Xcel Energy 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

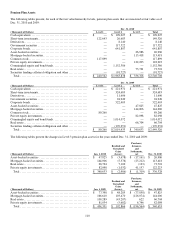

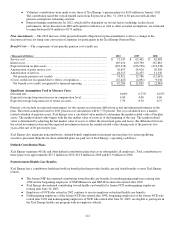

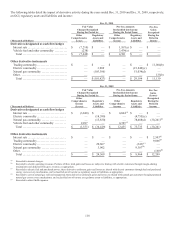

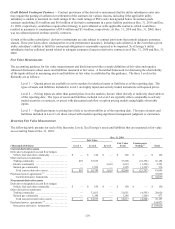

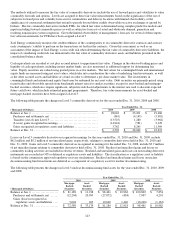

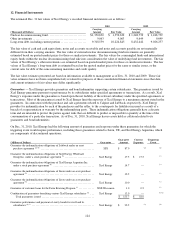

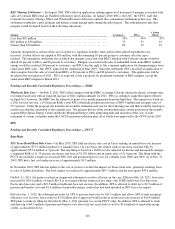

The following tables detail the impact of derivative activity during the years ended Dec. 31, 2010 and Dec. 31, 2009, respectively,

on OCI, regulatory assets and liabilities and income:

Dec. 31, 2010

Pre-Tax

Gains

Recognized

During the

Period in

Income

Fair Value Pre-Tax Amounts

Changes Recognized

During the Period in: Reclassified into Income

During the Period from:

(Thousands of Dollars)

Other

Comprehensive

Losses

Regulatory

Assets and

Liabilities

Other

Comprehensive

Income

Regulatory

Assets and

Liabilities

Derivatives designated as cash flow hedges

Interest rate .............................. . $ (7,210) $

—

$ 1,107(a) $

—

$

—

Vehicle fuel and other commodity.. ..... .. . (238)

—

3,474(e)

—

—

Total ............ ............ .... ....... $ (7,448) $

—

$ 4,581 $

—

$

—

Other derivative instruments

Trading commodity . ....... .... ............ $

—

$

—

$

—

$

—

$ 11,004(b)

Electric commodity .. .. .. .. .... .... .. ......

—

3,969

—

)c() 048,12(

—

Natural gas commodity ... .... .... .. .......

—

(105,396)

—

51,034(d)

—

Other .... .. ............. .. .... .... ....... .

—

—

—

—

135(b)

