The Hartford 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

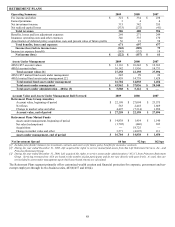

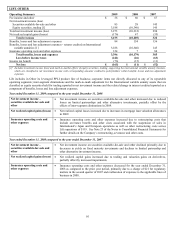

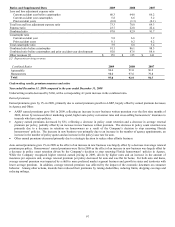

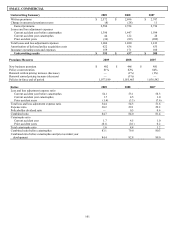

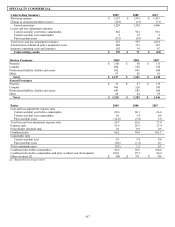

Ratios and Supplemental Data 2009 2008 2007

Loss and loss adjustment expense ratio

Current accident year before catastrophes 68.3 64.8 66.2

Current accident year catastrophes 5.8 6.6 3.2

Prior accident years (0.8) (1.3) (0.1)

Total loss and loss adjustment expense ratio 73.3 70.0 69.3

Expense ratio 23.7 22.8 22.4

Combined ratio 97.0 92.9 91.7

Catastrophe ratio

Current accident year 5.8 6.6 3.2

Prior accident years 0.1 0.2 0.2

Total catastrophe ratio 5.9 6.8 3.4

Combined ratio before catastrophes 91.1 86.1 88.3

Combined ratio before catastrophes and prior accident year development 92.0 87.6 88.6

Other revenues [1] $ 153 $ 135 $ 141

[1] Represents servicing revenues.

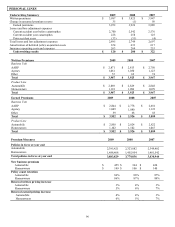

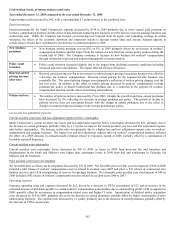

Combined Ratios

2009

2008

2007

Automobile 96.6 91.0 96.2

Homeowners 98.0 97.6 79.8

Total 97.0 92.9 91.7

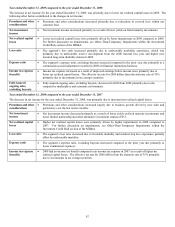

Underwriting results, premium measures and ratios

Year ended December 31, 2009 compared to the year ended December 31, 2008

Underwriting results decreased by $160, with a corresponding 4.1 point increase in the combined ratio.

Earned premiums

Earned premiums grew by 1% in 2009, primarily due to earned premium growth in AARP, largely offset by earned premium decreases

in Agency and Other.

• AARP earned premiums grew $66 in 2009, reflecting an increase in new business written premium over the first nine months of

2009, driven by increased direct marketing spend, higher auto policy conversion rates and cross-selling homeowners’ insurance to

insureds who have auto policies.

• Agency earned premiums decreased by $31, reflecting a decrease in policy count retention and a decrease in average renewal

premium per policy, partially offset by an increase in new business written premium. The decrease in policy count retention was

primarily due to a decrease in retention on homeowners as a result of the Company’ s decision to stop renewing Florida

homeowners’ policies. The increase in new business was primarily due to an increase in the number of agency appointments, an

increase in the number of policy quotes and an increase in the policy issue rate for auto.

• Other earned premiums decreased primarily due to a strategic decision to reduce other affinity business.

Auto earned premiums grew 1% in 2009 as the effect of an increase in new business was largely offset by a decrease in average renewal

premium per policy. Homeowners’ earned premiums were flat in 2009 as the effect of an increase in new business was largely offset by

a decrease in policy count retention driven by the Company’ s decision to stop renewing Florida homeowners’ policies in Agency.

While the Company recognized higher renewal earned pricing in 2009, driven by higher rates and an increase in the amount of

insurance per exposure unit, average renewal premium per policy decreased for auto and was flat for home. For both auto and home,

average renewal premium was impacted by a shift to more preferred market segment business and growth in states and territories with

lower average premium. In addition, average renewal premium was affected by the impact of the economic downturn on consumer

behavior. Among other actions, insureds have reduced their premiums by raising deductibles, reducing limits, dropping coverage and

reducing mileage.