The Hartford 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

The Company is also exposed to credit spread risk related to security market price and cash flows associated with changes in credit

spreads. Credit spread widening will reduce the fair value of the investment portfolio and will increase net investment income on new

purchases. If issuer credit spreads increase significantly or for an extended period of time, it may result in higher impairment losses.

Credit spread tightening will reduce net investment income associated with new purchases of fixed maturities and increase the fair value

of the investment portfolio. For further discussion of sectors most significantly impacted, see the Investment Credit Risk section of the

MD&A. Also, for a discussion of the movement of credit spread impacts on the Company’ s statutory financial results as it relates to the

accounting and reporting for market value fixed annuities, see the Capital Resources & Liquidity section of the MD&A.

Equity Risk

The Company does not have significant equity risk exposure from invested assets. The Company’ s primary exposure to equity risk

relates to the potential for lower earnings associated with certain of the Life’ s businesses such as variable annuities where fee income is

earned based upon the fair value of the assets under management. During 2009, Life’ s fee income declined $555 or 11%. In addition,

Life offers certain guaranteed benefits, primarily associated with variable annuity products, which increases the Company’ s potential

benefit exposure as the equity markets decline.

The Company is also subject to equity risk based upon the assets that support its pension plans. The asset allocation mix is reviewed on

a periodic basis. In order to minimize risk, the pension plans maintain a listing of permissible and prohibited investments. In addition,

the pension plans have certain concentration limits and investment quality requirements imposed on permissible investment options. For

further discussion of equity risk associated with the pension plans, see Pension and Other Postretirement Benefit Obligations within the

Critical Accounting Estimates section of the MD&A and Note 17 of the Notes to Consolidated Financial Statements.

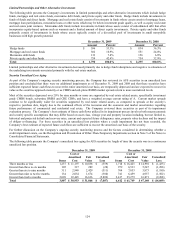

Foreign Currency Exchange Risk

The Company’ s foreign currency exchange risk is related to non–U.S. dollar denominated investments, which primarily consist of fixed

maturity investments, the investment in and net income of the Japanese Life and U.K. Life operations, and non-U.S. dollar denominated

liability contracts, including its GMDB, GMAB, GMWB and GMIB benefits associated with its Japanese and U.K. variable annuities,

and a yen denominated individual fixed annuity product. A portion of the Company’ s foreign currency exposure is mitigated through

the use of derivatives.

Fixed Maturity Investments

The risk associated with the non-U.S. dollar denominated fixed maturities relates to potential decreases in value and income resulting

from unfavorable changes in foreign exchange rates. The fair value of the non-U.S. dollar denominated fixed maturities, which are

primarily denominated in euro, sterling, yen and Canadian dollars, at December 31, 2009 and 2008, were approximately $1.2 billion and

$3.8 billion, respectively.

In order to manage its currency exposures, the Company enters into foreign currency swaps and forwards to hedge the variability in cash

flows associated with certain foreign denominated fixed maturities. These foreign currency swap and forward agreements are structured

to match the foreign currency cash flows of the hedged foreign denominated securities. At December 31, 2009 and 2008, the derivatives

used to hedge currency exchange risk related to non-U.S. dollar denominated fixed maturities had a total notional amount of $480 and

$1.6 billion, respectively, and total fair value of $(26) and $39, respectively.

Based on the fair values of the Company’ s non-U.S. dollar denominated securities and derivative instruments as of December 31, 2009

and 2008, management estimates that a 10% unfavorable change in exchange rates would decrease the fair values by a before-tax total

of approximately $62 and $205, respectively. The estimated impact was based upon a 10% change in December 31 spot rates. The

selection of the 10% unfavorable change was made only for illustration of the potential hypothetical impact of such an event and should

not be construed as a prediction of future market events. Actual results could differ materially from those illustrated above due to the

nature of the estimates and assumptions used in the above analysis.

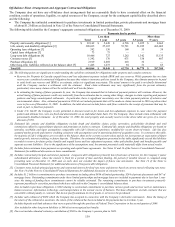

Liabilities

The Company’ s Life operations issued non-U.S. dollar denominated funding agreement liability contracts. The Company hedges the

foreign currency risk associated with these liability contracts with currency rate swaps. At December 31, 2009 and 2008, the derivatives

used to hedge foreign currency exchange risk related to foreign denominated liability contracts had a total notional amount of $814 and

$820, respectively, and a total fair value of $(2) and $(76), respectively.

The Company enters into foreign currency forward and option contracts that convert euros to yen in order to economically hedge the

foreign currency risk associated with certain Japanese variable annuity products. As of December 31, 2009 and 2008, the derivatives

used to hedge foreign currency risk associated with Japanese variable annuity products had a total notional amount of $257 and $259,

respectively, and a total fair value of ($8) and $35, respectively.