The Hartford 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

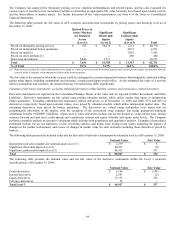

The Company has analyzed the third-party pricing services valuation methodologies and related inputs, and has also evaluated the

various types of securities in its investment portfolio to determine an appropriate fair value hierarchy level based upon trading activity

and the observability of market inputs. For further discussion of fair value measurement, see Note 4 of the Notes to Consolidated

Financial Statements.

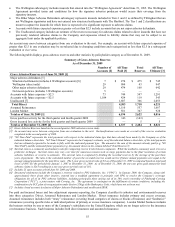

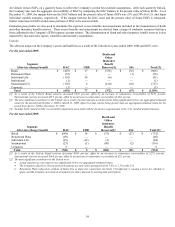

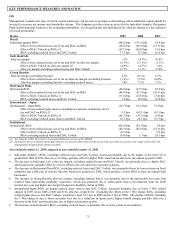

The following table presents the fair value of AFS securities and short-term investments by pricing source and hierarchy level as of

December 31, 2009.

Quoted Prices in

Active Markets

for Identical

Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Priced via third-party pricing services $ 785 $ 58,274 $ 1,711 $ 60,770

Priced via independent broker quotations — — 4,071 4,071

Priced via matrices — — 7,053 7,053

Priced via other methods [1] — — 480 480

Short-term investments 6,846 3,511 — 10,357

Total $ 7,631 $ 61,785 $ 13,315 $ 82,731

% of Total 9.2% 74.7% 16.1% 100.0%

[1] Represents securities for which adjustments were made to reduce prices received from third parties and certain private equity investments that are

carried at the Company’s determination of fair value from inception.

The fair value is the amount at which the security could be exchanged in a current transaction between knowledgeable, unrelated willing

parties using inputs, including assumptions and estimates, a market participant would utilize. As the estimated fair value of a security

utilizes assumptions and estimates, the amount that may be realized may differ significantly.

Valuation of Derivative Instruments, excluding embedded derivatives within liability contracts and reinsurance related derivatives

Derivative instruments are reported on the Consolidated Balance Sheets at fair value and are reported in Other Investments and Other

Liabilities. Derivative instruments are fair valued using pricing valuation models, which utilize market data inputs or independent

broker quotations. Excluding embedded and reinsurance related derivatives, as of December 31, 2009 and 2008, 97% and 94% of

derivatives, respectively, based upon notional values, were priced by valuation models, which utilize independent market data. The

remaining derivatives were priced by broker quotations. The derivatives are valued using mid-market level inputs that are

predominantly observable in the market, with the exception of the customized swap contracts that hedge guaranteed minimum

withdrawal benefits (“GMWB”) liabilities. Inputs used to value derivatives include, but are not limited to, swap interest rates, foreign

currency forward and spot rates, credit spreads and correlations, interest and equity volatility and equity index levels. The Company

performs a monthly analysis on derivative valuations which includes both quantitative and qualitative analysis. Examples of procedures

performed include, but are not limited to, review of pricing statistics and trends, back testing recent trades, analyzing the impacts of

changes in the market environment, and review of changes in market value for each derivative including those derivatives priced by

brokers.

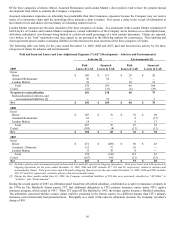

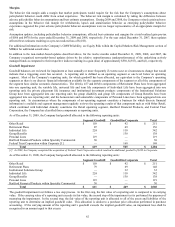

The following table presents the notional value and net fair value of derivative instruments by hierarchy level as of December 31, 2009.

Notional Value Fair Value

Quoted prices in active markets for identical assets (Level 1) $ 2,279 $ 6

Significant observable inputs (Level 2) 40,871 (9)

Significant unobservable inputs (Level 3) 44,917 337

Total $ 88,067 $ 334

The following table presents the notional value and net fair value of the derivative instruments within the Level 3 securities

classification as of December 31, 2009.

Notional Value Fair Value

Credit derivatives $ 5,166 $ (193)

Interest derivatives 2,591 (2)

Equity derivatives 37,135 532

Currency derivatives 25 —

Total Level 3 $ 44,917 $ 337