The Hartford 2009 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-72

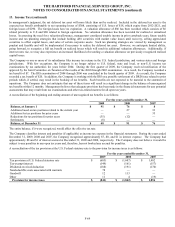

14. Debt (continued)

Contingent Capital Facility

On February 12, 2007, The Hartford entered into a put option agreement (the “Put Option Agreement”) with Glen Meadow ABC Trust,

a Delaware statutory trust (the “ABC Trust”), and LaSalle Bank National Association, as put option calculation agent. The Put Option

Agreement provides The Hartford with the right to require the ABC Trust, at any time and from time to time, to purchase The Hartford’ s

junior subordinated notes (the “Notes”) in a maximum aggregate principal amount not to exceed $500. Under the Put Option

Agreement, The Hartford will pay the ABC Trust premiums on a periodic basis, calculated with respect to the aggregate principal

amount of Notes that The Hartford had the right to put to the ABC Trust for such period. The Hartford has agreed to reimburse the

ABC Trust for certain fees and ordinary expenses. The Company holds a variable interest in the ABC Trust where the Company is not

the primary beneficiary. As a result, the Company did not consolidate the ABC Trust. As of December 31, 2009, The Hartford has not

exercised its right to require ABC Trust to purchase the Notes. As a result, the Notes remain a source of capital for the HFSG Holding

Company.

Commercial Paper and Revolving Credit Facility

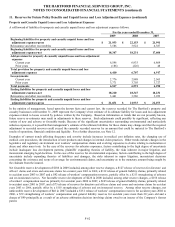

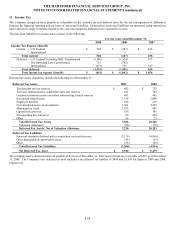

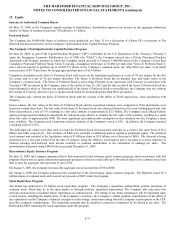

The table below details the Company’ s short-term debt programs and the applicable balances outstanding.

Maximum Available As of Outstanding As of

Effective Expiration December 31,

December 31,

Description Date Date 2009 2008

2009 2008

Commercial Paper

The Hartford 11/10/86 N/A $ 2,000 $ 2,000 $ — $ 374

Revolving Credit Facility

5-year revolving credit facility 8/9/07 8/9/12 1,900 1,900 — —

Total Commercial Paper and Revolving Credit Facility $ 3,900 $ 3,900 $ — $ 374

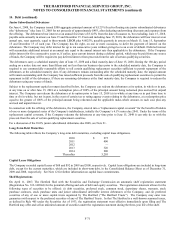

While The Hartford’ s maximum borrowings available under its commercial paper program are $2.0 billion, the Company is dependent

upon market conditions to access short-term financing through the issuance of commercial paper to investors. As of December 31,

2009, the Company has no commercial paper outstanding.

The revolving credit facility provides for up to $1.9 billion of unsecured credit through August 9, 2012, which excludes a $100

commitment from an affiliate of Lehman Brothers. Of the total availability under the revolving credit facility, up to $100 is available to

support letters of credit issued on behalf of The Hartford or other subsidiaries of The Hartford. Under the revolving credit facility, the

Company must maintain a minimum level of consolidated net worth of $12.5 billion. At December 31, 2009, the consolidated net worth

of the Company as calculated in accordance with the terms of the credit facility was $22.9 billion. The definition of consolidated net

worth under the terms of the credit facility, excludes AOCI and includes the Company’ s outstanding junior subordinated debentures and

perpetual preferred securities, net of discount. In addition, the Company must not exceed a maximum ratio of debt to capitalization of

40%. At December 31, 2009, as calculated in accordance with the terms of the credit facility, the Company’ s debt to capitalization ratio

was 15.3%. Quarterly, the Company certifies compliance with the financial covenants for the syndicate of participating financial

institutions. As of December 31, 2009, the Company was in compliance with all such covenants.

The Hartford’ s Life Japan operations also maintain a line of credit in the amount of $54, or ¥5 billion, which expires January 4, 2011 in

support of the subsidiary operations.

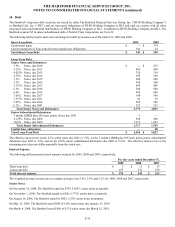

Consumer Notes

In 2008, the Company made the decision to discontinue future issuances of consumer notes; this decision does not impact consumer

notes currently outstanding. Institutional began issuing consumer notes through its Retail Investor Notes Program in September 2006.

A consumer note is an investment product distributed through broker-dealers directly to retail investors as medium-term, publicly traded

fixed or floating rate, or a combination of fixed and floating rate, notes. Consumer notes are part of the Company’ s spread-based

business and proceeds are used to purchase investment products, primarily fixed rate bonds. Proceeds are not used for general operating

purposes. Consumer notes maturities may extend up to 30 years and have contractual coupons based upon varying interest rates or

indexes (e.g. consumer price index) and may include a call provision that allows the Company to extinguish the notes prior to its

scheduled maturity date. Certain Consumer notes may be redeemed by the holder in the event of death. Redemptions are subject to

certain limitations, including calendar year aggregate and individual limits. The aggregate limit is equal to the greater of $1 or 1% of the

aggregate principal amount of the notes as of the end of the prior year. The individual limit is $250 thousand per individual. Derivative

instruments are utilized to hedge the Company’ s exposure to market risk in accordance with Company policy.

As of December 31, 2009 and 2008, $1,136 and $1,210, respectively, of consumer notes were outstanding. As of December 31, 2009,

these consumer notes have interest rates ranging from 4% to 6% for fixed notes and, for variable notes, based on December 31, 2009

rates, notes indexed to the consumer price index plus 80 to 260 basis points, or indexed to the S&P 500, Dow Jones Industrials, foreign

currency, or the Nikkei 225. The aggregate maturities of consumer notes are as follows: $24 in 2010, $120 in 2011, $274 in 2012, $200

in 2013, and $518 thereafter. For 2009, 2008 and 2007, interest credited to holders of consumer notes was $51, $59 and $11,

respectively.