The Hartford 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

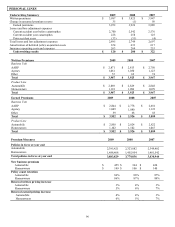

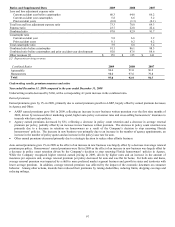

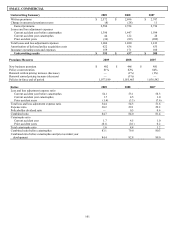

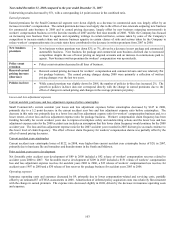

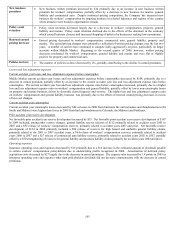

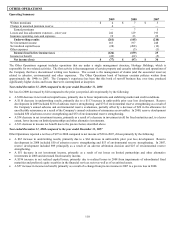

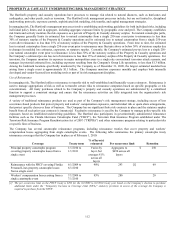

New business

premium

• New business written premium increased by $14 primarily due to an increase in new business written

premium for workers’ compensation, partially offset by a decrease in new business for marine, general

liability and commercial auto. Despite continued pricing competition, the Company has increased new

business for workers’ compensation by targeting business in selected industries and regions of the country

where attractive new business opportunities remain.

Policy count

retention

• Policy count retention decreased largely due to a decrease in workers’ compensation, property, general

liability and marine. Policy count retention declined due to the effects of the downturn in the economy

which caused business closures and increased shopping of policies by businesses seeking lower premiums.

Renewal earned

pricing decrease

• Earned pricing decreased in workers’ compensation, commercial auto, general liability, property and

marine. The earned pricing changes were primarily a reflection of written pricing changes over the last two

years. A number of carriers have continued to compete fairly aggressively on price, particularly on larger

accounts within Middle Market. Beginning in the second quarter of 2009, however, written pricing

decreases moderated for workers’ compensation, general liability and marine and were flat or slightly

positive for property and commercial auto.

Policies in-force • The number of policies in-force decreased by 2%, partially contributing to the decline in earned premiums.

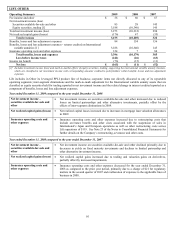

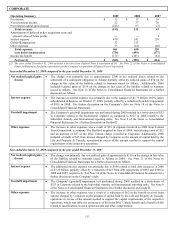

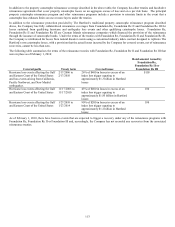

Losses and loss adjustment expenses

Current accident year losses and loss adjustment expenses before catastrophes

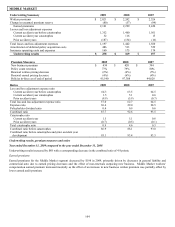

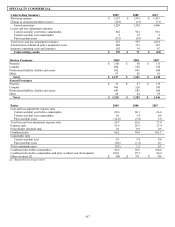

Middle Market current accident year losses and loss adjustment expenses before catastrophes decreased by $108, primarily due to a

decrease in earned premium, partially offset by an increase in the current accident year loss and loss adjustment expense ratio before

catastrophes. The current accident year loss and loss adjustment expense ratio before catastrophes increased, primarily due to a higher

loss and loss adjustment expense ratio on workers’ compensation and general liability, partially offset by lower non-catastrophe losses

on property and marine business, driven by favorable claim frequency and severity. The higher loss and loss adjustment expense ratio

on workers’ compensation and general liability business was primarily due to the effects of renewal earned pricing decreases in excess

of loss cost changes.

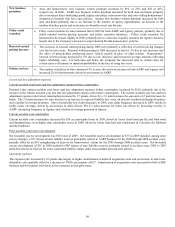

Current accident year catastrophes

Current accident year catastrophe losses decreased by $84 as losses in 2008 from hurricane Ike and tornadoes and thunderstorms in the

South and Midwest were higher than losses in 2009 from hail and windstorms in Colorado, the Midwest and Southeast.

Prior accident year reserve development

Net favorable prior accident year reserve development increased by $53. Net favorable prior accident year reserve development of $187

in 2009 included, among other reserve changes, general liability reserve releases of $112 primarily related to accident years 2003 to

2007 and a $52 release of workers’ compensation reserves, primarily related to accident years 2007 and prior. Net favorable reserve

development of $134 in 2008 primarily included a $90 release of reserves for high hazard and umbrella general liability claims,

primarily related to the 2001 to 2007 accident years, a $64 release of workers’ compensation reserves, primarily related to accident

years 2000 to 2007 and a $27 release of commercial auto liability reserves, primarily related to accident years 2002 to 2007, partially

offset by a $50 strengthening of reserves for general liability and products liability claims primarily for accident years 2004 and prior.

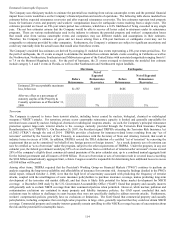

Operating expenses

Insurance operating costs and expenses decreased by $15 primarily due to a $14 increase in the estimated amount of dividends payable

to certain workers’ compensation policyholders due to underwriting profits recognized in 2008. Amortization of deferred policy

acquisition costs decreased by $27 largely due to the decrease in earned premiums. The expense ratio increased by 1.4 points in 2009 as

insurance operating costs and expenses other than policyholders dividends did not decrease commensurate with the decrease in earned

premiums.