Xcel Energy 2010 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

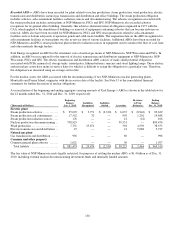

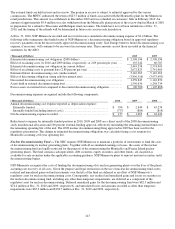

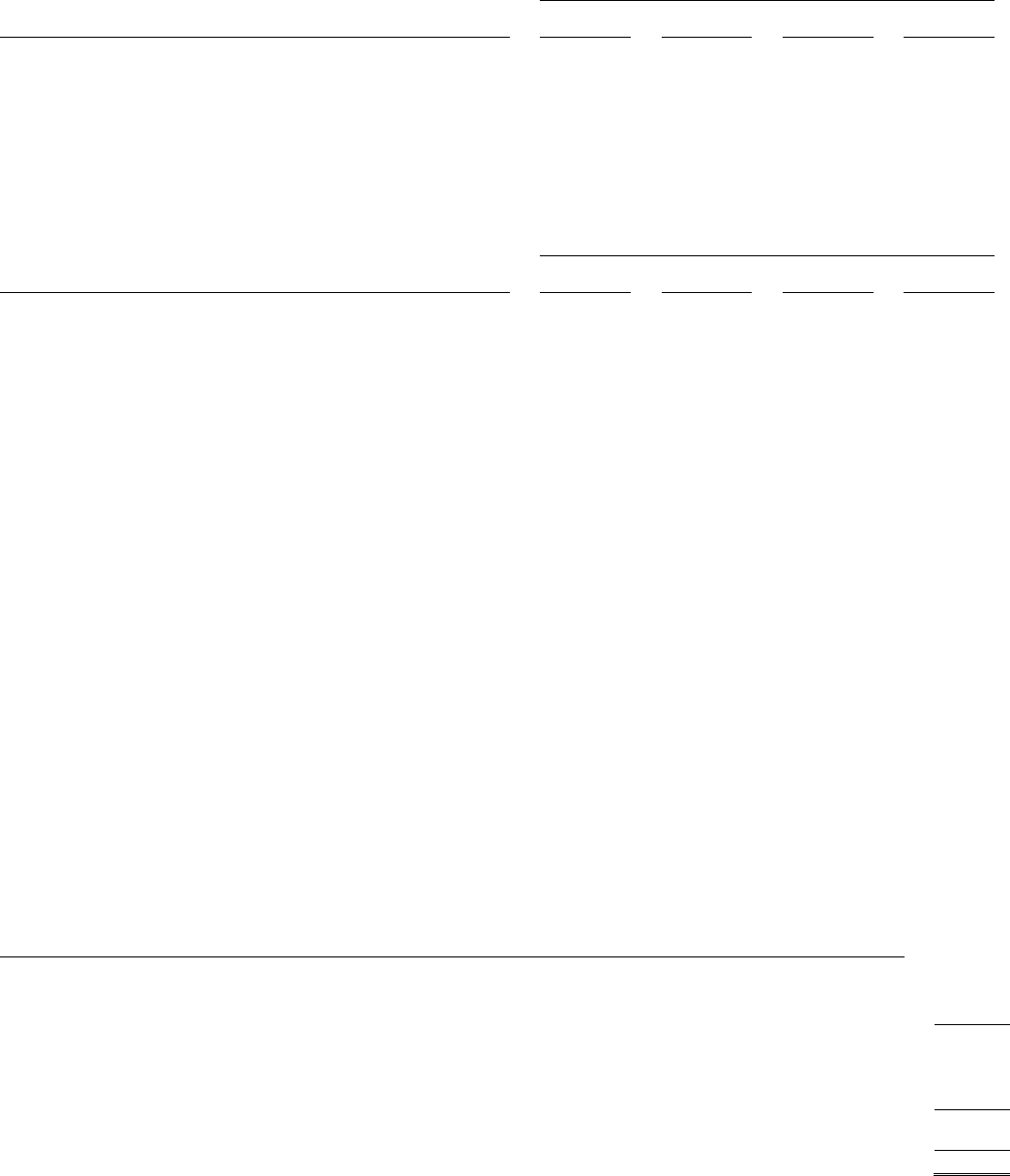

18. Summarized Quarterly Financial Data (Unaudited)

Due to the seasonality of Xcel Energy’s electric and natural gas sales, such interim results are not necessarily an appropriate base

from which to project annual results. Summarized quarterly unaudited financial data is as follows:

