The Hartford 2009 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-76

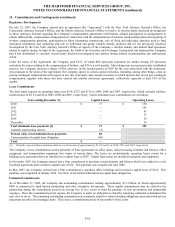

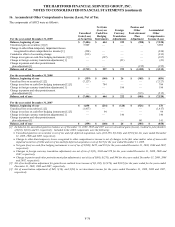

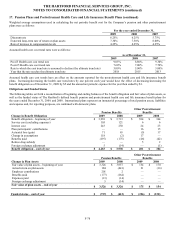

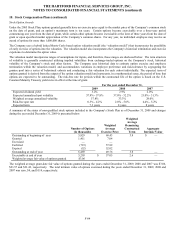

16. Accumulated Other Comprehensive Income (Loss), Net of Tax

The components of AOCI were as follows:

For the year ended December 31, 2009

Unrealized

Gain (Loss)

on Securities

Net Gain

(Loss) on

Cash-Flow

Hedging

Instruments

Foreign

Currency

Translation

Adjustments

Pension and

Other

Postretirement

Plan

Adjustment

Accumulated

Other

Comprehensive

Income (Loss)

Balance, beginning of year $ (7,486) $ 644 $ 222 $ (900) $ (7,520)

Unrealized gain on securities [1] [2] 5,909 — — — 5,909

Change in other-than-temporary impairment losses

recognized in other comprehensive income [1]

(224) —

— —

(224)

Cumulative effect of accounting change (912) — — — (912)

Change in net gain on cash-flow hedging instruments [1] [3] — (387) — — (387)

Change in foreign currency translation adjustments [1] — — (23) — (23)

Change in pension and other postretirement

plan adjustment [1]

— — — (155) (155)

Balance, end of year $ (2,713) $ 257 $ 199 $ (1,055) $ (3,312)

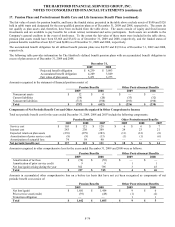

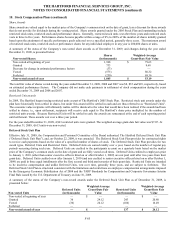

For the year ended December 31, 2008

Balance, beginning of year $ (359) $ (140) $ 26 $ (385) $ (858)

Unrealized loss on securities [1] [2] (7,127) — — — (7,127)

Change in net loss on cash-flow hedging instruments [1] [3] — 784 — — 784

Change in foreign currency translation adjustments [1] — — 196 — 196

Change in pension and other postretirement

plan adjustment [1]

—

—

—

(515)

(515)

Balance, end of year $ (7,486) $ 644 $ 222 $ (900) $ (7,520)

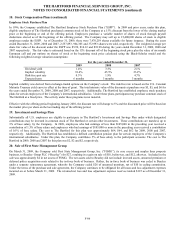

For the year ended December 31, 2007

Balance, beginning of year $ 1,058 $ (234) $ (120) $ (526) $ 178

Unrealized loss on securities [1] [2] (1,417) — — — (1,417)

Change in net loss on cash-flow hedging instruments [1] [3] — 94 — — 94

Change in foreign currency translation adjustments [1] — — 146 — 146

Change in pension and other postretirement

plan adjustment [1]

—

—

—

141

141

Balance, end of year $ (359) $ (140) $ 26 $ (385) $ (858)

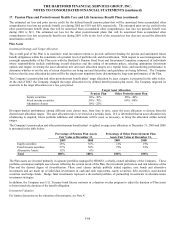

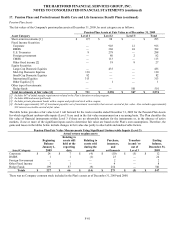

[1] Included in the unrealized gain/loss balance as of December 31, 2009, 2008 and 2007 was net unrealized gains (losses) credited to policyholders

of $(82), $(101) and $3, respectively. Included in the AOCI components were the following:

• Unrealized gain/loss on securities is net of tax and Life deferred acquisition costs of $2,358, $(3,366), and $(718) for the years ended December

31, 2009, 2008 and 2007, respectively.

• Change in other-than-temporary losses recognized in other comprehensive income is net of changes in the fair value and/or sales of non-credit

impaired securities of $244 and net of tax and Life deferred acquisition costs of $215 for the year ended December 31, 2009.

• Net gain (loss) on cash-flow hedging instruments is net of tax of $(208), $422, and $51 for the years ended December 31, 2009, 2008 and 2007,

respectively.

• Changes in foreign currency translation adjustments are net of tax of $(12), $106 and $79 for the years ended December 31, 2009, 2008 and

2007, respectively.

• Change in pension and other postretirement plan adjustment is net of tax of $(86), $(276), and $48 for the years ended December 31, 2009, 2008

and 2007, respectively.

[2] Net of reclassification adjustment for gains/losses realized in net income of $(1,202), $(2,876), and $(192) for the years ended for the years ended

December 31, 2009, 2008 and 2007, respectively.

[3] Net of amortization adjustment of $49, $(16), and $(20) to net investment income for the years ended December 31, 2009, 2008 and 2007,

respectively.