The Hartford 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 20

If assumptions used in estimating future gross profits differ from actual experience, we may be required to accelerate the

amortization of DAC and increase reserves for guaranteed minimum death and income benefits, which could have a material

adverse effect on our results of operations and financial condition.

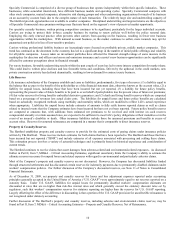

The Company defers acquisition costs associated with the sales of its universal and variable life and variable annuity products. These

costs are amortized over the expected life of the contracts. The remaining deferred but not yet amortized cost is referred to as the

Deferred Acquisition Cost (“DAC”) asset. We amortize these costs in proportion to the present value of estimated gross profits

(“EGPs”). The Company also establishes reserves for GMDB and GMIB using components of EGPs. The projection of estimated gross

profits requires the use of certain assumptions, principally related to separate account fund returns in excess of amounts credited to

policyholders, surrender and lapse rates, interest margin (including impairments), mortality, and hedging costs. Of these factors, we

anticipate that changes in investment returns are most likely to impact the rate of amortization of such costs. However, other factors

such as those the Company might employ to reduce risk, such as the cost of hedging or other risk mitigating techniques, could also

significantly reduce estimates of future gross profits. Estimating future gross profits is a complex process requiring considerable

judgment and the forecasting of events well into the future. If our assumptions regarding policyholder behavior, hedging costs or costs

to employ other risk mitigating techniques prove to be inaccurate, if significant impairment charges are anticipated or if significant or

sustained equity market declines persist, we could be required to accelerate the amortization of DAC related to variable annuity and

variable universal life contracts, and increase reserves for GMDB and GMIB which would result in a charge to net income. Such

adjustments could have a material adverse effect on our results of operations and financial condition. For 2009, the Company recorded

a $1.0 billion, after-tax, charge related to the DAC Unlock.

If our businesses do not perform well, we may be required to recognize an impairment of our goodwill or to establish a valuation

allowance against the deferred income tax asset, which could have a material adverse effect on our results of operations and

financial condition.

Goodwill represents the excess of the amounts we paid to acquire subsidiaries and other businesses over the fair value of their net assets

at the date of acquisition. We test goodwill at least annually for impairment. Impairment testing is performed based upon estimates of

the fair value of the “reporting unit” to which the goodwill relates. The reporting unit is the operating segment or a business one level

below that operating segment if discrete financial information is prepared and regularly reviewed by management at that level. The fair

value of the reporting unit is impacted by the performance of the business and could be adversely impacted by any efforts made by the

Company to limit risk. If it is determined that the goodwill has been impaired, the Company must write down the goodwill by the

amount of the impairment, with a corresponding charge to net income. These write downs could have a material adverse effect on our

results of operations or financial condition.

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Deferred tax

assets are assessed periodically by management to determine if they are realizable. Factors in management’ s determination include the

performance of the business including the ability to generate capital gains, to offset previously recognized capital losses, from a variety

of sources and tax planning strategies. However, we anticipate limited ability, going forward, to recognize a full tax benefit on certain

realized capital losses. Therefore, if based on available information, it is more likely than not that the deferred income tax asset will not

be realized then a valuation allowance must be established with a corresponding charge to net income. Our valuation allowance of $86,

as of December 31, 2009, based on future facts and circumstances may not be sufficient. Charges to increase our valuation allowance

could have a material adverse effect on our results of operations and financial condition.

The occurrence of one or more terrorist attacks in the geographic areas we serve or the threat of terrorism in general may have a

material adverse effect on our business, consolidated operating results, financial condition and liquidity.

The occurrence of one or more terrorist attacks in the geographic areas we serve could result in substantially higher claims under our

insurance policies than we have anticipated. Private sector catastrophe reinsurance is extremely limited and generally unavailable for

terrorism losses caused by attacks with nuclear, biological, chemical or radiological weapons. Reinsurance coverage from the federal

government under the Terrorism Risk Insurance Program Reauthorization Act of 2007 is also limited. Accordingly, the effects of a

terrorist attack in the geographic areas we serve may result in claims and related losses for which we do not have adequate reinsurance.

This would likely cause us to increase our reserves, adversely affect our earnings during the period or periods affected and, could

adversely affect our liquidity and financial condition. Further, the continued threat of terrorism and the occurrence of terrorist attacks,

as well as heightened security measures and military action in response to these threats and attacks, may cause significant volatility in

global financial markets, disruptions to commerce and reduced economic activity. These consequences could have an adverse effect on

the value of the assets in our investment portfolio as well as those in our separate accounts. The continued threat of terrorism also could

result in increased reinsurance prices and potentially cause us to retain more risk than we otherwise would retain if we were able to

obtain reinsurance at lower prices. Terrorist attacks also could disrupt our operations centers in the U.S. or abroad. As a result, it is

possible that any, or a combination of all, of these factors may have a material adverse effect on our business, consolidated operating

results, financial condition and liquidity.