Xcel Energy 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Fuel Contracts — Xcel Energy and its subsidiaries have contracts providing for the purchase and delivery of a significant portion

of its current coal, nuclear fuel and natural gas requirements. These contracts expire in various years between 2011 and 2040. In

addition, Xcel Energy is required to pay additional amounts depending on actual quantities shipped under these agreements. Xcel

Energy’s risk of loss, in the form of increased costs from market price changes in fuel, is mitigated through the use of natural gas

and energy cost rate adjustment mechanisms, which provide for pass-through of most fuel, storage and transportation costs to

customers.

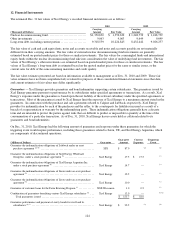

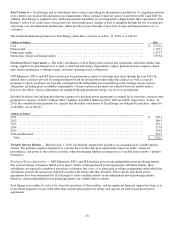

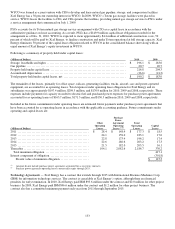

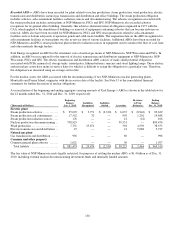

The estimated minimum purchases for Xcel Energy under these contracts as of Dec. 31, 2010, is as follows:

(Millions of Dollars) 2010

Coal ................................................................................................... $ 2,711.2

N

uclear fuel ............................................................................................ 1,170.1

N

atural gas supply ...................................................................................... 1,313.7

N

atural gas storage and transportation .................................................................... 3,053.4

Purchased Power Agreements — The utility subsidiaries of Xcel Energy have entered into agreements with other utilities and

energy suppliers for purchased power to meet system load and energy requirements, replace generation from company-owned

units under maintenance or during outages, and meet operating reserve obligations.

NSP-Minnesota, PSCo and SPS have various pay-for-performance contracts with expiration dates through the year 2034. In

general, these contracts provide for energy payments based on actual power taken under the contracts as well as capacity

payments. Capacity payments are typically contingent on the independent power producing entity meeting certain contract

obligations, including plant availability requirements. Certain contractual payments are adjusted based on market indices;

however, the effects of price adjustments are mitigated through purchased energy cost recovery mechanisms.

Included in electric fuel and purchased power expenses for purchase power agreements accounted for as executory contracts were

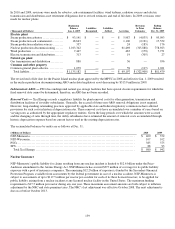

payments for capacity of $426.7 million, $461.3 million, and $480.2 million in 2010, 2009 and 2008, respectively. At Dec. 31,

2010, the estimated future payments for capacity that the utility subsidiaries of Xcel Energy are obligated to purchase, subject to

availability, are as follows:

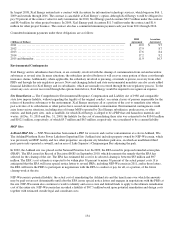

(Millions of Dollars)

2011 ................................................................................................... $328.1

2012 ................................................................................................... 266.5

2013 ................................................................................................... 219.1

2014 ................................................................................................... 217.0

2015 ................................................................................................... 195.8

2016 and thereafter ...................................................................................... 535.7

Total ................................................................................................. $ 1,762.2

Variable Interest Entities — Effective Jan. 1, 2010, Xcel Energy adopted new guidance on consolidation of variable interest

entities. The guidance requires enterprises to consider the activities that most significantly impact an entity’s financial

performance, and power to direct those activities, when determining whether an enterprise is a variable interest entity’s primary

beneficiary.

Purchased Power Agreements — NSP-Minnesota, PSCo and SPS purchase power from independent power producing entities

that own natural gas or biomass fueled power plants. Under certain purchased power agreements with these entities, these

subsidiaries are required to reimburse natural gas or biomass fuel costs, or to participate in tolling arrangements under which the

subsidiaries procure the natural gas required to produce the energy that they purchase. These specific purchased power

agreements have been determined by Xcel Energy to create variable interests in the independent power producing entities;

therefore, certain independent power producing entities are variable interest entities.

Xcel Energy is not subject to risk of loss from the operations of these entities, and no significant financial support has been, or is

in the future required to be provided other than contractual payments for energy and capacity set forth in purchased power

agreements.