The Hartford 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 126

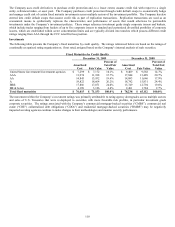

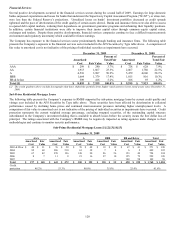

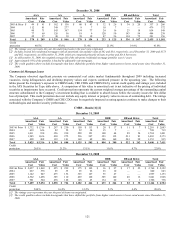

Year ended December 31, 2009

Impairments recognized in earnings were comprised of credit impairments of $1,216, impairments on debt securities for which the

Company intended to sell of $156 and impairments on equity securities of $136.

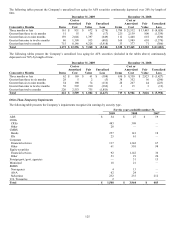

Credit impairments were primarily concentrated on structured securities, mainly CRE CDOs, below-prime RMBS and CMBS bonds.

These securities were impaired primarily due to increased severity in macroeconomic assumptions and continued deterioration of the

underlying collateral. The Company determined these impairments utilizing both a top down modeling approach and, for certain real

estate-backed securities, a loan by loan collateral review. The top down modeling approach used discounted cash flow models that

considered losses under current and expected future economic conditions. Assumptions used over the current recessionary period

included macroeconomic factors, such as a high unemployment rate, as well as sector specific factors including, but not limited to:

• Commercial property value declines that averaged 40% to 45% from the valuation peak but differed by property type and location.

• Average cumulative CMBS collateral loss rates that varied by vintage year but reached approximately 12% for the 2007 vintage

year.

• Residential property value declines that averaged 40% to 45% from the valuation peak but differed by location.

• Average cumulative RMBS collateral loss rates that varied by vintage year but reached approximately 50% for the 2007 vintage

year.

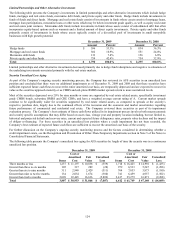

In addition to the top down modeling approach, the Company reviewed the underlying collateral of certain of its real estate-backed

securities to estimate potential future losses. This review included loan by loan underwriting utilizing assumptions about expected

future collateral cash flows discounted at the security’ s book yield prior to impairment. The expected future cash flows included

projected rental rates and occupancy levels that varied based on property type and sub-market. Impairments are recorded to the lower

discounted value between the top down modeling approach and loan by loan collateral review.

Impairments on securities for which the Company had the intent to sell were primarily on corporate financial services securities where

the Company had an active plan to dispose of the securities. Impairments on equity securities were primarily on below investment grade

hybrid securities that had been depressed 20% for six continuous months.

In addition to the credit impairments recognized in earnings, the Company recognized $683 of non-credit impairments in other

comprehensive income, predominately concentrated in RMBS and CRE CDOs. These non-credit impairments represent the difference

between the fair value and the Company’ s best estimate of expected future cash flows discounted at the security’ s effective yield prior to

impairment, rather than at current credit spreads. The non-credit impairments primarily represent increases in market liquidity

premiums and credit spread widening that occurred after the securities were purchased. In general, larger liquidity premiums and wider

credit spreads are the result of deterioration of the underlying collateral performance of the securities, as well as the risk premium

required to reflect future uncertainty in the real estate market.

Future impairments may develop as the result of changes in intent to sell or if actual results underperform current modeling

assumptions, which may be the result of, but are not limited to, macroeconomic factors, changes in assumptions used and property

performance below current expectations.

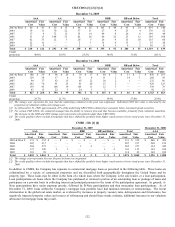

Year ended December 31, 2008

Impairments were primarily concentrated on subordinated fixed maturities and preferred equities within the financial services sector, as

well as in sub-prime RMBS and CRE CDOs. The remaining impairments were primarily recorded on securities in various sectors that

experienced significant credit spread widening and for which the Company was uncertain of its intent to retain the investments for a

period of time sufficient to allow for recovery.

Year ended December 31, 2007

Impairments were primarily concentrated on structured securities backed by sub-prime RMBS and corporate securities primarily within

the financial services and home builders sectors. The remaining impairments were primarily recorded on securities in various sectors

that had declined in value for which the Company was uncertain of its intent to retain the investments for a period of time sufficient to

allow for recovery.