Xcel Energy 2010 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

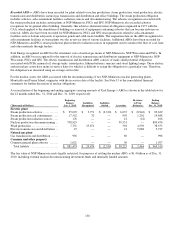

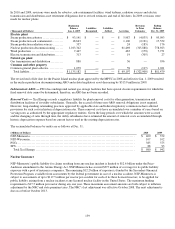

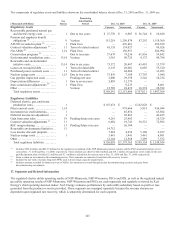

The following tables present the cost and fair value of the investments in the nuclear decommissioning fund, by asset class on

Dec. 31, 2010 and 2009:

2010 2009

(Thousands of Dollars) Cost Fair

Value Cost Fair

Value

Cash equivalents ............................................. $ 83,837 $ 83,837 $ 28,134 $ 28,134

Commingled funds ........................................... 131,000 133,080

—

—

International equity funds ..................................... 54,561 58,584

—

—

Equity securities - Common stock .............................. 436,334 435,270 662,655 581,995

Debt securities

Government securities ...................................... 146,473 146,654 74,162 74,126

U.S. corporate bonds ........................................ 279,028 288,304 299,259 312,844

Foreign securities ........................................... 1,233 1,581 9,269 9,445

Municipal bonds ............................................ 100,277 97,557 147,689 149,088

Asset-backed securities ..................................... 32,558 33,174 11,565 11,918

Mortgage-backed securities .................................. 68,072 72,589 80,276 81,189

Total nuclear decommissioning fund ....................... $ 1,333,373 $ 1,350,630 $ 1,313,009 $ 1,248,739

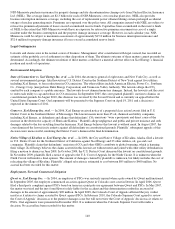

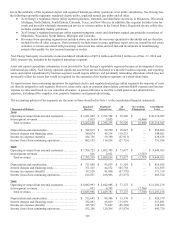

The following table summarizes the final contractual maturity dates of the debt securities in the nuclear decommissioning fund,

by asset class for the year ended Dec. 31, 2010:

Final Contractual Maturity

(Thousands of Dollars)

Due in 1

Year

or Less Due in 1 to 5

Years

Due in 5 to

10

Years Due after 10

Years Total

Government securities ............................ $ 301 $ 117,041 $ 15,270 $ 14,042 $ 146,654

U.S. corporate bonds .............................. 3,071 71,615 178,067 35,551 288,304

Foreign securities .................................

—

1,581

—

—

1,581

Municipal bonds ..................................

—

—

50,729 46,828 97,557

Asset-backed securities ...........................

—

22,232 10,942

—

33,174

Mortgage-backed securities ........................

—

—

1,249 71,340 72,589

Debt securities ................................. $ 3,372 $ 212,469 $ 256,257 $ 167,761 $ 639,859

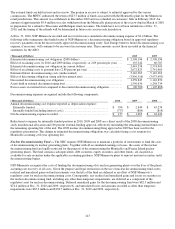

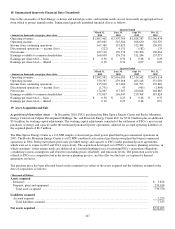

16. Regulatory Assets and Liabilities

Xcel Energy’s regulated businesses prepare their consolidated financial statements in accordance with the provisions of the

applicable accounting guidance, as discussed in Note 1 to the consolidated financial statements. Under this guidance, regulatory

assets and liabilities can be created for amounts that regulators may allow to be collected, or may require to be paid back to

customers in future electric and natural gas rates. Any portion of Xcel Energy’s business that is not regulated cannot establish

regulatory assets and liabilities. If changes in the utility industry or the business of Xcel Energy no longer allow for the

application of regulatory accounting guidance under GAAP, Xcel Energy would be required to recognize the write-off of

regulatory assets and liabilities in its consolidated statement of income.