Xcel Energy 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

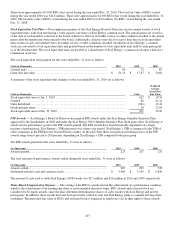

6. Income Taxes

COLI — In 2007, Xcel Energy and the U.S. government settled an ongoing dispute regarding PSCo’s right to deduct interest

expense on policy loans related to its COLI program that insured lives of certain PSCo employees. These COLI policies were

owned and managed by PSRI, a wholly owned subsidiary of PSCo. Xcel Energy paid the U.S. government a total of $64.4 million

in settlement of the U.S. government’s claims for tax, penalty, and interest for tax years 1993 through 2007. Xcel Energy

surrendered the policies to its insurer on Oct. 31, 2007, without recognizing a taxable gain. As a result of the settlement, the

lawsuit filed by Xcel Energy in the U.S. District Court was dismissed and the Tax Court proceedings were dismissed in December

2010 and January 2011.

As part of the Tax Court proceedings, during the first quarter of 2010, Xcel Energy and the IRS reached an agreement in principle

after a comprehensive financial reconciliation of Xcel Energy’s statement of account, dating back to tax year 1993. Upon

completion of this review, PSRI recorded a net non-recurring tax and interest charge of approximately $10 million (including $7.7

million tax expense and $2.3 million interest expense, net of tax), during the first quarter of 2010. During the third quarter of

2010, Xcel Energy and the IRS came to final agreement on the applicable interest netting computations related to these tax years.

Accordingly, PSRI recorded a reduction to expense of $0.6 million, net of tax, during the third quarter of 2010.

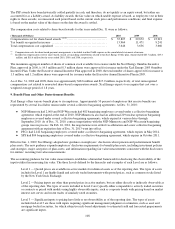

In July 2010, Xcel Energy, PSCo and PSRI entered into a settlement agreement with Provident related to all claims asserted by

Xcel Energy, PSCo and PSRI against Provident in a lawsuit associated with the discontinued COLI program. Under the terms of

the settlement, Xcel Energy, PSCo and PSRI were paid $25 million by Provident and Reassure America Life Insurance Company

in the third quarter of 2010. The $25 million proceeds were not subject to income taxes.

Medicare Part D Subsidy Reimbursements — In March 2010, the Patient Protection and Affordable Care Act was signed into

law. The law includes provisions to generate tax revenue to help offset the cost of the new legislation. One of these provisions

reduces the deductibility of retiree health care costs to the extent of federal subsidies received by plan sponsors that provide

retiree prescription drug benefits equivalent to Medicare Part D coverage, beginning in 2013. Based on this provision, Xcel

Energy is subject to additional taxes and is required to reverse previously recorded tax benefits in the period of enactment. Xcel

Energy expensed approximately $17 million of previously recognized tax benefits relating to Medicare Part D subsidies during

the first quarter of 2010. Xcel Energy does not expect the $17 million of additional tax expense to recur in future periods.

Federal Audit — Xcel Energy files a consolidated federal income tax return. During the first quarter of 2010, the IRS completed

an examination of Xcel Energy’s federal income tax returns of tax years 2006 and 2007. The IRS did not propose any material

adjustments for those tax years. The statute of limitations applicable to Xcel Energy’s 2006 federal income tax return expired in

August 2010. The statute of limitations applicable to Xcel Energy’s 2007 federal income tax return expires in September 2011.

The IRS commenced an examination of tax years 2008 and 2009 in the third quarter of 2010. As of Dec. 31, 2010, the IRS had

not proposed any material adjustments to tax years 2008 and 2009.

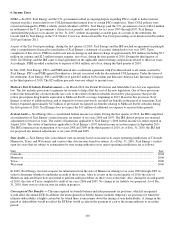

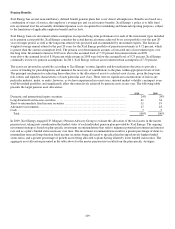

State Audits — Xcel Energy files consolidated state tax returns based on income in its major operating jurisdictions of Colorado,

Minnesota, Texas, and Wisconsin, and various other state income-based tax returns. As of Dec. 31, 2010, Xcel Energy’s earliest

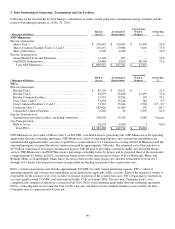

open tax years that are subject to examination by state taxing authorities in its major operating jurisdictions are as follows:

State Year

Colorado .......................................................................................................

.

2004

Minnesota .....................................................................................................

.

2006

Texas ..........................................................................................................

.

2006

Wisconsin .....................................................................................................

.

2006

In 2009, Xcel Energy received a request for information from the state of Minnesota relating to tax years 2002 through 2007 in

order to determine whether to undertake an audit of those years. After its review in the second quarter of 2010, the state of

Minnesota indicated that it does not intend to perform audit procedures on these years at this time. Also, during the second quarter

of 2010, the state of Texas completed its audit of tax years 2006 and 2007. No change in tax liability was proposed. As of Dec.

31, 2010, there were no state income tax audits in progress.

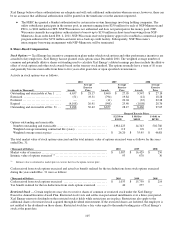

Unrecognized Tax Benefits — The unrecognized tax benefit balance includes permanent tax positions, which if recognized

would affect the annual ETR. In addition, the unrecognized tax benefit balance includes temporary tax positions for which the

ultimate deductibility is highly certain but for which there is uncertainty about the timing of such deductibility. A change in the

period of deductibility would not affect the ETR but would accelerate the payment of cash to the taxing authority to an earlier

period.