The Hartford 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-9

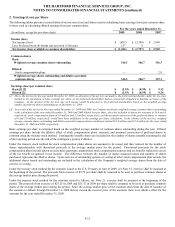

1. Basis of Presentation and Accounting Policies (continued)

Adoption of New Accounting Standards

Other-Than-Temporary Impairments

In April 2009, the Financial Accounting Standards Board (“FASB”) updated the guidance related to the recognition and presentation of

other-than-temporary impairments. The Company adopted this guidance for its interim reporting period ending on June 30, 2009 and

recognized a $912, net of tax and deferred acquisition costs, increase to retained earnings with an offsetting decrease in Accumulated

Other Comprehensive Income (Loss) reported in the Company’ s Consolidated Statements of Operations, Changes in Equity and

Comprehensive Income (Loss). See Note 5 for the Company’ s accounting policy and disclosures.

Noncontrolling Interests

A noncontrolling interest refers to the minority interest portion of the equity of a subsidiary that is not attributable directly or indirectly

to a parent. The guidance establishes accounting and reporting standards that require for-profit entities that prepare consolidated

financial statements to: (a) present noncontrolling interests as a component of equity, separate from the parent’ s equity, (b) separately

present the amount of consolidated net income attributable to noncontrolling interests in the income statement, (c) consistently account

for changes in a parent’ s ownership interests in a subsidiary in which the parent entity has a controlling financial interest as equity

transactions, (d) require an entity to measure at fair value its remaining interest in a subsidiary that is deconsolidated, and (e) require an

entity to provide sufficient disclosures that identify and clearly distinguish between interests of the parent and interests of noncontrolling

owners. This guidance applies to all for-profit entities that prepare consolidated financial statements, and affects those for-profit entities

that have outstanding noncontrolling interests in one or more subsidiaries or that deconsolidate a subsidiary. This guidance is effective

for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008 with earlier adoption prohibited.

Upon adoption of this guidance on January 1, 2009, the Company reclassified $78 of noncontrolling interest, recorded in other

liabilities, to equity as of January 1, 2007. The adoption did not have a material effect on the Company’ s Consolidated Statements of

Operations and Comprehensive Income (Loss). See Note 5 for the Company’ s accounting policy and disclosures.

Future Adoption of New Accounting Standards

Amendments to Consolidation Guidance for Variable Interest Entities

In June 2009, the FASB issued accounting guidance which amends the current quantitative consolidation requirements applicable to

variable interest entities (“VIE”). Under this new guidance, an entity would consolidate a VIE when the entity has both (a) the power to

direct the activities of a VIE that most significantly impact the entity’ s economic performance and (b) the obligation to absorb losses of

the entity that could potentially be significant to the VIE or the right to receive benefits from the entity that could potentially be

significant to the VIE. The FASB also issued a proposed amendment to this guidance in January 2010 which defers application of this

guidance to certain entities that apply specialized accounting guidance for investment companies.

The Company adopted this updated guidance on January 1, 2010, the effective date. As a result of adoption, in addition to those VIEs

the Company currently consolidates under the old guidance, the Company determined it will consolidate a Company sponsored

collateralized debt obligation (“CDO”) and a Company sponsored collateralized loan obligation (“CLO”) that are VIEs. The Company

expects the impact of these consolidations on its consolidated financial statements to be an increase in assets and increase in liabilities of

approximately $400. The Hartford concluded that the Company has control over the activities that most significantly impact the

economic performance of these VIEs as they provide collateral management services, earn a fee for these services and also have

investments issued by the entities. These vehicles issued securities which have no recourse to the general credit of The Hartford. The

Hartford’ s maximum exposure to loss for these vehicles is their investment in the entities, fair valued at $263 as of December 31, 2009.

The Company has investments in mutual funds, limited partnerships and other alternative investments including hedge funds, mortgage

and real estate funds, mezzanine debt funds, and private equity and other funds which may be VIEs. The accounting for these

investments will remain unchanged as they fall within the scope of the proposed deferral of this new consolidation guidance.