Xcel Energy 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

In addition, there are certain statutory limitations that could affect dividend levels. Federal law places certain limits on the ability

of public utilities within a holding company system to declare dividends.

Specifically, under the Federal Power Act, a public utility may not pay dividends from any funds properly included in a capital

account. The utility subsidiaries dividends may be limited indirectly or directly by state regulatory commissions, bond indenture

covenants or restrictions under credit agreements for debt to total capitalization ratios.

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay when

preferred stock is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’ s capitalization ratio (on

a holding company basis only, not on a consolidated basis) is less than 25 percent. For these purposes, the capitalization ratio is

equal to (i) common stock plus surplus divided by (ii) the sum of common stock plus surplus plus long-term debt. Based on this

definition, Xcel Energy’ s holding company capitalization ratio at Dec. 31, 2010 and 2009 was 84 percent and 85 percent,

respectively. Therefore, the restrictions do not place any effective limit on Xcel Energy’ s ability to pay dividends.

Regulation of Derivatives — In July 2010, President Obama signed financial reform legislation which will regulate derivative

transactions amongst other provisions. Provisions within the bill provide the Commodity Futures Trading Commission (CFTC)

and SEC with expanded regulatory authority over derivative and swap transactions. This legislation could preclude or impede

some types of over-the-counter energy commodity transactions and/or require clearing through regulated central counterparties,

which could negatively impact the market for these transactions as well as result in extensive margin and fee requirements.

Additionally there may be material increased reporting requirements. The bill contains provisions that should exempt certain

derivatives end-users from much of the clearing and margining requirements. However, the CFTC is still developing the

appropriate regulatory rules under the act and, at this time, it is not clear whether Xcel Energy will qualify for the exemption. If

Xcel Energy does not meet the end-user exception, the margin requirements could be significant. Xcel Energy expects the various

definitions and rulemakings to be completed during 2011. The full implications for Xcel Energy can not be determined until that

time.

Pension Fund — Xcel Energy’ s pension assets are invested in a diversified portfolio of domestic and international equity

securities, short–term to long-duration fixed income securities, and alternative investments, including, private equity, real estate

and commodity index investments. Xcel Energy accelerated its planned 2010 contribution of $100 million, based on available

liquidity, bringing its total 2009 pension contributions to $200 million. In 2010, Xcel Energy voluntarily contributed $34 million

to one of its pension plans. In January 2011, Xcel Energy contributed $134 million, allocated across three of its pension plans.

The January 2011 contribution raised the overall funded status from 84 percent at Dec. 31, 2010 to 88 percent with all other

pension assumptions remaining constant. At this time, no additional contributions are planned for 2011. Projected pension

funding contributions for 2012, which will be dependent on several factors including realized asset performance, future discount

rate, IRS and legislative initiatives as well as other actuarial assumptions, are estimated to range between $150 million to $175

million. The funded status and pension assumptions are summarized in the following tables:

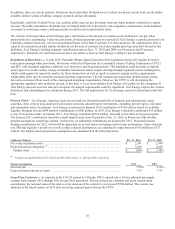

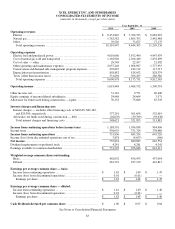

(Millions of Dollars) Dec. 31,

2010 Dec. 31,

2009

Fair value of pension assets .. .. .... .. .......... .. ...... ................................ $ 2,541 $ 2,449

Projected pension obligation (a) . .. .. .. ..... .... .. .............. .... .. ................... 3,030 2,830

Funded status ............ .. .... ..................................................... $ (489) $ (381)

(a) Excludes non-qualified plan of $47 million and $46 million at Dec. 31, 2010 and 2009, respectively.

Pension Assumptions 2011 2010

Discount rate ........................ ....... ........ .................................. 5.50% 6.00%

Expected long-term rate of return ...... .... .. .... ............... .. .... .................. 7.50 7.79

Long-Term Contracts — In response to the CACJA passed in Colorado, PSCo entered into a 10-year physical gas supply

contract from January 2012 through 2021 for gas-fired generation. Pricing is based on a formula and given current input

assumptions; the notional value of the deal over the duration of the contract is in excess of $700 million. The contact was

finalized in the fourth quarter of 2010 after receiving required approval from the CPUC.