The Hartford 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

INVESTMENT CREDIT RISK

The Company has established investment credit policies that focus on the credit quality of obligors and counterparties, limit credit

concentrations, encourage diversification and require frequent creditworthiness reviews. Investment activity, including setting of policy

and defining acceptable risk levels, is subject to regular review and approval by senior management.

The Company invests primarily in securities which are rated investment grade and has established exposure limits, diversification

standards and review procedures for all credit risks including borrower, issuer and counterparty. Creditworthiness of specific obligors is

determined by consideration of external determinants of creditworthiness, typically ratings assigned by nationally recognized ratings

agencies and is supplemented by an internal credit evaluation. Obligor, asset sector and industry concentrations are subject to

established Company limits and are monitored on a regular basis.

The Company is not exposed to any credit concentration risk of a single issuer greater than 10% of the Company’ s stockholders’ equity

other than U.S. government and government agencies backed by the full faith and credit of the U.S. government. For further discussion

of concentration of credit risk, see the Concentration of Credit Risk section in Note 5 of the Notes to Consolidated Financial Statements.

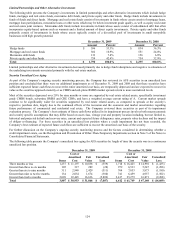

Derivative Instruments

In the normal course of business, the Company uses various derivative counterparties in executing its derivative transactions. The use of

counterparties creates credit risk that the counterparty may not perform in accordance with the terms of the derivative transaction. The

Company has developed a derivative counterparty exposure policy which limits the Company’ s exposure to credit risk.

The derivative counterparty exposure policy establishes market-based credit limits, favors long-term financial stability and

creditworthiness of the counterparty and typically requires credit enhancement/credit risk reducing agreements.

The Company minimizes the credit risk of derivative instruments by entering into transactions with high quality counterparties rated

A2/A or better, which are monitored and evaluated by the Company’ s risk management team and reviewed by senior management. In

addition, the Company monitors counterparty credit exposure on a monthly basis to ensure compliance with Company policies and

statutory limitations. The Company also maintains a policy of requiring that derivative contracts, other than exchange traded contracts,

certain currency forward contracts, and certain embedded and reinsurance derivatives, be governed by an International Swaps and

Derivatives Association Master Agreement which is structured by legal entity and by counterparty and permits right of offset.

The Company has developed credit exposure thresholds which are based upon counterparty ratings. Credit exposures are measured

using the market value of the derivatives, resulting in amounts owed to the Company by its counterparties or potential payment

obligations from the Company to its counterparties. Credit exposures are generally quantified daily based on the prior business day’ s

market value and collateral is pledged to and held by, or on behalf of, the Company to the extent the current value of derivatives exceeds

the contractual thresholds. In accordance with industry standards and the contractual agreements, collateral is typically settled on the

next business day. The Company has exposure to credit risk for amounts below the exposure thresholds which are uncollateralized, as

well as for market fluctuations that may occur between contractual settlement periods of collateral movements.

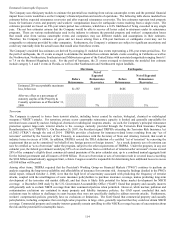

The maximum uncollateralized threshold for a derivative counterparty for a single legal entity is $10. The Company currently transacts

over-the-counter derivatives in five legal entities and therefore the maximum combined threshold for a single counterparty over all legal

entities that use derivatives is $50. In addition, the Company may have exposure to multiple counterparties in a single corporate family

due to a common credit support provider. As of December 31, 2009, the maximum combined threshold for all counterparties under a

single credit support provider over all legal entities that use derivatives is $100. Based on the contractual terms of the collateral

agreements, these thresholds may be immediately reduced due to a downgrade in a counterparty’ s credit rating. For further discussion,

see the Derivative Commitments Section of Note 12 of the Notes to Consolidated Financial Statements.

For the year ended December 31, 2009, the Company has incurred no losses on derivative instruments due to counterparty default.

In addition to counterparty credit risk, the Company enters into credit default swaps to manage credit exposure. Credit default swaps

involve a transfer of credit risk of one or many referenced entities from one party to another in exchange for periodic payments. The

party that purchases credit protection will make periodic payments based on an agreed upon rate and notional amount, and for certain

transactions there will also be an upfront premium payment. The second party, who assumes credit risk, will typically only make a

payment if there is a credit event and such payment will be equal to the notional value of the swap contract less the value of the

referenced security issuer’ s debt obligation. A credit event is generally defined as default on contractually obligated interest or principal

payments or bankruptcy of the referenced entity.