Xcel Energy 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

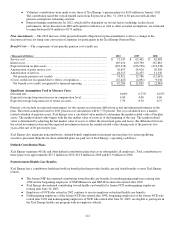

In 1993, Xcel Energy adopted accounting guidance regarding other non-pension postretirement benefits and elected to amortize

the unrecognized APBO on a straight-line basis over 20 years.

Regulatory agencies for nearly all of Xcel Energy’s retail and wholesale utility customers have allowed rate recovery of accrued

postretirement benefit costs. The Colorado jurisdictional postretirement benefit costs deferred during the transition period are

being amortized to expense on a straight-line basis over the 15-year period from 1998 to 2012. NSP-Minnesota also transitioned

to full accrual accounting for postretirement benefit costs, with regulatory differences fully amortized prior to 1997.

Plan Assets — Certain state agencies that regulate Xcel Energy’s utility subsidiaries also have issued guidelines related to the

funding of postretirement benefit costs. SPS is required to fund postretirement benefit costs for Texas and New Mexico

jurisdictional amounts collected in rates and PSCo is required to fund postretirement benefit costs in irrevocable external trusts

that are dedicated to the payment of these postretirement benefits. Also, a portion of the assets contributed on behalf of

nonbargaining retirees has been funded into a sub-account of the Xcel Energy pension plans. These assets are invested in a

manner consistent with the investment strategy for the pension plan.

Xcel Energy bases its investment-return assumption for the postretirement health care fund assets on expected long-term

performance for each of the investment types included in its asset portfolio. The assets are invested in a portfolio according to

Xcel Energy’s return, liquidity and diversification objectives to provide a source of funding for plan obligations and minimize the

necessity of contributions to the plan, within appropriate levels of risk. The principal mechanism for achieving these objectives is

the allocation of assets to selected asset classes, given the long-term risk, return, and liquidity characteristics of each particular

asset class. There were no significant concentrations of risk in any particular industry, index, or entity. Investment-return

volatility is not considered to be a material factor in postretirement health care costs.

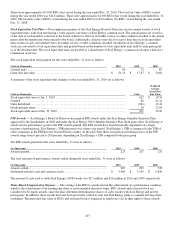

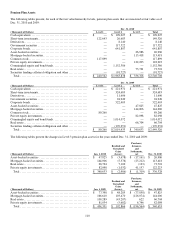

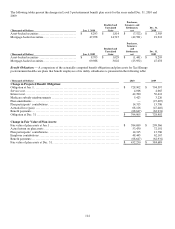

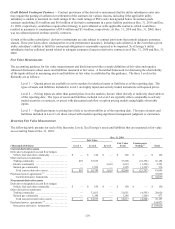

The following tables present, for each of the fair value hierarchy Levels, postretirement benefit plan assets that are measured at

fair value as of Dec. 31, 2010 and 2009:

Dec. 31, 2010

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents ............................................. $ 72,573 $ 76,352 $

—

$148,925

Derivatives...................................................

—

13,632

—

13,632

Government securities ........................................

—

3,402

—

3,402

Corporate bonds ..............................................

—

70,752

—

70,752

Asset-backed securities .......................................

—

—

2,585 2,585

Mortgage-backed securities ....................................

—

—

19,212 19,212

Preferred stock ...............................................

—

507

—

507

Commingled equity and bond funds............................

—

102,962

—

102,962

Securities lending collateral obligation and other ................

—

70,253

—

70,253

Total ...................................................... $ 72,573 $ 337,860 $ 21,797 $ 432,230

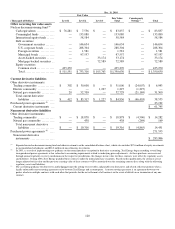

Dec. 31, 2009

(Thousands of Dollars) Level 1 Level 2 Level 3 Total

Cash equivalents ............................................. $

—

$ 165,291 $

—

$165,291

Short-term investments........................................

—

2,226

—

2,226

Derivatives...................................................

—

5,937

—

5,937

Government securities ........................................

—

1,538

—

1,538

Corporate bonds ..............................................

—

60,416

—

60,416

Asset-backed securities .......................................

—

—

8,293 8,293

Mortgage-backed securities ....................................

—

—

47,078 47,078

Preferred stock ...............................................

—

540

—

540

Commingled equity and bond funds............................

—

89,296

—

89,296

Securities lending collateral obligation and other ................

—

4,074

—

4,074

Total ...................................................... $

—

$ 329,318 $ 55,371 $ 384,689