Xcel Energy 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

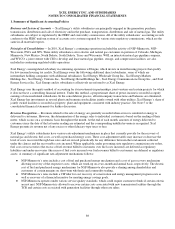

Renewable Energy Credits — RECs are marketable environmental commodities that represent proof that energy was generated

from eligible renewable energy sources. RECs are awarded upon delivery of the associated energy and can be bought and sold.

RECs are typically used as a form of measurement of compliance to RPS enacted by those states that are encouraging

construction and consumption from renewable energy sources, but can also be sold separately from the energy produced.

Currently, utility subsidiaries acquire RECs from the generation or purchase of renewable power.

When RECs are acquired in the course of generation or purchased as a result of meeting load obligations, they are recorded as

inventory at cost. RECs acquired for trading purposes are recorded as other investments and are also recorded at cost. The cost of

RECs that are utilized for compliance purposes is recorded as electric fuel and purchased power expense. The net margin on sales

of RECs for trading purposes is recorded as electric utility operating revenues, net of any margin sharing requirements. As a result

of state regulatory orders, Xcel Energy reduces recoverable fuel costs for the value of certain RECs and records the cost of future

compliance requirements that are recoverable in future rates as regulatory assets.

Emission Allowances — Emission allowances are recorded at cost, including the annual SO2 and NOx emission allowance

entitlement received at no cost from the EPA. Xcel Energy follows the inventory accounting model for all emission allowances.

The sales of emission allowances are included in electric utility operating revenues and the operating activities section of the

consolidated statements of cash flows.

Reclassifications — Certain prior year amounts have been reclassified to conform to the current year presentation, including amounts

related to discontinued operations, regulatory assets and liabilities, and deferred income taxes in the consolidated balance sheet and

consolidated statements of cash flows. These reclassifications did not have an impact on income from continuing operations.

Subsequent Events — Management has evaluated the impact of events occurring after Dec. 31, 2010 up to the date of issuance of

these consolidated financial statements. These statements contain all necessary adjustments and disclosures resulting from that

evaluation.

2. Accounting Pronouncements

Consolidation of Variable Interest Entities — In June 2009, the FASB issued new guidance on consolidation of variable interest

entities. The guidance affects various elements of consolidation, including the determination of whether an entity is a variable

interest entity and whether an enterprise is a variable interest entity’s primary beneficiary. These updates to the ASC were

effective for interim and annual periods beginning after Nov. 15, 2009. Xcel Energy implemented the guidance on Jan. 1, 2010,

and the implementation did not have a material impact on its consolidated financial statements. See Note 14 to the consolidated

financial statements for further information and required disclosures regarding variable interest entities.

Fair Value Measurement Disclosures — In January 2010, the FASB issued Fair Value Measurements and Disclosures

(Topic 820) — Improving Disclosures about Fair Value Measurements (ASU No. 2010-06), which updates the Codification to

require new disclosures for assets and liabilities measured at fair value. The requirements include expanded disclosure of

valuation methodologies for fair value measurements, transfers between levels of the fair value hierarchy, and gross rather than

net presentation of certain changes in Level 3 fair value measurements. The updates to the Codification contained in ASU

No. 2010-06 were effective for interim and annual periods beginning after Dec. 15, 2009, except for requirements related to gross

presentation of certain changes in Level 3 fair value measurements, which are effective for interim and annual periods beginning

after Dec. 15, 2010. Xcel Energy implemented the portions of the guidance required on Jan. 1, 2010, and the implementation did

not have a material impact on its consolidated financial statements. See Note 11 to the consolidated financial statements for

further information and required disclosures.