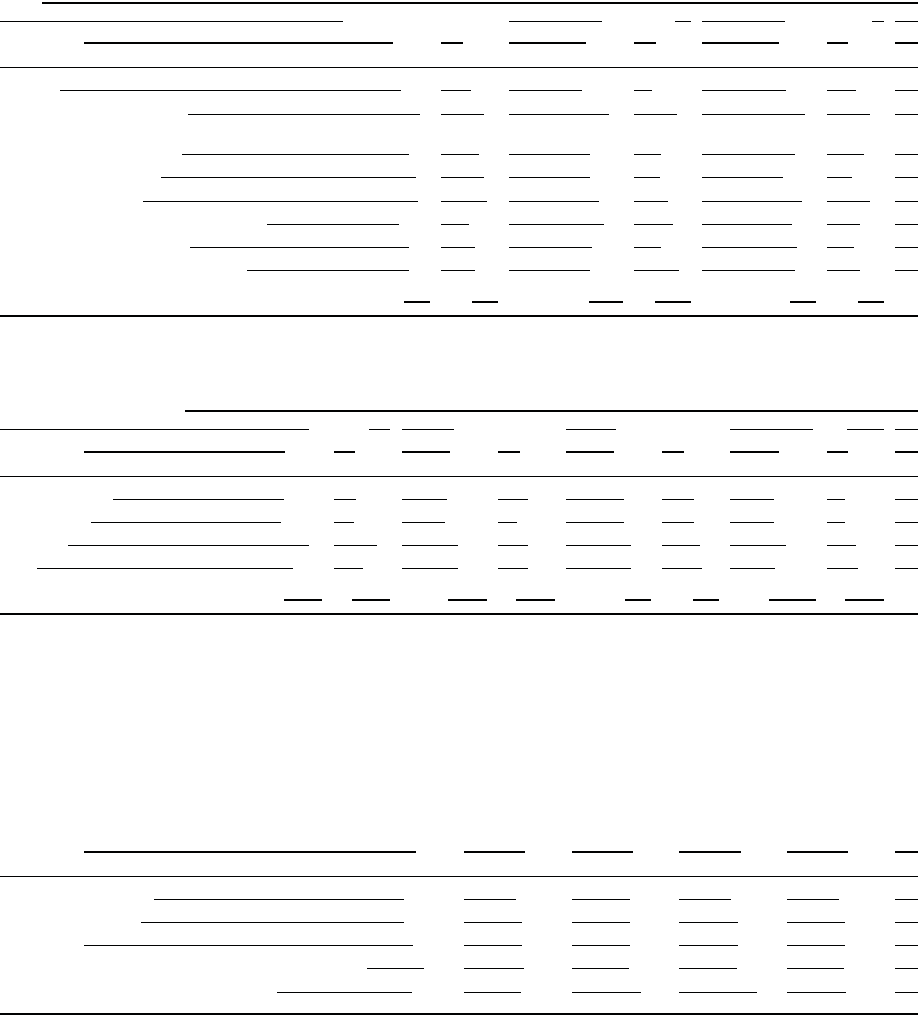

Components of plan assets

Germany United Kingdom Other countries To t a l

in euro million 2010 2009 2010 2009 2010 2009 2010 2009

Equity instruments 1,368 1,020 1,082 823 197 165 2,647 2,008

Debt securities 3,167 1,835 2,843 2,951 153 142 6,163 4,928

Real estate – – 430 315 26 20 456 335

Other 672 289 457 398 60 19 1,189 706

31 December 5,207 3,144 4,812 4,487 436 346 10,455 7,977

Plan assets in Germany, the UK and other countries comprised the following:

A substantial portion of plan assets is invested in debt

s ecurities in order to minimise the effect of capital market

fluctuations. Other investment classes, such as stocks

and shares, serve to generate higher rates of return. This

is necessary to cover risks (such as changes in morbidity

tables) not taken into account in the actuarial assumptions

applied. The financial risk of pension payments having

to be made for longer than the calculated period is also

Actuarial gains on benefit obligations, mostly attributable

to experience adjustments, amounted to euro 76 million

(2009: euro 22 million).

hedged for pensioners in the UK by a so-called “longevity

hedge”.

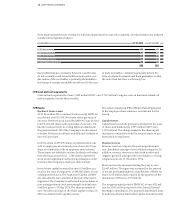

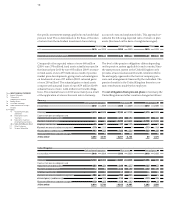

The present value of the defined benefit obligations and

the fair values of fund assets – as well as the actuarial

adjustments made for those two items – have developed

as follows over the last five years:

Experience adjustments relating to fund assets also re-

sulted in actuarial gains of euro 221 million in the finan-

cial year under report (2009: euro 289 million).

in euro million 2010 2009 2008 2007 2006

Defined benefit obligation 12,008 10,931 8,788 10,631 11,430

Fair value of plan assets 10,455 7,977 5,491 6,029 6,432

Net obligation 1,553 2,954 3,297 4,602 4,998

Actuarial gains (–) and losses (+) on defined benefit obligations 459 1,464 – 919 – 557 – 400

Actuarial gains (–) and losses (+) on plan assets – 227 – 289 868 44 –117