The Hartford 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 8

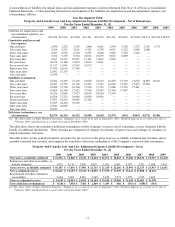

Property & Casualty Segments

Property & Casualty is organized into five reporting segments: the underwriting segments of Personal Lines, Small Commercial, Middle

Market and Specialty Commercial (collectively “Ongoing Operations”); and the Other Operations segment. For a discussion of

Property & Casualty operations including segment performance, see Part II, Item 7, MD&A, Key Performance Measures and Ratios and

the respective segment discussions.

Property & Casualty Principal Products

Property & Casualty provides (1) workers’ compensation, property, automobile, liability, umbrella, specialty casualty, marine, livestock

and fidelity and surety coverages to commercial accounts primarily throughout the United States; (2) professional liability coverage and

directors and officers liability coverage; (3) automobile, homeowners and home-based business coverage to individuals throughout the

United States; and (4) insurance-related services.

The Hartford seeks to distinguish itself in the property and casualty market through its product depth and innovation, distribution

capacity, customer service expertise, and technology for ease of doing business.

Personal Lines provides standard automobile, homeowners and home-based business coverages to individuals across the United States,

including a special program designed exclusively for members of AARP. Over the past three years, The Hartford rolled out new auto

and homeowners products with more coverage options and customized pricing tailored to a customer’ s individual risk. AARP

represents a significant portion of the total Personal Lines business and amounted to earned premiums of $2.8 billion in both 2009 and

2008 and $2.7 billion in 2007. Personal Lines also operates a member contact center for health insurance products offered through the

AARP Health program. In July, 2009, the Company extended the AARP Health program agreement through 2018.

Small Commercial and Middle Market provide workers’ compensation, property, automobile, liability and umbrella coverages under

several different products, primarily throughout the United States. In Small Commercial, some of these coverages are sold together as

part of a single multi-peril package policy called Spectrum. The sale of Spectrum business owners’ package policies and workers’

compensation policies accounts for most of the written premium in the Small Commercial segment. Like Personal Lines, Small

Commercial offers a product with more coverage options and customized pricing based on the policyholder’ s individualized risk

characteristics. Workers’ compensation insurance accounts for the largest share of the written premium in the Middle Market segment.

Small Commercial businesses generally represent companies with up to $5 in annual payroll, $15 in annual revenues or $15 in total

property values while Middle market businesses generally represent companies with greater than $5 in annual payroll, $15 in annual

revenues or $15 in total property values.

Specialty Commercial offers a variety of customized insurance products and risk management services. Specialty Commercial provides

standard commercial insurance products including workers’ compensation, automobile and liability coverages to large-sized companies.

Specialty Commercial also provides professional liability, fidelity, surety and specialty casualty coverages. A significant portion of

specialty casualty business, including workers’ compensation business, is written through large deductible programs where the insured

typically provides collateral to support loss payments made within their deductible. The specialty casualty business also provides

retrospectively-rated programs where the premiums are adjustable based on loss experience. Captive and Specialty Programs within

Specialty Commercial, provides insurance products and services primarily to captive insurance companies, pools and self-insurance

groups. In addition, Specialty Commercial provides third-party administrator services for claims administration, integrated benefits and

loss control through Specialty Risk Services, LLC, a subsidiary of the Company.

The Other Operations segment operates under a single management structure, Heritage Holdings, which is responsible for two related

activities. The first activity is the management of certain subsidiaries and operations of The Hartford that have discontinued writing new

business. The second is the management of claims (and the associated reserves) related to asbestos, environmental and other exposures.

Property & Casualty Marketing and Distribution

Personal Lines reaches diverse markets through multiple distribution channels including direct sales to the consumer, brokers and

independent agents. In direct sales to the consumer, the Company markets its products through a mix of media, including direct

marketing, the internet and advertising in publications. Most of Personal Lines’ direct sales to the consumer are through its exclusive

licensing arrangement with AARP to market automobile, homeowners and home-based business insurance products to AARP’ s nearly

37 million members. The Hartford’ s exclusive licensing arrangement with AARP continues until January 1, 2020 for automobile,

homeowners and home-based business. This agreement provides Personal Lines with an important competitive advantage as

management expects favorable “baby boom” demographics to increase AARP membership during this period.

The Personal Lines Agency business provides customized products and services to customers through a network of independent agents

in the standard personal lines market. Similar to the other Ongoing Operations’ segments, these independent agents are not employees

of The Hartford. An important strategic objective of the Company is to develop common products and processes for all of its personal

lines business regardless of the distribution channel. In 2009, the Company began selling its new Open Road Advantage auto product in

20 states. In those 20 states, the Open Road Advantage auto product is sold across the Company’ s distribution channels, including

directly to AARP members, through independent agents to both AARP members and non-members and directly to non-members in four

pilot states.