The Hartford 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

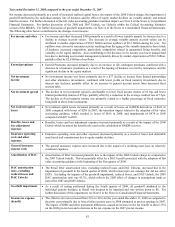

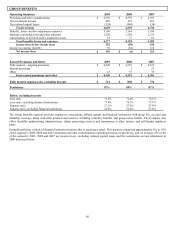

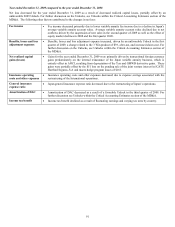

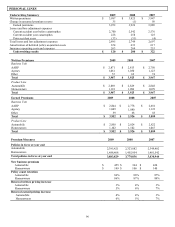

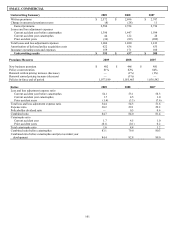

Year ended December 31, 2008 compared to the year ended December 31, 2007

Net income decreased for the year ended December 31, 2008 as a result of the 2008 Unlock versus the 2007 Unlock along with

increased realized capital losses from the adoption of fair value guidance, which resulted in a net realized capital loss of $34 during the

first quarter of 2008, impact of the 3 Win trigger, impairment charges, increases in insurance operating costs and other expenses,

partially offset by an increase in fee income. Due to significant market declines in the fourth quarter of 2008, approximately 97% of the

Company’ s in-force 3 Win policies, or $3.1 billion in account value, had triggered the associated GMIB. 3 Win is a variable annuity

product that was offered in Japan with a GMIB and GMAB rider. The GMIB trigger occurred as a result of policyholder account values

falling below 80% of their initial deposit. As a result of the GMIB trigger, the majority of the Company’ s 3 Win policies annuitized or

surrendered free of charge in the fourth quarter of 2008. For further discussion on the Unlock, see Unlocks within the Critical

Accounting Estimates section of the MD&A. For further discussion of the fair value guidance transition impact, see Note 4a of the

Notes to Consolidated Financial Statements. The following other factors contributed to the changes in net income:

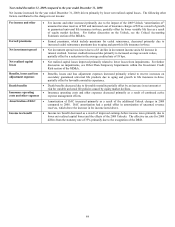

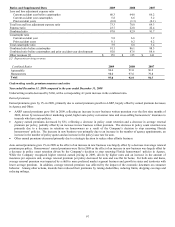

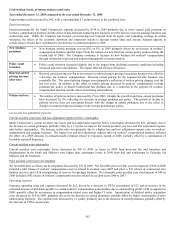

Fee income • Fee income increased primarily due to growth in Japan’ s variable annuity average assets under

management. The increase in average assets under management over the prior year was driven by

deposits of $3.0 billion and a $6.6 billion increase due to foreign currency exchange translation as the

yen strengthened compared to the U.S. dollar. Deposits and favorable foreign currency exchange

were offset by unfavorable market performance of $10.9 billion. Net flows have decreased in Japan

annuities due the 3 Win trigger and to increased competition from domestic and foreign insurers,

particularly competition relating to products offered with living benefit guarantees.

Benefits, losses and loss

adjustment expenses

• Benefits, losses and loss adjustment expense increased as a result of the impacts of the Unlock in the

third quarter of 2008 as compared to the third quarter of 2007, the impact of the 3 Win trigger, as

well as higher GMDB net amount at risk and increased claims costs.

Net realized capital

gains (losses)

• Losses for the year ended December 31, 2008 were primarily driven by transactional foreign

currency losses predominately on the internal reinsurance of the Japan variable annuity business,

which is entirely offset in AOCI, resulting from appreciation of the Yen, fair value measurement

transition and impairments.

Insurance operating

costs and other expenses

• Insurance operating costs and other expenses increased due to the growth and strategic investment in

the Japan and Other International operations, as well as lower capitalization of deferred policy

acquisition costs, as acquisition costs exceeded pricing allowables.

Amortization of DAC • Amortization of DAC increased as a result of the impacts of the Unlock in the third quarter of 2008

as compared to the third quarter of 2007, as well as the accelerated amortization associated with the 3

Win trigger.

DAC amortization ratio,

excluding realized gains

(losses) and DAC

Unlocks

• Japan DAC amortization ratio, excluding realized gains (losses) and DAC Unlocks, increased due to

actual gross profits being less than expected as a result of lower fees earned on declining assets

resulting in negative true-ups and a higher DAC amortization rate, as well as the accelerated

amortization associated with the impact of the 3 Win trigger.

Income tax expense

(benefit)

• Income tax expense decreased primarily as a result of a decline in income before taxes.