Xcel Energy 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

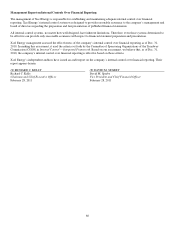

86

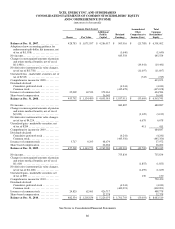

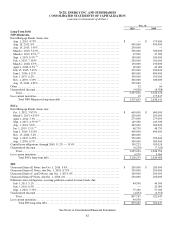

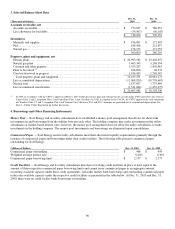

XCEL ENERGY INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMMON STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

(amounts in thousands)

Common Stock Issued Accumulated

Other

Comprehensive

Income (Loss)

Total

Common

Stockholders’

Equity Shares Par Value

Additional

Paid In

Capital

Retained

Earnings

Balance at Dec. 31, 2007 ................. 428,783 $ 1,071,957 $ 4,286,917 $ 963,916 $ (21,788) $ 6,301,002

Adoption of new accounting guidance for

endorsement split-dollar life insurance, net

of tax of $(1,038) ..................... (1,640 ) (1,640)

N

et income............................. 645,554 645,554

Changes in unrecognized amounts of pension

and retiree medical benefits, net of tax of

$(11,986) ............................ (19,441) (19,441)

N

et derivative instrument fair value changes,

net of tax of $(5,758) .................. (11,697) (11,697)

Unrealized loss - marketable securities, net of

tax of $(513) ........................ (743) (743)

Comprehensive income for 2008 ........... 613,673

Dividends declared:

Cumulative preferred stock ............. (4,241 ) (4,241)

Common stock........................ (415,678 ) (415,678)

Issuances of common stock ............... 25,009 62,523 372,061 434,584

Share-based compensation ................ 36,041 36,041

Balance at Dec. 31, 2008 ................. 453,792 $ 1,134,480 $ 4,695,019 $ 1,187,911 $ (53,669) $ 6,963,741

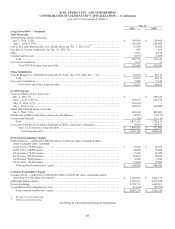

N

et income............................. 680,887 680,887

Changes in unrecognized amounts of

p

ension

and retiree medical benefits, net of tax of

$(2,203) ............................ (3,129) (3,129)

N

et derivative instrument fair value changes,

net of tax of $4,224 .................... 6,678 6,678

Unrealized gain - marketable securities, net

of tax of $284 ........................ 411 411

Comprehensive income for 2009 ........... 684,847

Dividends declared:

Cumulative preferred stock ............. (4,241 ) (4,241)

Common stock........................ (445,356 ) (445,356)

Issuances of common stock ............... 3,717 9,293 48,679 57,972

Share-based compensation ................ 26,282 26,282

Balance at Dec. 31, 2009 ................. 457,509 $ 1,143,773 $ 4,769,980 $ 1,419,201 $ (49,709) $ 7,283,245

N

et income............................. 755,834 755,834

Changes in unrecognized amounts of pension

and retiree medical benefits, net of tax of

$(1,416) ............................ (1,855) (1,855)

N

et derivative instrument fair value changes,

net of tax of $(1,208) .................. (1,659) (1,659)

Unrealized gain - marketable securities, net

of tax of $89 ......................... 130 130

Comprehensive income for 2010 ........... 752,450

Dividends declared:

Cumulative preferred stock ............. (4,241 ) (4,241)

Common stock........................ (469,091 ) (469,091)

Issuances of common stock ............... 24,825 62,061 426,717 488,778

Share-based compensation ................ 32,378 32,378

Balance at Dec. 31, 2010 ................. 482,334 $ 1,205,834 $ 5,229,075 $ 1,701,703 $ (53,093) $ 8,083,519

See Notes to Consolidated Financial Statements