The Hartford 2009 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-35

5. Investments and Derivative Instruments (continued)

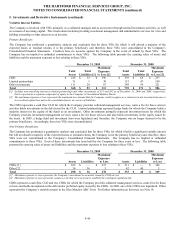

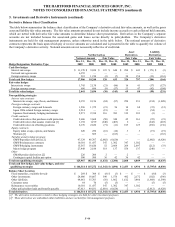

Credit Risk

The Company’ s derivative counterparty exposure policy establishes market-based credit limits, favors long-term financial stability and

creditworthiness and typically requires credit enhancement/credit risk reducing agreements. Credit risk is measured as the amount owed

to the Company based on current market conditions and potential payment obligations between the Company and its counterparties. For

each legal entity of the Company credit exposures are generally quantified daily, netted by counterparty and collateral is pledged to and

held by, or on behalf of, the Company to the extent the current value of derivatives exceeds the contractual thresholds which do not

exceed $10. The Company also minimizes the credit risk in derivative instruments by entering into transactions with high quality

counterparties rated A2/A or better, which are monitored and evaluated by the Company’ s risk management team and reviewed by

senior management. In addition, the Company monitors counterparty credit exposure on a monthly basis to ensure compliance with

Company policies and statutory limitations. The Company also maintains a policy of requiring that derivative contracts, other than

exchange traded contracts, certain currency forward contracts, and certain embedded derivatives, be governed by an International Swaps

and Derivatives Association Master Agreement which is structured by legal entity and by counterparty and permits right of offset.

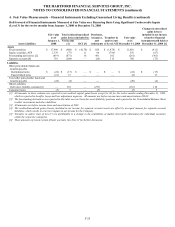

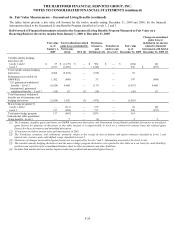

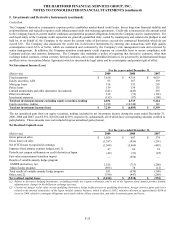

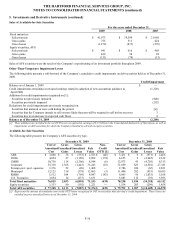

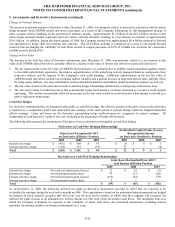

Net Investment Income (Loss)

For the years ended December 31,

(Before-tax) 2009 2008 2007

Fixed maturities $3,618 $ 4,310 $4,653

Equity securities, AFS 93 167 139

Mortgage loans 316 333 293

Policy loans 139 139 135

Limited partnerships and other alternative investments (341) (445) 255

Other investments 318 (72) (161)

Investment expenses (112) (97) (100)

Total net investment income excluding equity securities, trading 4,031 4,335 5,214

Equity securities, trading 3,188 (10,340) 145

Total net investment income (loss) $7,219 $ (6,005) $5,359

The net unrealized gain (loss) on equity securities, trading, included in net investment income during the years ended December 31,

2009, 2008 and 2007, was $3,391, $(9,626) and $(539), respectively, substantially all of which have corresponding amounts credited to

policyholders. These amounts were not included in gross unrealized gains (losses).

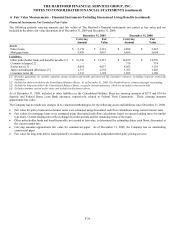

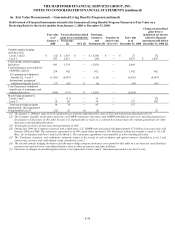

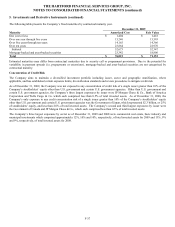

Net Realized Capital Losses

For the years ended December 31,

(Before-tax) 2009 2008 2007

Gross gains on sales $1,056 $ 607 $374

Gross losses on sales (1,397) (856) (291)

Net OTTI losses recognized in earnings (1,508) (3,964) (483)

Japanese fixed annuity contract hedges, net [1] 47 64 18

Periodic net coupon settlements on credit derivatives/Japan (49) (33) (25)

Fair value measurement transition impact — (650) —

Results of variable annuity hedge program

GMWB derivatives, net 1,526 (713) (286)

Macro hedge program (895) 74 (12)

Total results of variable annuity hedge program 631 (639) (298)

Other, net [2] (790) (447) (289)

Net realized capital losses $(2,010) $ (5,918) $(994)

[1] Relates to derivative hedging instruments, excluding periodic net coupon settlements, and is net of the Japanese fixed annuity product liability

adjustment for changes in the dollar/yen exchange spot rate.

[2] Consists of changes in fair value on non-qualifying derivatives, hedge ineffectiveness on qualifying derivatives, foreign currency gains and losses

related to the internal reinsurance of the Japan variable annuity business, which is offset in AOCI, valuation allowances, approximately $300 of

losses in 2009 related to contingent obligations associated with the Allianz transaction, and other investment gains and losses.