Total ............ ............ .... ....... $

—

$ (101,427) $

—

$ 29,194 $ 11,139

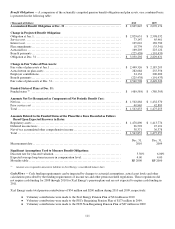

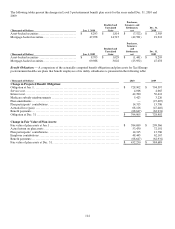

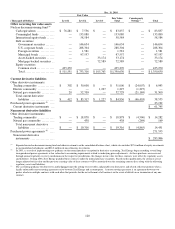

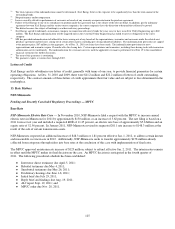

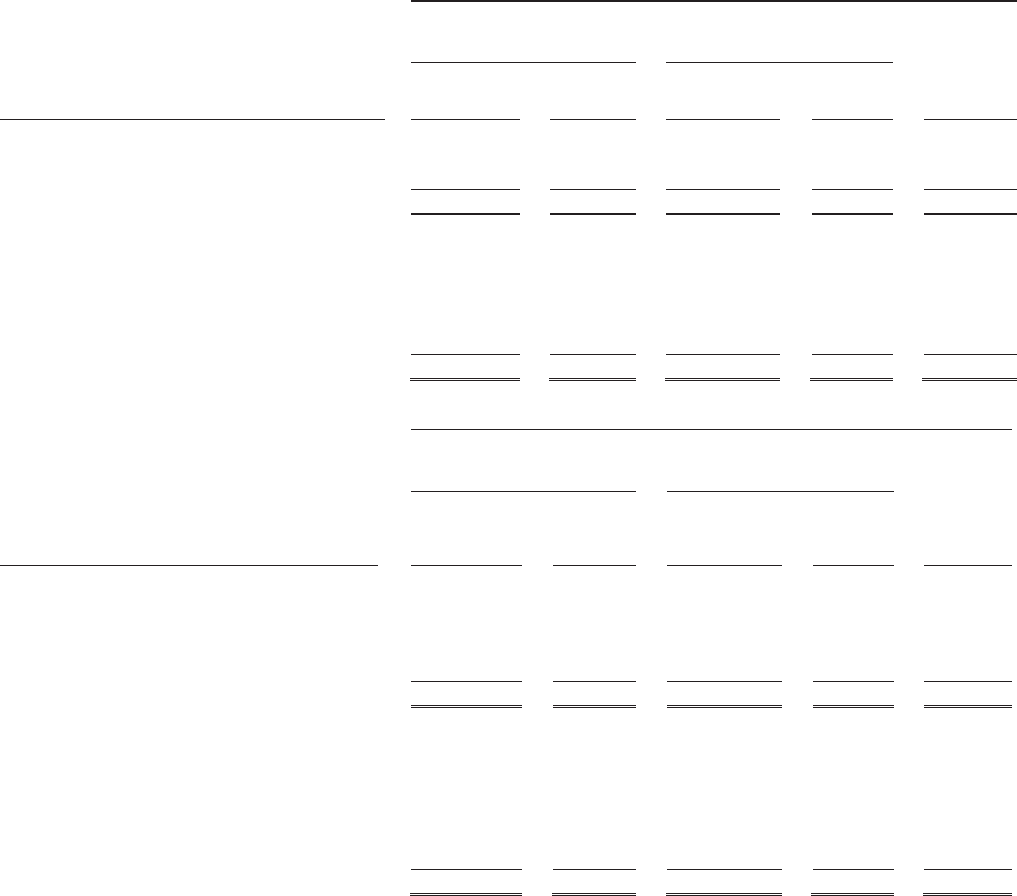

Dec. 31, 2009

Pre-Tax

Gains

(Losses)

Recognized

During the

Period in

Income

Fair Value Pre-Tax Amounts

Changes Recognized

During the Period in: Reclassified into Income

During the Period from:

(Thousands of Dollars)

Other

Comprehensive

Income

(Losses)

Regulatory

Assets and

Liabilities

Other

Comprehensive

Income

Regulatory

Assets and

Liabilities

Derivatives designated as cash flow hedges

Interest rate .............................. $ (3,840) $

—

$ 6,064(a) $

—

$

—

Electric commodity .. .. .. .. .... .... .. .....

—

(18,599)

—

(4,755)(c)

—

Natural gas commodity ... .... .... .. ......

—

(15,830)

—

78,488(d) (30,241 )(d)

Vehicle fuel and other commodity.. ..... .. 2,287

—

6,391(e)

—

—

Total ............ ............ .... ...... $ (1,553) $ (34,429) $ 12,455 $ 73,733 $ (30,241 )

Other derivative instruments

Interest rate .............................. $

—

$

—

$

—

$

—

$ 2,503(a)

Trading commodity . .. ..... .... .......... .

—

—

—

—

9,866(b)

Electric commodity .. .. .. .. .... .... .. .....

—

20,607

—

(343)(c)

—

Natural gas commodity ... .... .... .. ......

—

3,962

—

9,307(d)

—

Other ...... ............. .. .... .... .......

—

—

—

—

(160 )(b)

Total ............ ............ .... .... .. $

—

$ 24,569 $

—

$ 8,964 $ 12,209

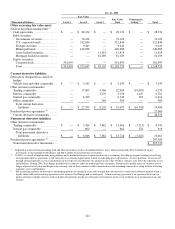

(a) Recorded to interest charges.

(b) Recorded to electric operating revenues. Portions of these total gains and losses are subject to sharing with electric customers through margin-sharing

mechanisms and deducted from gross revenue, as appropriate.

(c) Recorded to electric fuel and purchased power; these derivative settlement gains and losses are shared with electric customers through fuel and purchased

energy cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate.

(d) Recorded to cost of natural gas sold and transported; these derivative settlement gains and losses are shared with natural gas customers through purchased

natural gas cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate.

(e) Recorded to other O&M expenses.