Xcel Energy 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

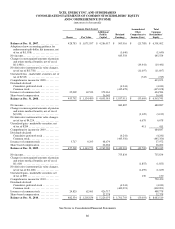

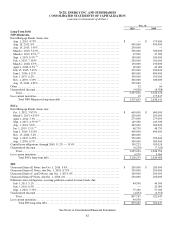

96

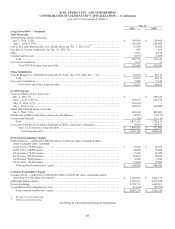

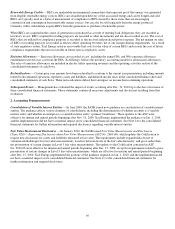

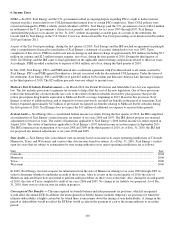

3. Selected Balance Sheet Data

(Thousands of Dollars) Dec. 31,

2010

Dec. 31,

2009

Accounts receivable, net

Accounts receivable ................................................................ $ 773,037 $ 786,255

Less allowance for bad debts ........................................................ (54,563) (56,103)

$ 718,474 $ 730,152

Inventories

Materials and supplies .............................................................. $ 196,081 $ 172,993

Fuel ............................................................................... 188,566 221,457

Natural gas ......................................................................... 176,153 171,755

$ 560,800 $ 566,205

Property, plant and equipment, net

Electric plant ....................................................................... $ 24,993,582 $ 22,402,657

Natural gas plant ................................................................... 3,463,343 3,269,934

Common and other property ......................................................... 1,555,287 1,492,463

Plant to be retired (a) ............................................................... 236,606 48,572

Construction work in progress ....................................................... 1,186,433 1,769,545

Total property, plant and equipment ................................................ 31,435,251 28,983,171

Less accumulated depreciation ....................................................... (11,068,820) (10,776,667)

Nuclear fuel ........................................................................ 1,837,697 1,737,469

Less accumulated amortization ...................................................... (1,541,046) (1,435,677)

$ 20,663,082 $ 18,508,296

(a) In 2009, in accordance with the CPUC’s approval of PSCo’s 2007 Colorado resource plan and subsequent rate case decisions, PSCo agreed to early retire its

Cameo Units 1 and 2, Arapahoe Units 3 and 4 and Zuni Units 1 and 2 facilities. In 2010, in response to the CACJA, the CPUC approved the early retirement

of Cherokee Units 1, 2 and 3, Arapahoe Unit 3 and Valmont Unit 5 between 2011 and 2017. Amounts are presented net of accumulated depreciation. See

Item 1 – Public Utility Regulation for further discussion.

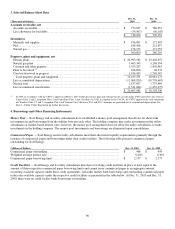

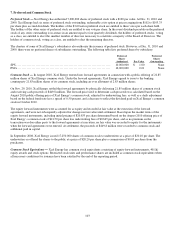

4. Borrowings and Other Financing Instruments

Money Pool — Xcel Energy and its utility subsidiaries have established a money pool arrangement that allows for short-term

investments in and borrowings from the utilities between each other. The holding company may make investments in the utility

subsidiaries at market-based interest rates; however, the money pool arrangement does not allow the utility subsidiaries to make

investments in the holding company. The money pool investments and borrowings are eliminated upon consolidation.

Commercial Paper — Xcel Energy and its utility subsidiaries meet their short-term liquidity requirements primarily through the

issuance of commercial paper and borrowings under their credit facilities. The following table presents commercial paper

outstanding for Xcel Energy:

(Millions of Dollars) Dec. 31, 2010 Dec. 31, 2009

Commercial paper outstanding ......................................................... $ 466 $ 459

Weighted average interest rate ......................................................... 0.40% 0.36

%

Commercial paper borrowing limit..................................................... $ 2,177 $ 2,177

Credit Facilities — Xcel Energy and its utility subsidiaries must have revolving credit facilities in place at least equal to the

amount of their respective commercial paper borrowing limits and cannot issue commercial paper in an aggregate amount

exceeding available capacity under these credit agreements. All credit facility bank borrowings and outstanding commercial paper

reduce the available capacity under the respective credit facilities as presented in the table below. At Dec. 31, 2010 and Dec. 31,

2009, there were no credit facility bank borrowings outstanding.