The Hartford 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

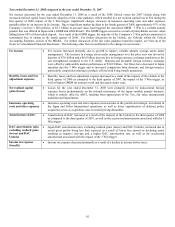

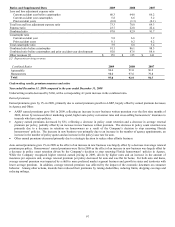

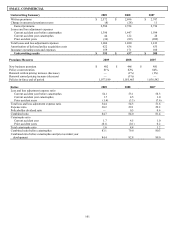

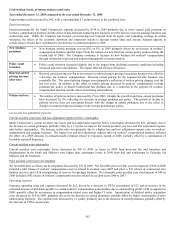

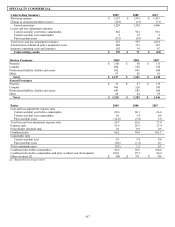

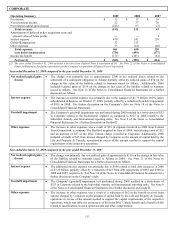

Underwriting results, premium measures and ratios

Year ended December 31, 2009 compared to the year ended December 31, 2008

Underwriting results decreased by $42, with a corresponding 0.7 point increase in the combined ratio.

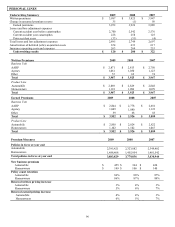

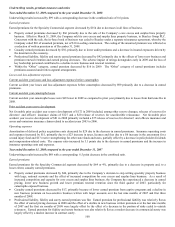

Earned premiums

Earned premiums for the Small Commercial segment decreased by $144 in 2009 primarily due to lower earned audit premium on

workers’ compensation business and the effect of non-renewals outpacing new business over the last two years for package business and

commercial auto. While the Company has focused on increasing new business from its agents and expanding writings in certain

territories, the effects of the economic downturn and competitor actions to increase market share and increase business appetite in

certain classes of risks have contributed to the decrease in earned premiums in 2009.

New business

premium

• New business written premium was up $36, or 8%, in 2009 primarily driven by an increase in workers’

compensation business and the impact from the rollout of a new business owners policy product during the

second half of 2009. The Company continues to increase its new business for workers’ compensation

through refinement of pricing and underwriting appetite in certain markets.

Policy count

retention

• Policy count retention decreased slightly due to the impact from declining economic conditions including

increased mid-term cancellations. The impact affected all lines of business.

Renewal earned

pricing increase

(decrease)

• Renewal earned pricing was flat as an increase in renewal earned pricing for package business was offset by

a decrease for workers’ compensation. Renewal earned pricing for the commercial auto business was

essentially flat. The earned pricing changes were primarily a reflection of written pricing changes over the

last two years. In addition to the effect of written pricing decreases in workers’ compensation, average

premium per policy in Small Commercial has declined due to a reduction in the payrolls of workers’

compensation insureds and the effect of declining endorsements.

Policies in-force • The number of policies-in-force increased by 2% in 2009. Despite the growth in policies, earned premiums

have decreased by 5%, reflecting the decrease in average premium per policy. The growth or decline in

policies in-force does not correspond directly with the change in earned premiums due to the effect of

changes in earned pricing and changes in the average premium per policy.

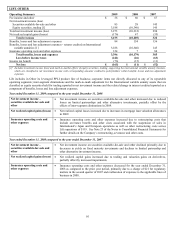

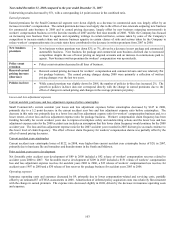

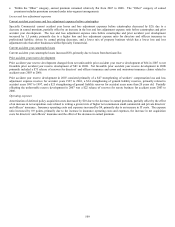

Losses and loss adjustment expenses

Current accident year losses and loss adjustment expenses before catastrophes

Small Commercial’ s current accident year losses and loss adjustment expenses before catastrophes decreased by $51, primarily due to

the decrease in earned premiums, partially offset by a 1.0 point increase in the current accident year loss and loss adjustment expense

ratio before catastrophes. The increase in this ratio was primarily due to a higher loss and loss adjustment expense ratio on workers’

compensation and package business. The higher loss and loss adjustment expense ratio on workers’ compensation business reflected

the effect of a 2009 decrease in estimated audit premium related to exposures earned in 2008, partially offset by a continuation of

favorable expected frequency.

Current accident year catastrophes

Current accident year catastrophe losses decreased by $78 in 2009, as losses in 2008 from hurricane Ike and tornadoes and

thunderstorms in the South and Midwest were higher than catastrophe losses in 2009 from hail and windstorms in Colorado, the

Midwest and the Southeast.

Prior accident year reserve development

Net favorable prior accident year development decreased by $53 in 2009. Net favorable prior accident year development of $36 in 2009

included a $40 release of workers' compensation reserves related to accident years 2007 and prior, a $33 release of commercial auto

liability reserves and a $38 strengthening of reserves for package business. Net favorable prior accident year development of $89 in

2008 included a $92 release of workers' compensation reserves related to accident years 2000 to 2007.

Operating expenses

Insurance operating costs and expenses decreased by $12, driven by a decrease in TWIA assessments of $12 and an increase in the

estimated amount of dividends payable to certain workers’ compensation policyholders due to underwriting profits of $8 recognized in

2008, partially offset by an increase in compensation-related costs and higher IT costs. Amortization of deferred policy acquisition

costs decreased by $14 in 2009, primarily driven by the decrease in earned premiums, partially offset by higher amortization of other

underwriting expenses. The expense ratio increased by 1.1 points, primarily due to the decrease in earned premiums, partially offset by

the decrease in TWIA assessments.