The Hartford 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

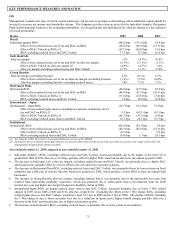

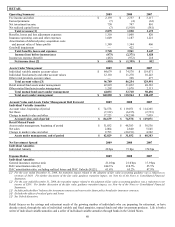

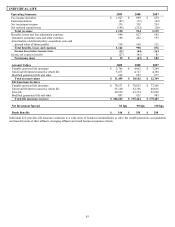

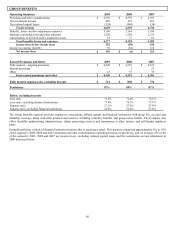

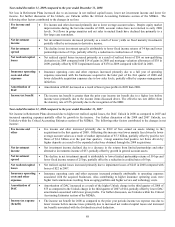

RETAIL

Operating Summary 2009 2008 2007

Fee income and other $ 2,139 $ 2,757 $ 3,117

Earned premiums (7) (4) (62)

Net investment income 750 747 801

Net realized capital losses (7) (1,910) (381)

Total revenues [1] 2,875 1,590 3,475

Benefits, losses and loss adjustment expenses 1,310 1,008 820

Insurance operating costs and other expenses 1,049 1,187 1,221

Amortization of deferred policy acquisition costs

and present value of future profits

1,389

1,344

406

Goodwill impairment — 422 —

Total benefits, losses and expenses 3,748 3,961 2,447

Income (loss) before income taxes (873) (2,371) 1,028

Income tax expense (benefit) (463) (972) 216

Net income (loss) [2] $ (410) $(1,399) $ 812

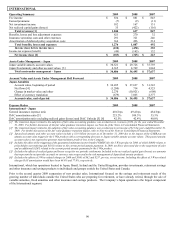

Assets Under Management

2009

2008

2007

Individual variable annuity account values $ 84,679 $ 74,578 $ 119,071

Individual fixed annuity and other account values 12,110 11,278 10,243

Other retail products account values — 398 677

Total account values [3] 96,789 86,254 129,991

Retail mutual fund assets under management 42,829 31,032 48,383

Other mutual fund assets under management 1,202 1,678 2,113

Total mutual fund assets under management 44,031 32,710 50,496

Total assets under management $ 140,820 $118,964 $ 180,487

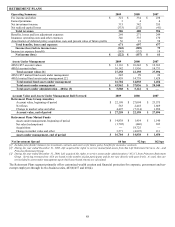

Account Value and Assets Under Management Roll Forward

2009

2008

2007

Individual Variable Annuities

Account value, beginning of period $ 74,578 $ 119,071 $114,365

Net flows (7,122) (6,235) (2,733)

Change in market value and other 17,223 (38,258) 7,439

Account value, end of period $ 84,679 $74,578 $119,071

Retail Mutual Funds

Assets under management, beginning of period $ 31,032 $ 48,383 $38,536

Net sales 2,004 2,840 5,545

Change in market value and other 9,793 (20,191) 4,302

Assets under management, end of period $ 42,829 $31,032 $48,383

Net Investment Spread

2009

2008

2007

Individual Annuities

Individual Annuity 28 bps 73 bps 174 bps

Expense Ratios

2009

2008

2007

Individual Annuities

General insurance expense ratio 21.0 bps 21.0 bps 17.9 bps

DAC amortization ratio [4] 244.3% 218.5% 25.5%

DAC amortization ratio, excluding realized losses and DAC Unlocks [4] [5] 61.6% 65.2% 47.9%

[1] For the year ended December 31, 2008, the transition impact related to the adoption of fair value accounting guidance was a reduction in

revenues of $616. For further discussion of the fair value guidance transition impact, see Note 4a of the Notes to Consolidated Financial

Statements.

[2] For the year ended December 31, 2008, the transition impact related to the adoption of fair value accounting guidance was a reduction in net

income of $209. For further discussion of the fair value guidance transition impact, see Note 4a of the Notes to Consolidated Financial

Statements.

[3] Includes policyholders’ balances for investment contracts and reserves for future policy benefits for insurance contracts.

[4] Excludes the effects of realized gains and losses.

[5] See Unlock discussion.

Retail focuses on the savings and retirement needs of the growing number of individuals who are preparing for retirement, or have

already retired, through the sale of individual variable and fixed annuities, mutual funds and other investment products. Life is both a

writer of individual variable annuities and a seller of individual variable annuities through banks in the United States.