Xcel Energy 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.125

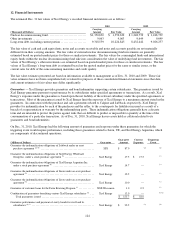

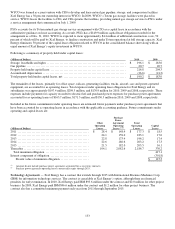

(a) The total exposure of this indemnification cannot be determined. Xcel Energy believes the exposure to be significantly less than the total amount of the

outstanding bonds.

(b) Nonperformance and/or nonpayment.

(c) Losses caused by default in performance of covenants or breach of any warranty or representation in the purchase agreement.

(d) Failure of Xcel Energy or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the indemnity

agreement between Xcel Energy and the various surety companies, the surety companies have the discretion to demand that collateral be posted.

(e) The debtor becomes the subject of bankruptcy or other insolvency proceedings.

(f) Xcel Energy agreed to indemnify an insurance company in connection with surety bonds they may issue or have issued for Utility Engineering up to $80

million. The Xcel Energy indemnification will be triggered only in the event that Utility Engineering has failed to meet its obligations to the surety

company.

(g) SPS has provided indemnification to Lubbock for losses arising out of any breach of the representations, warranties and covenants under the related asset

purchase agreement and for losses arising out of certain other matters, including pre-closing unknown liabilities. The indemnification provisions are capped

at the purchase price, $87 million, in the aggregate. As of Dec. 31, 2010, no claims have been made. The indemnification provisions for most

representations and warranties expire 12 months after the closing date. Certain representations and warranties, including those having to do with transaction

authorization survive indefinitely. The indemnification for covenants survives until the applicable covenant is performed. See Note 19 to the consolidated

financial statements for further discussion.

(h) The term of this guarantee is continuing.

(i) The guarantee expires at various dates through 2022.

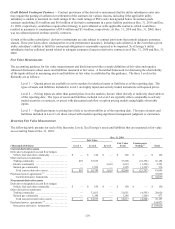

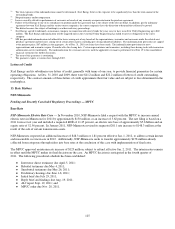

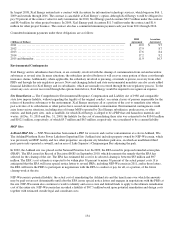

Letters of Credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for certain

operating obligations. At Dec. 31, 2010 and 2009, there were $11.2 million and $22.2 million of letters of credit outstanding,

respectively. The contract amounts of these letters of credit approximate their fair value and are subject to fees determined in the

marketplace.

13. Rate Matters

NSP-Minnesota

Pending and Recently Concluded Regulatory Proceedings — MPUC

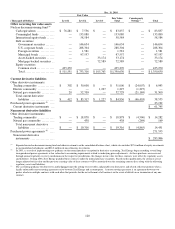

Base Rate

NSP-Minnesota Electric Rate Case — In November 2010, NSP-Minnesota filed a request with the MPUC to increase annual

electric rates in Minnesota for 2011 by approximately $150 million, or an increase of 5.62 percent. The rate filing is based on a

2011 forecast test year and included a requested ROE of 11.25 percent, an electric rate base of approximately $5.6 billion and an

equity ratio of 52.56 percent. In January 2011, NSP-Minnesota revised its requested 2011 rate increase to $148.3 million as the

result of the sale of certain transmission assets.

NSP-Minnesota requested an additional increase of $48.3 million or 1.81 percent effective Jan. 1, 2012, to address certain known

and measurable cost increases in 2012. Additionally, NSP-Minnesota seeks to transfer approximately $158 million already

collected from ratepayers through riders into base rates at the conclusion of this case with implementation of final rates.

The MPUC approved an interim rate increase of $123 million, subject to refund, effective Jan. 2, 2011. The interim rates remain

in effect until the MPUC makes its final decision on the case. An MPUC decision is anticipated in the fourth quarter of

2011. The following procedural schedule has been established:

● Intervenor direct testimony due April 5, 2011;

● Rebuttal testimony due May 4, 2011;

● Surrebuttal testimony due May 26, 2011;

● Evidentiary hearings due June 1-8, 2011;

● Initial brief due July 29, 2011;

● Reply brief and findings due Aug. 19, 2011;

● ALJ report Sept. 19, 2011; and

● MPUC order due Nov. 28, 2011.