The Hartford 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

• The Wellington subcategory includes insureds that entered into the “Wellington Agreement” dated June 19, 1985. The Wellington

Agreement provided terms and conditions for how the signatory asbestos producers would access their coverage from the

signatory insurers.

• The Other Major Asbestos Defendants subcategory represents insureds included in Tiers 1 and 2, as defined by Tillinghast that are

not Wellington signatories and have not entered into structured settlements with The Hartford. The Tier 1 and 2 classifications are

meant to capture the insureds for which there is expected to be significant exposure to asbestos claims.

• Accounts with future expected exposures greater or less than $2.5 include accounts that are not major asbestos defendants.

• The Unallocated category includes an estimate of the reserves necessary for asbestos claims related to direct insureds that have not

previously tendered asbestos claims to the Company and exposures related to liability claims that may not be subject to an

aggregate limit under the applicable policies.

An account may move between categories from one evaluation to the next. For example, an account with future expected exposure of

greater than $2.5 in one evaluation may be reevaluated due to changing conditions and recategorized as less than $2.5 in a subsequent

evaluation or vice versa.

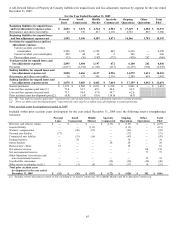

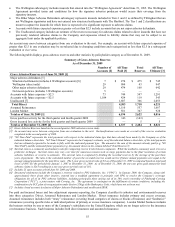

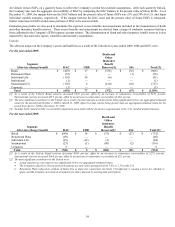

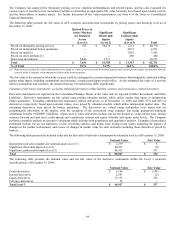

The following table displays gross asbestos reserves and other statistics by policyholder category as of December 31, 2009.

Summary of Gross Asbestos Reserves

As of December 31, 2009

Number of

Accounts [2]

All Time

Paid [3]

Total

Reserves

All Time

Ultimate [3]

Gross Asbestos Reserves as of June 30, 2009 [1]

Major asbestos defendants [5]

Structured settlements (includes 4 Wellington accounts) [6] 7 $ 270 $ 475 $ 745

Wellington (direct only) 29 904 43 947

Other major asbestos defendants 29 474 168 642

No known policies (includes 3 Wellington accounts) 5 — — —

Accounts with future exposure > $2.5 73 744 547 1,291

Accounts with future exposure < $2.5 1,104 424 119 543

Unallocated [7] 1,687 366 2,053

Total Direct 4,503 1,718 6,221

Assumed Reinsurance 1,110 557 1,667

London Market 581 347 928

Total as of June 30, 2009 [1] 6,194 2,622 8,816

Gross paid loss activity for the third quarter and fourth quarter 2009 143 (143) —

Gross incurred loss activity for the third quarter and fourth quarter 2009 — 5 5

Total as of December 31, 2009 [4] $6,337 $ 2,484 $ 8,821

[1] Gross Asbestos Reserves based on the second quarter 2009 asbestos reserve study.

[2] An account may move between categories from one evaluation to the next. Reclassifications were made as a result of the reserve evaluation

completed in the second quarter of 2009.

[3] "All Time Paid" represents the total payments with respect to the indicated claim type that have already been made by the Company as of the

indicated balance sheet date. "All Time Ultimate" represents the Company's estimate, as of the indicated balance sheet date, of the total payments

that are ultimately expected to be made to fully settle the indicated payment type. The amount is the sum of the amounts already paid (e.g. "All

Time Paid") and the estimated future payments (e.g. the amount shown in the column labeled "Total Reserves").

[4] Survival ratio is a commonly used industry ratio for comparing reserve levels between companies. While the method is commonly used, it is not a

predictive technique. Survival ratios may vary over time for numerous reasons such as large payments due to the final resolution of certain

asbestos liabilities, or reserve re-estimates. The survival ratio is computed by dividing the recorded reserves by the average of the past three

years of payments. The ratio is the calculated number of years the recorded reserves would survive if future annual payments were equal to the

average annual payments for the past three years. The 3-year gross survival ratio of 8.0 as of December 31, 2009 is computed based on total paid

losses of $937 for the period from January 1, 2007 to December 31, 2009. As of December 31, 2009, the one year gross paid amount for total

asbestos claims is $245 resulting in a one year gross survival ratio of 10.1.

[5] Includes 25 open accounts at both June 30, 2009 and 2008.

[6] Structured settlements include the Company’s reserves related to PPG Industries, Inc. (“PPG”). In January 2009, the Company, along with

approximately three dozen other insurers, entered into a modified agreement in principle with PPG to resolve the Company’s coverage

obligations for all of its PPG asbestos liabilities, including principally those arising out of its 50% stock ownership of Pittsburgh Corning

Corporation (“PCC”), a joint venture with Corning, Inc. The agreement is contingent on the fulfillment of certain conditions, including the

confirmation of a PCC plan of reorganization under Section 524(g) of the Bankruptcy Code, which have not yet been met.

[7] Includes closed accounts (exclusive of Major Asbestos Defendants) and unallocated IBNR.

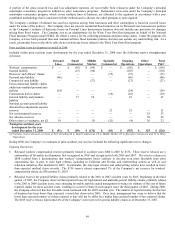

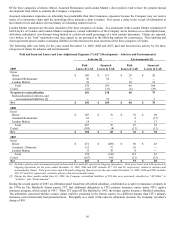

For paid and incurred losses and loss adjustment expenses reporting, the Company classifies its asbestos and environmental reserves

into three categories: Direct, Assumed Reinsurance and London Market. Direct insurance includes primary and excess coverage.

Assumed reinsurance includes both “treaty” reinsurance (covering broad categories of claims or blocks of business) and “facultative”

reinsurance (covering specific risks or individual policies of primary or excess insurance companies). London Market business includes

the business written by one or more of the Company’ s subsidiaries in the United Kingdom, which are no longer active in the insurance

or reinsurance business. Such business includes both direct insurance and assumed reinsurance.