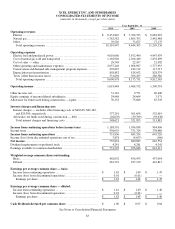

Xcel Energy 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

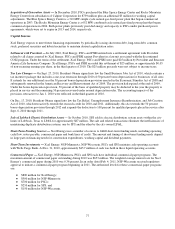

Acquisition of Generation Assets — In December 2010, PSCo purchased the Blue Spruce Energy Center and Rocky Mountain

Energy Center from subsidiaries of Calpine Corporation for $739 million plus an additional $3 million for working capital

adjustments. The Blue Spruce Energy Center is a 310 MW simple cycle natural gas-fired power plant that began commercial

operations in 2003. The Rocky Mountain Energy Center is a 652 MW combined-cycle natural gas-fired power plant that began

commercial operations in 2004. Both power plants previously provided energy and capacity to PSCo under purchased power

agreements, which were set to expire in 2013 and 2014, respectively.

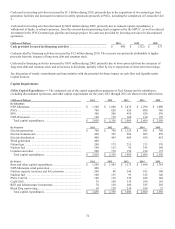

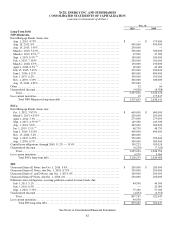

Capital Sources

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt, common

stock, preferred securities and hybrid securities to maintain desired capitalization ratios.

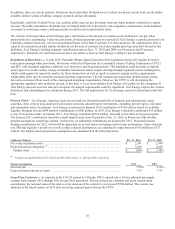

Settlement with Provident — In July 2010, Xcel Energy, PSCo and PSRI entered into a settlement agreement with Provident

related to all claims asserted by Xcel Energy, PSCo and PSRI against Provident in a lawsuit associated with the discontinued

COLI program. Under the terms of the settlement, Xcel Energy, PSCo and PSRI were paid $25 million by Provident and Reassure

America Life Insurance Company. Xcel Energy, PSCo and PSRI recorded this settlement of $25 million, or approximately $0.05

of non-recurring earnings per share, in the third quarter of 2010. The $25 million proceeds were not subject to income taxes.

Tax Law Changes — On Sept. 27, 2010, President Obama signed into law the Small Business Jobs Act of 2010, which contains a

tax incentive package that includes a one-year extension through 2010 of 50 percent bonus depreciation for businesses of all sizes.

It extends for one additional year the 50 percent bonus depreciation provision enacted in the Economic Stimulus Act of 2008 and

subsequently renewed in the American Recovery and Reinvestment Act of 2009. The provision had expired at the end of 2009.

Under the bonus depreciation provision, 50 percent of the basis of qualified property may be deducted in the year the property is

placed in service and the remaining 50 percent recovered under normal depreciation rules. The accounting impacts of the

provision, retroactive to Jan. 1, 2010 were reflected in the third quarter of 2010.

On Dec. 17, 2010, President Obama signed into law the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation

Act of 2010, which retroactively extends the research credit for 2010 and 2011. Additionally, this Act extends the 50 percent

bonus depreciation provision through 2012 and expands the deduction to 100 percent for qualified property placed in service after

Sept. 8, 2010 through 2011.

Sale of Lubbock Electric Distribution Assets — In October 2010, SPS sold its electric distribution system assets within the city

limits of Lubbock, Texas to LP&L for approximately $87 million. The sale and related transactions eliminate the inefficiencies of

maintaining duplicate distribution systems, one by SPS and the other by the city-owned LP&L.

Short-Term Funding Sources — Xcel Energy uses a number of sources to fulfill short-term funding needs, including operating

cash flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term funding needs depend

in large part on financing needs for construction expenditures, working capital and dividend payments.

Short-Term Investments — Xcel Energy, NSP-Minnesota, NSP-Wisconsin, PSCo and SPS maintain cash operating accounts

with Wells Fargo Bank. At Dec. 31, 2010, approximately $45.7 million of cash was held in these liquid operating accounts.

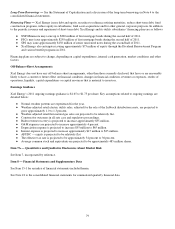

Commercial Paper — Xcel Energy, NSP-Minnesota, PSCo and SPS each have individual commercial paper programs. The

maximum amount of commercial paper outstanding during 2010 was $653 million. The weighted average interest rate for Xcel

Energy’s commercial paper during 2010 was 0.36 percent. In an order dated Feb. 4, 2011, NSP-Wisconsin received regulatory

approval to initiate a commercial paper program beginning in 2011. The authorized levels for these commercial paper programs

are:

● $800 million for Xcel Energy;

● $500 million for NSP-Minnesota;

● $700 million for PSCo;

● $250 million for SPS; and

● $150 million for NSP-Wisconsin.