The Hartford 2009 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

II-6

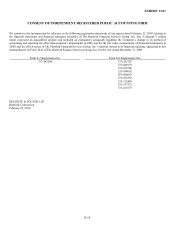

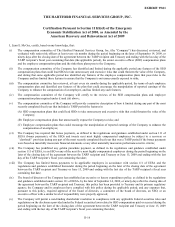

EXHIBIT 12.01

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

COMPUTATION OF RATIOS OF EARNINGS TO FIXED CHARGES

(In millions)

Years Ended December 31,

2009 2008 2007 2006 2005

EARNINGS:

Income (loss) before income taxes $ (1,728) $ (4,591) $ 4,005 $ 3,602 $ 2,985

Less: Undistributed earnings from limited partnerships and other

alternative investments (380) (539) 93 58 21

Add: Total fixed charges, before interest credited to contractholders 537 413 332 354 321

Total earnings, before interest credited to contractholders (811) (3,639) 4,244 3,898 3,285

Interest credited to contractholders [1] 4,947 (8,533) 2,022 3,553 5,671

Total earnings $ 4,136 $ (12,172) $ 6,266 $ 7,451 $ 8,956

FIXED CHARGES:

Interest expense $ 476 $ 343 $ 263 $ 277 $ 252

Interest factor attributable to rentals and other [2] 61 70 69 77 69

Total fixed charges, before interest credited to contractholders 537 413 332 354 321

Interest credited to contractholders [1] 4,947 (8,533) 2,022 3,553 5,671

Total fixed charges 5,484 (8,120) 2,354 3,907 5,992

Preferred stock dividend requirements [3] 249 13 — — —

Total fixed charges and preferred stock dividend requirements,

before interest credited to contractholders

786

426 332 354 321

Total fixed charges and preferred stock dividend requirements $ 5,733 $ (8,107) $ 2,354 $ 3,907 $ 5,992

RATIOS:

Total earnings to total fixed charges [4] NM NM 2.7 1.9 1.5

Total earnings to total fixed charges and preferred stock dividend

requirements [4]

NM

NM 2.7 1.9 1.5

Deficiency of total earnings to total fixed charges [5] $ 1,348 $ 4,052 — — —

Deficiency of total earnings to total fixed charges and preferred stock

dividend requirements [5] $ 1,597 $ 4,065 — — —

Ratios before interest credited to contractholders [6]

Total earnings to total fixed charges [4] NM NM 12.8 11.0 10.2

Total earnings to total fixed charges and preferred stock dividend

requirements [4]

NM

NM 12.8 11.0 10.2

[1] Interest credited to contractholders includes interest credited on general account assets and interest credited on consumer notes. For the year

ended December 31, 2008, the $(8.5) billion in interest credited to contractholders was primarily due to $(10.3) billion in investment income

losses and mark-to-market effects of equity securities, trading, supporting the international variable annuity business.

[2] Interest factor attributable to rental and others includes 1/3 of total rent expense as disclosed in the notes to the financial statements, capitalized

interest and amortization of debt issuance costs.

[3] Preferred stock dividend requirements include preferred stock dividends accrued and accretion of discount on preferred stock issuance.

[4] Ratios of less than one-to-one are presented as “NM” or not meaningful.

[5] Represents additional earnings that would be necessary to result in a one-to-one ratio. These amounts are primarily due to before-tax realized

losses of $(2.0) billion and $(5.9) billion, which includes before-tax impairments of $(1.5) billion and $(4.0) billion, for the years ended December

31, 2009 and 2008, respectively.

[6] These secondary ratios are disclosed for the convenience of fixed income investors and the rating agencies that serve them and is more

comparable to the ratios disclosed by all issuers of fixed income securities.