Quarter Ended

(Amounts in thousands, except per share data) March 31,

2010 June 30,

2010 Sept. 30,

2010 Dec. 31,

2010

Operating revenues .......................................... $ 2,807,462 $ 2,307,764 $ 2,628,787 $ 2,566,934

Operating income ............................................ 403,665 325,304 568,630 322,370

Income from continuing operations ........................... 167,340 135,625 312,488 136,503

Discontinued operations — income (loss) ..................... (222) 4,151 (182) 131

N

et income ................................................. 167,118 139,776 312,306 136,634

Earnings available to common shareholders .................... 166,058 138,716 311,246 135,573

Earnings per share total — basic .............................. $ 0.36 $ 0.30 $ 0.68 $ 0.29

Earnings per share total — diluted ............................ 0.36 0.30 0.67 0.29

Quarter Ended

(Amounts in thousands, except per share data) March 31,

2009 June 30,

2009 Sept. 30,

2009 Dec. 31,

2009

Operating revenues .......................................... $ 2,695,542 $ 2,016,083 $ 2,314,562 $ 2,618,116

Operating income ............................................ 370,797 279,368 465,148 353,259

Income from continuing operations ........................... 175,818 117,064 221,793 170,849

Discontinued operations — income (loss) ..................... (1,751) 43 (965) (1,964)

N

et income ................................................. 174,067 117,107 220,828 168,885

Earnings available to common shareholders .................... 173,007 116,047 219,768 167,824

Earnings per share total — basic .............................. $ 0.38 $ 0.25 $ 0.48 $ 0.37

Earnings per share total — diluted ............................ 0.38 0.25 0.48 0.37

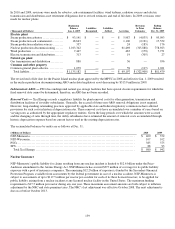

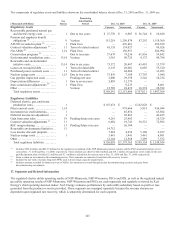

19. Asset Acquisition and Sale

Acquisition of Generation Assets — In December 2010, PSCo purchased the Blue Spruce Energy Center and Rocky Mountain

Energy Center from Calpine Development Holdings, Inc. and Riverside Energy Center LLC for $739.0 million plus an additional

$3.0 million for working capital adjustments. The working capital adjustments consisted of the settlement of PSCo’s most recent

purchases of energy and capacity under the terminated purchased power agreements, adjusted for accrued operating liabilities of

the acquired plants of $6.5 million.

The Blue Spruce Energy Center is a 310 MW simple cycle natural gas-fired power plant that began commercial operations in

2003. The Rocky Mountain Energy Center is a 652 MW combined-cycle natural gas-fired power plant that began commercial

operations in 2004. Both power plants previously provided energy and capacity to PSCo under purchased power agreements,

which were set to expire in 2013 and 2014, respectively. The acquisition developed out of PSCo’s resource planning activities, in

which customers’ future energy needs are addressed in a formal planning process for meeting PSCo’s generation obligations,

considering various assumptions and objectives including prices, reliability, and emissions levels. The generation assets were

offered to PSCo as a competitive bid in the resource planning process, and the offer was the least cost option for thermal

generation resources.

The purchase price has been allocated based on the estimated fair values of the assets acquired and the liabilities assumed at the

date of acquisition, as follows:

(Thousands of Dollars)

Assets acquired

Inventory ................................................................................................. $3,834

Property, plant and equipment .............................................................................. 735,916

Total assets acquired ..................................................................................... 739,750

Liabilities assumed

Accrued expenses ......................................................................................... 7,255

Total liabilities assumed .................................................................................. 7,255

Net assets acquired ......................................................................................... $732,495