The Hartford 2009 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-67

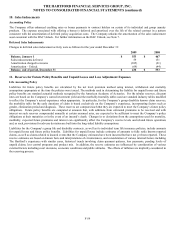

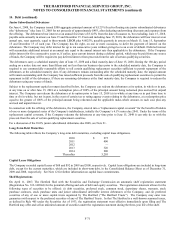

12. Commitments and Contingencies (continued)

Guaranty Fund and Other Insurance-related Assessments

In all states, insurers licensed to transact certain classes of insurance are required to become members of a guaranty fund. In most states,

in the event of the insolvency of an insurer writing any such class of insurance in the state, members of the funds are assessed to pay

certain claims of the insolvent insurer. A particular state’ s fund assesses its members based on their respective written premiums in the

state for the classes of insurance in which the insolvent insurer was engaged. Assessments are generally limited for any year to one or

two percent of the premiums written per year depending on the state.

Liabilities for guaranty fund and other insurance-related assessments are accrued when an assessment is probable, when it can be

reasonably estimated, and when the event obligating the Company to pay an imposed or probable assessment has occurred. Liabilities

for guaranty funds and other insurance-related assessments are not discounted and are included as part of other liabilities in the

Consolidated Balance Sheets. As of December 31, 2009 and 2008, the liability balance was $111 and $128, respectively. As of

December 31, 2009 and 2008, $18 and $17, respectively, related to premium tax offsets were included in other assets.

Derivative Commitments

Certain of the Company’ s derivative agreements contain provisions that are tied to the financial strength ratings of the individual legal

entity that entered into the derivative agreement as set by nationally recognized statistical rating agencies. If the insurance operating

entity’ s financial strength were to fall below certain ratings, the counterparties to the derivative agreements could demand immediate

and ongoing full collateralization and in certain instances demand immediate settlement of all outstanding derivative positions traded

under each impacted bilateral agreement. The settlement amount is determined by netting the derivative positions transacted under each

agreement. If the termination rights were to be exercised by the counterparties, it could impact the insurance operating entity’ s ability to

conduct hedging activities by increasing the associated costs and decreasing the willingness of counterparties to transact with the

insurance operating entity. The aggregate fair value of all derivative instruments with credit-risk-related contingent features that are in a

net liability position as of December 31, 2009, is $655. Of this $655, the insurance operating entities have posted collateral of $591 in

the normal course of business. Based on derivative market values as of December 31, 2009, a downgrade of one level below the current

financial strength ratings by either Moody’ s or S&P could require approximately an additional $50 to be posted as collateral. Based on

derivative market values as of December 31, 2009, a downgrade by either Moody’ s or S&P of two levels below the insurance operating

entities’ current financial strength ratings could require approximately an additional $70 of assets to be posted as collateral. These

collateral amounts could change as derivative market values change, as a result of changes in our hedging activities or to the extent

changes in contractual terms are negotiated. The nature of the collateral that we may be required to post is primarily in the form of U.S.

Treasury bills and U.S. Treasury notes.