The Hartford 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 37

The Company will continue to use direct marketing to AARP members to drive new business in AARP and will expand the sale of its

Open Road Advantage product through independent agents to drive new business in Agency. In all states where the Open Road

Advantage product is available, the Company distributes its discounted AARP Open Road Advantage auto product through those

independent agents who are authorized to offer the AARP product. The Company expects to expand the sale of the Open Road

Advantage auto product to an additional 23 states in 2010.

In 2009, renewal written pricing increased 3% for auto and 5% for home and management expects that renewal written pricing for both

auto and homeowners will continue to increase in 2010 driven by rate increases in response to rising loss costs. For both auto and home,

management expects that the increase in average written premium per policy in 2010 will not be as significant as the increase in written

pricing due primarily to a continued shift to more preferred market segment business (which has lower average premium) and growth in

states and territories with lower average premium.

The combined ratio before catastrophes and prior accident year development for Personal Lines in 2010 is expected to be relatively

close to the 92.0 ratio achieved in 2009 as a slight improvement in the current accident year loss and loss adjustment expense ratio is

expected to be offset by a slight increase in the expense ratio. For auto business, emerged claim frequency increased in 2009 after a

historically low claim frequency in 2008. In 2010, management expects ultimate claim frequency for the 2010 accident year will be

slightly favorable reflecting the Company’ s shift to more preferred market segment business. While emerged claim severity increases

for auto were flat to the prior year, management expects auto claim severity to increase in 2010 more in line with historical experience.

Non-catastrophe homeowners’ loss costs increased in 2009 due to higher claim frequency and severity and management expects that

loss costs will increase in 2010 driven by higher claim severity. In response to increasing loss costs, the Company is taking rating and

underwriting actions in auto and homeowners and the Company expects the current accident year loss and loss adjustment expense ratio

before catastrophes for both auto and homeowners will be slightly lower in 2010. Management expects the expense ratio will be slightly

higher in 2010 driven by higher amortization of AARP acquisition costs.

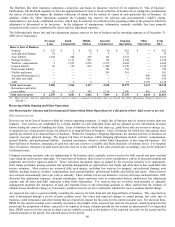

Small Commercial

Within the Small Commercial segment, management expects single-digit written premium growth in 2010, due to higher new business

premium and stabilization of policy count retention. During 2009, the Company experienced a decrease in both earned audit premium

and endorsement premium, primarily as a result of lower payrolls. This resulted in declining average premium on renewed policies, a

trend that is expected to continue into the early part of 2010. Small Commercial introduced several initiatives in 2009 including

programs aimed at improving policy count retention and new product offerings for package business and expects to introduce a new

pricing model for commercial auto in 2010. The workers’ compensation business is expected to produce strong policy growth in 2010

reflecting: our current market position and capabilities; targeted broadening of underwriting capabilities in selected industries; and

leveraging the payroll model to both increase penetration in well-established partners and continue developing opportunities with

recently added partners including the marketing relationship with Intuit. While renewal written pricing in Small Commercial was flat in

2009, increases are expected in 2010.

The Small Commercial segment’ s combined ratio before catastrophes and prior accident year development is expected to be higher in

2010 than the 84.4 achieved in 2009. The increase in the combined ratio results from an expected increase in the current accident year

loss and loss adjustment expense ratio, as well as, a higher expense ratio. Small Commercial experienced favorable frequency trends on

workers’ compensation and commercial auto claims in recent accident years. Management expects favorable frequency to continue, but

at a moderated rate, for the 2010 accident year. Across the Small Commercial lines of business, severity is expected to continue its

long-term upward trend. The expense ratio is expected to be higher in 2010 driven by an increase in total underwriting expenses.

Middle Market

Management expects that 2010 written premiums for Middle Market will be higher due to an increase in new business premium, while

policy count retention is expected to remain flat. Written premiums in Middle Market decreased by 10% in 2009 as the downturn in the

economy reduced exposures across most lines of business, particularly payroll exposures for workers’ compensation and construction

lines in marine, which were partially reflected in lower earned audit premium.

The Company continues to take a disciplined approach to evaluating and pricing risks in the face of declines in renewal written pricing.

While renewal written pricing for Middle Market business declined by 2% in 2009, management expects carriers will continue to price

new business more aggressively than renewals. Carriers in the commercial lines market segment reported some moderation in the rate

of price declines in 2009. Like in the Personal Lines and Small Commercial market segments, current economic conditions (lower

payrolls, declines in production, lower sales, etc.) have reduced written premium growth opportunities in Middle Market.

In 2010, management will seek to compete for new business and protect renewals in Middle Market by, among other actions, refining its

pricing and risk selection models, targeting industries with growth potential and looking to cross-sell other lines on existing accounts.

The combined ratio before catastrophes and prior accident year development for Middle Market is expected to be higher in 2010 than

the 95.1 achieved in 2009 due to an expected increase in the current accident year loss and loss adjustment expense ratio and, to a lesser

extent, an increase in the expense ratio. Claim cost severity was favorable on property and marine in 2009. However, management

expects that claim cost severity for property and marine claims will return to historically normal levels in 2010 and that severity will

continue to increase for general liability and workers’ compensation claims. The Company also expects a continuation of moderately

lower frequency in 2010.