The Hartford 2009 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

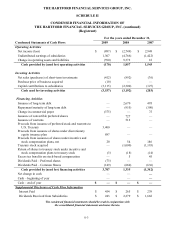

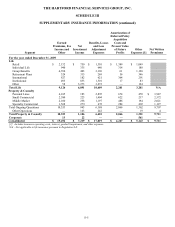

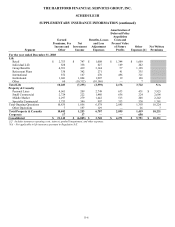

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-89

22. Acquisition of Federal Trust Corporation

On June 24, 2009, the Company acquired 100% of the equity interests in Federal Trust Corporation (“FTC”), a savings and loan holding

company, for $10, enabling the Company to participate in the CPP. The acquisition resulted in goodwill of $168. The goodwill

generated, which is tax deductible, was due, in part, to the fair value discount on mortgage loans acquired in comparison to their

expected cash flows. Mortgage loans acquired were fair valued at $288. Contractual cash flows from the mortgage loans acquired were

$450. The Company’ s best estimate of contractual cash flows not expected to be collected at the acquisition date was $129. Other

assets acquired included $27 of fixed maturity securities, $46 of short-term investments and $3 of cash. Liabilities assumed included

other liabilities of $389 in bank deposits and $149 in Federal Home Loan Bank advances and long-term debt of $25. The acquired

assets and liabilities have been stated at fair value. These fair values are subject to adjustment based upon management’ s subsequent

receipt of additional information but are not expected to be material. The Company expects to be completed with its fair value estimates

as of June 30, 2010. The Company contributed $185 to FTC in June 2009 and received $20 in full repayment of amounts lent to FTC in

March 2009. In the third quarter of 2009, The Hartford contributed an additional $10 to FTC. Revenue and earnings of FTC are

immaterial to the Company’ s consolidated financial statements.

Federal Trust Bank, an indirect wholly-owned subsidiary (the “Bank”), is subject to certain restrictions on the amount of dividends that

it may declare and distribute to The Hartford without prior regulatory notification or approval.

The Bank is also subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet

minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if

undertaken, could have a direct material effect on the Bank’ s financial statements. Under capital adequacy guidelines and the regulatory

framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of the Bank’ s

assets, liabilities and certain off-balance-sheet items as calculated under regulatory accounting practices. The Bank’ s capital amounts

and classification are also subject to qualitative judgments by the regulators about components, risk weightings and other factors.

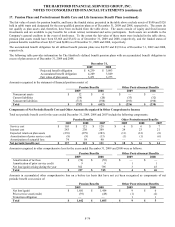

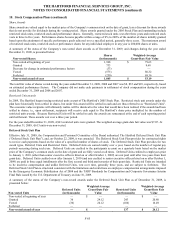

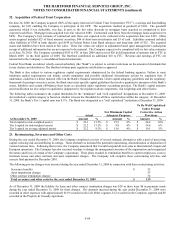

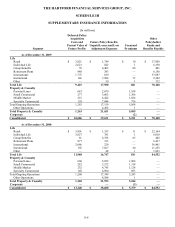

The following tables summarize the capital thresholds for the “minimum” and “well capitalized” designations at December 31, 2009.

An institution’ s capital category is based on whether it meets the threshold for all three capital ratios within the category. At December

31, 2009, the Bank’ s Tier 1 capital ratio was 8.3%. The Bank was designated as a “well capitalized” institution at December 31, 2009.

To Be Well Capitalized

Under Prompt

For Minimum Capital Corrective Action

Actual Adequacy Purposes Provisions

At December 31, 2009 Amount % Amount % Amount %

Total capital (to risk-weighted assets) $ 32.3 13.2% $ 19.5 8% $ 24.4 10%

Tier I capital (to risk-weighted assets) $ 32.2 13.2% $ 9.8 4% $ 14.6 6%

Tier I capital (to average adjusted assets) $ 32.2 8.3% $ 15.6 4% $ 19.5 5%

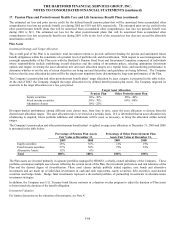

23. Restructuring, Severance and Other Costs

During the year ended December 31, 2009, the Company completed a review of several strategic alternatives with a goal of preserving

capital, reducing risk and stabilizing its ratings. These alternatives included the potential restructuring, discontinuation or disposition of

various business lines. Following that review, the Company announced that it would suspend all new sales in International’ s Japan and

European operations. The Company has also executed on plans to change the management structure of the organization and reorganized

the nature and focus of certain of the Company’ s operations. These plans resulted in termination benefits to current employees, costs to

terminate leases and other contracts and asset impairment charges. The Company will complete these restructuring activities and

execute final payment by December 2010.

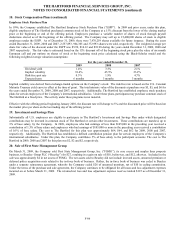

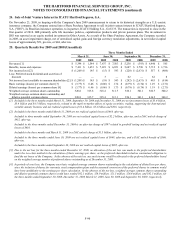

The following pre-tax charges were incurred during the year ended December 31, 2009 in connection with these restructuring activities:

Severance benefits $ 52

Asset impairment charges 53

Other contract termination charges 34

Total severance and other costs for the year ended December 31, 2009 $ 139

As of December 31, 2009 the liability for lease and other contract termination charges was $28 as there were $6 in payments made

during the year ended December 31, 2009 for these charges. The amounts incurred during the year ended December 31, 2009 were

recorded in other expenses with approximately $119 recorded in the Life Other segment, $12 recorded in the Corporate segment and $8

recorded in the Property & Casualty operations.