The Hartford 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

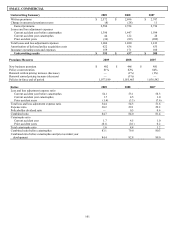

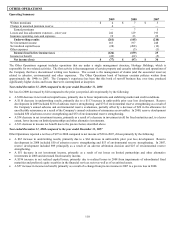

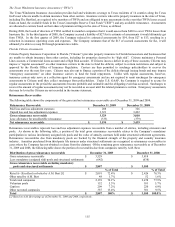

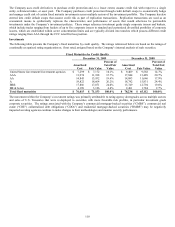

CORPORATE

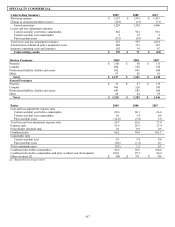

Operating Summary 2009 2008 2007

Fee income $ 13 $ 17 $ 16

Net investment income 22 37 30

Net realized capital gains (losses) (228) 97 (3)

Total revenues (193) 151 43

Amortization of deferred policy acquisition costs and

present value of future profits — — 1

Interest expense 476 341 259

Goodwill impairment 32 323 —

Other expenses 53 (14) (40)

Total expenses 561 650 220

Loss before income taxes (754) (499) (177)

Income tax benefit (171) (101) (61)

Net loss [1] $ (583) $ (398) $ (116)

[1] The year ended December 31, 2009 includes a net loss from Federal Trust Corporation of $6. See Note 22 of the Notes to Consolidated

Financial Statements for further information on the Company’s acquisition of Federal Trust Corporation.

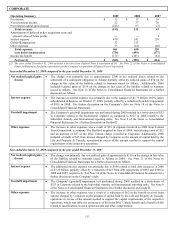

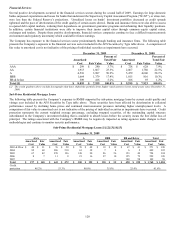

Year ended December 31, 2009 compared to the year ended December 31, 2008

Net realized capital gains

(losses)

• The change was primarily due to approximately $300 in net realized losses related to the

settlement of a contingent obligation to Allianz partially offset by realized gains of $70 on the

change in fair value of the liability related to warrants issued to Allianz. Additionally, 2008

included realized gains of $110 on the change in fair value of the liability related to warrants

issued to Allianz. See Note 21 of the Notes to Consolidated Financial Statements for a further

discussion on Allianz.

Interest expense • The increase in interest expense was primarily due to the issuance of $1.75 billion 10.0% junior

subordinated debentures on October 17, 2008, partially offset by a reduction from debt repayments

of $955 in 2008. For further discussion on the Company’ s debt see Note 14 of the Notes to

Consolidated Financial Statements.

Goodwill impairment • The Company’ s goodwill impairment test performed during 2009 resulted in a write-down of $32

in Corporate related to the Institutional segment as compared to $323 in 2008 related to the

Individual Annuity and International reporting units. See Note 8 of the Notes to Consolidated

Financial Statements for a further discussion on Goodwill.

Other expenses • The increase in other expenses was a result of $19 in expenses incurred in 2009 from Federal

Trust Corporation, a company The Hartford acquired in June of 2009, restructuring costs of $12

and an increase of $17 in the DAC Unlock charge recorded in Corporate. Additionally, 2008

included a benefit of $15 from interest charged by Corporate on the amount of capital held by the

Life and Property & Casualty operations in excess of the amount needed to support the capital

requirements of the respective operations.

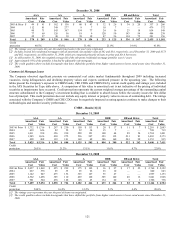

Year ended December 31, 2008 compared to the year ended December 31, 2007

Net realized capital gains

(losses)

• The change was primarily due to a realized gain of approximately $110 on the change in fair value

of the liability related to warrants issued to Allianz in 2008. See Note 21 of the Notes to

Consolidated Financial Statements for a further discussion on Allianz.

Interest expense • The additional interest expense was primarily due to $106 related to total debt issuances in 2008

of $3.25 billion, partially offset by a reduction of $23 from debt repayments of $955 and $300 in

2008 and 2007, respectively. See Note 14 of the Notes to Consolidated Financial Statements for a

further discussion on the Company’ s debt.

Goodwill impairment • The Company’ s goodwill impairment test performed during 2008 resulted in a write-down of

$323 in Corporate related to the Individual Annuity and International reporting units. See Note 8

of the Notes to Consolidated Financial Statements for a further discussion on Goodwill.

Other expenses • The increase in other expenses was a result of a reduction of $62 in the benefit received from

interest charged by Corporate on the amount of capital held by the Life and Property & Casualty

operations in excess of the amount needed to support the capital requirements of the respective

operations, which was offset by an increase of $8 in the DAC Unlock benefit and a benefit of $28

related to modifications to stock option awards and other compensation.