Xcel Energy 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

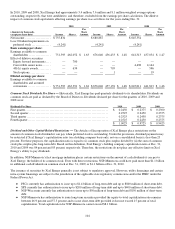

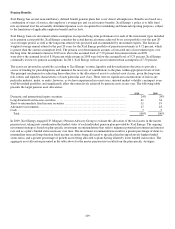

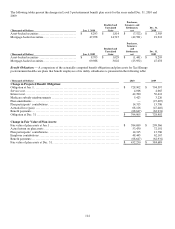

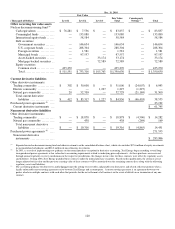

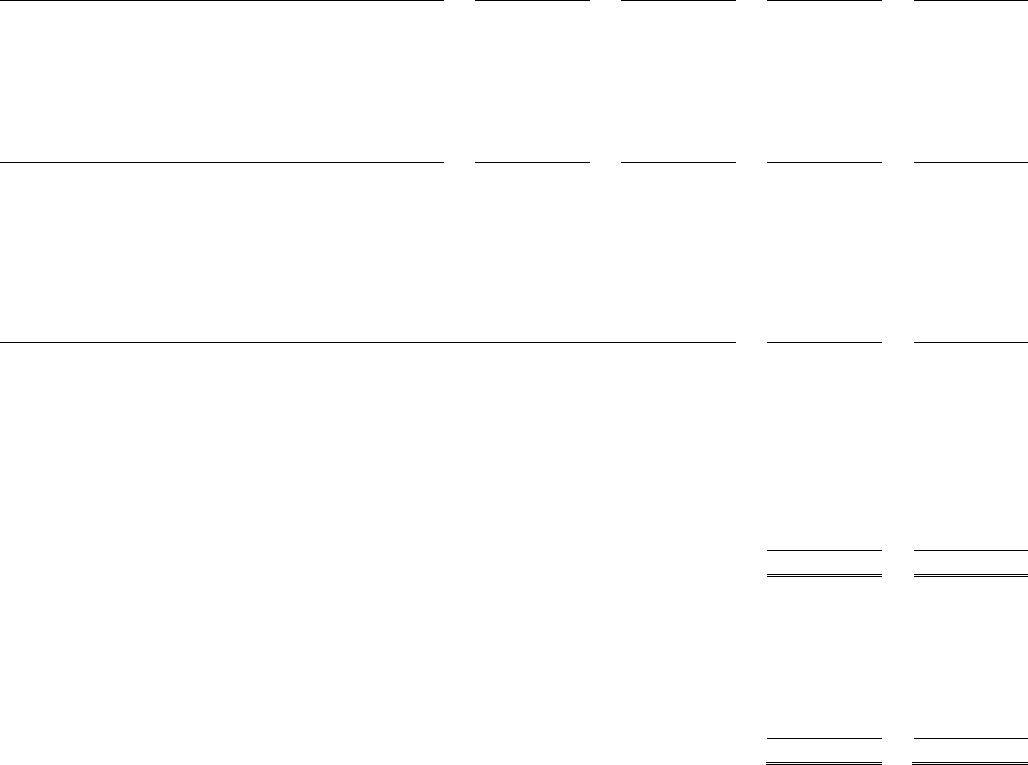

The following tables present the changes in Level 3 postretirement benefit plan assets for the years ended Dec. 31, 2010 and

2009:

(Thousands of Dollars) Jan. 1, 2010

Realized and

Unrealized

Gains

Purchases,

Issuances, and

Settlements,

net Dec. 31,

2010

Asset-backed securities ............................. $ 8,293 $ 1,814 $ (7,522) $ 2,585

Mortgage-backed securities .......................... 47,078 14,715 (42,581) 19,212

(Thousands of Dollars) Jan. 1, 2009

Realized and

Unrealized

Gains

Purchases,

Issuances,

and

Settlements,

net Dec. 31,

2009

Asset-backed securities ............................. $ 8,705 $ 1,029 $ (1,441) $ 8,293

Mortgage-backed securities .......................... 69,988 3,022 (25,932) 47,078

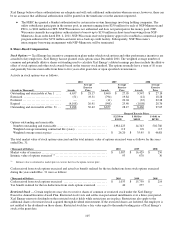

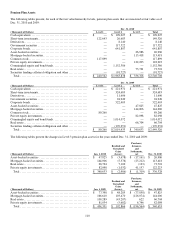

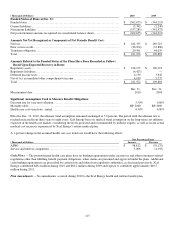

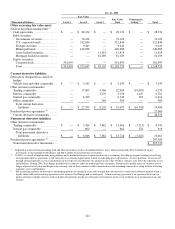

Benefit Obligations — A comparison of the actuarially computed benefit obligation and plan assets for Xcel Energy

postretirement health care plans that benefit employees of its utility subsidiaries is presented in the following table:

(Thousands of Dollars) 2010 2009

Change in Projected Benefit Obligation:

Obligation at Jan. 1 ................................................................... $ 728,902 $ 794,597

Service cost .......................................................................... 4,006 4,665

Interest cost .......................................................................... 42,780 50,412

Medicare subsidy reimbursements ..................................................... 5,423 3,226

Plan amendments .....................................................................

—

(27,407)

Plan participants’ contributions ........................................................ 14,315 13,786

Actuarial loss (gain) .................................................................. 68,126 (47,446)

Benefit payments ..................................................................... (68,647) (62,931)

Obligation at Dec. 31 ................................................................. $ 794,905 $ 728,902

Change in Fair Value of Plan Assets:

Fair value of plan assets at Jan. 1 ....................................................... $ 384,689 $ 299,566

Actual return on plan assets ........................................................... 53,430 72,101

Plan participants’ contributions ........................................................ 14,315 13,786

Employer contributions ............................................................... 48,443 62,167

Benefit payments ..................................................................... (68,647) (62,931)

Fair value of plan assets at Dec. 31..................................................... $ 432,230 $ 384,689