The Hartford 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 36

International

During the second quarter of 2009, the Company suspended all new sales in International’ s Japan and European operations.

International is currently in the process of restructuring its operations to maximize profitability and capital efficiency while continuing

to focus on risk management and maintaining appropriate service levels.

Profitability depends on the account values of our customers, which are affected by equity, bond and currency markets. Periods of

favorable market performance will increase assets under management and thus increase fee income earned on those assets, while

unfavorable market performance will have the reverse effect. In addition, higher or lower account value levels will generally reduce or

increase, respectively, certain costs for individual annuities to the Company, such as guaranteed minimum death benefits (“GMDB”),

guaranteed minimum income benefits (“GMIB”), guaranteed minimum accumulation benefits (“GMAB”) and GMWB. Prudent

expense management is also an important component of product profitability. During 2009, the Company took actions to realign our

organization and significantly reduce our expense structure which will result in improved earnings over time. The Company continually

evaluates opportunities to mitigate the risks associated with International businesses and manage expenses in order to balance costs and

earnings stability.

Markets partly recovered in the last three quarters of 2009, after a decline in the first quarter, resulting in increased margins in the

second, third, and fourth quarters.

In the fourth quarter of 2009, Hartford Life International, Ltd., an indirect, wholly-owned subsidiary of Hartford Life Insurance

Company, entered into a Share Purchase Agreement with Icatu Holding, S.A, the Company’ s joint venture partner, for the sale of all of

the Company’ s common registered shares and preferred registered shares in Icatu Hartford Seguros S.A, its Brazil operation. The

expected settlement date will be during the first quarter of 2010. The sale of our interests in Icatu Hartford Seguros S.A. will allow the

Company to focus on its core U.S. centric businesses and reduce exposure to currency volatility, but will also reduce the expected future

earnings of International.

Institutional

In 2009, the Company decided to exit several businesses that were determined to be outside of the Company’ s core business model.

Several lines – institutional mutual funds, private placement life insurance, income annuities and certain institutional annuities will

continue to be managed for growth. The private placement life insurance industry (including the corporate-owned and bank-owned life

insurance markets) has experienced a slowdown in sales due to, among other things, limited availability of stable value wrap providers.

We believe that the Company's current PPLI assets will experience high persistency, but our ability to grow this business in the future

will be affected by near term market and industry challenges. The remaining businesses, structured settlements, guaranteed investment

products, and most institutional annuities will be managed in conjunction with other businesses that the Company has previously

decided will not be actively marketed or sold.

The net income of this segment depends on Institutional’ s ability to retain assets under management, the relative mix of business, and

net investment spread. Net investment spread, as discussed in Institutional’ s Operating section of this MD&A, has declined year over

year and management expects net investment spread will remain pressured in the intermediate future due to the low level of market

short-term interest rates, increased allocation to lower yielding U.S. Treasuries and short-term investments, and anticipated performance

of limited partnerships and other alternative investments.

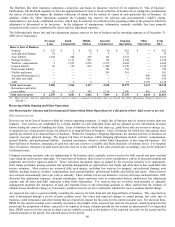

Stable value products experienced net outflows in 2009 as a result of contractual maturities and the payments associated with certain

contracts which allow an investor to accelerate principal repayments (after a defined notice period of typically thirteen months), as well

as the Company opting to accelerate the repayment of principal for certain stable value products. A total of $3.9 billion of account value

was paid out on stable value contracts during 2009. The Company has the option to accelerate the repayment of principal for certain

other stable value products and will continue to evaluate calling these contracts on a contract by contract basis based upon the financial

impact to the Company. In addition, the Company may, from time to time, seek to retire or repurchase certain other stable value

products in open market transactions. Such repurchases, if any, will depend on prevailing market conditions, our liquidity requirements,

contractual restrictions and other factors. Institutional will fund these obligations from cash and short-term investments presently held

in its investment portfolios along with projected receipts of earned interest and principal maturities from long-term invested assets.

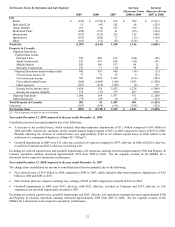

Property & Casualty

Personal Lines

The Company expects Personal Lines’ written premiums in 2010 will be relatively flat as growth in AARP is expected to be largely

offset by a decline in Agency. The Company expects personal auto written premiums will be relatively flat as the effects of increased

written premiums from the sale of the Company’ s Open Road Advantage product and increased written pricing will likely be offset by

actions to reduce written premiums in certain market segments and territories. The Company expects homeowners’ written premiums

will also be relatively flat as an increase in written pricing and the cross-sell of AARP homeowners’ insurance to auto policyholders will

likely be offset by the effect of rate and underwriting actions to improve profitability.