Xcel Energy 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

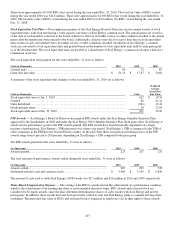

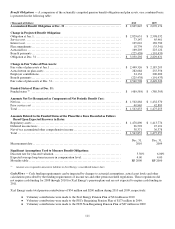

● Voluntary contributions were made across three of Xcel Energy’s pension plans for $134 million in January 2011.

The contribution raised the overall funded status from 84 percent at Dec. 31, 2010 to 88 percent with all other

pension assumptions remaining constant.

● Pension funding contributions for 2012, which will be dependent on several factors including, realized asset

performance, future discount rate, IRS and legislative initiatives as well as other actuarial assumptions, are estimated

to range between $150 million to $175 million.

Plan Amendments — The 2010 increase of the projected benefit obligation for plan amendments is due to a change in the

discount rate basis for lump sum conversion of annuities for participants in the Xcel Energy Pension Plan.

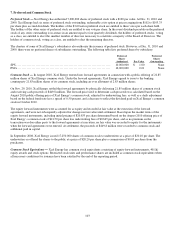

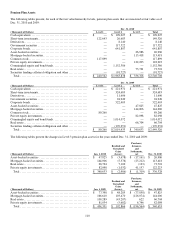

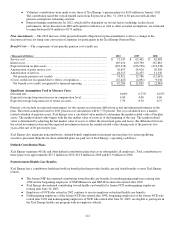

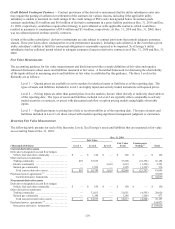

Benefit Costs — The components of net periodic pension cost (credit) are:

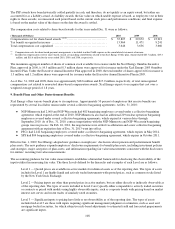

(Thousands of Dollars) 2010 2009 2008

Service cost ................................................................ $ 73,147 $ 65,461 $ 62,698

Interest cost ................................................................ 165,010 169,790 167,881

Expected return on plan assets ............................................... (232,318) (256,538) (274,338)

Amortization of prior service cost ............................................ 20,657 24,618 20,584

Amortization of net loss ..................................................... 48,315 12,455 11,156

Net periodic pension cost (credit) ......................................... 74,811 15,786 (12,019)

(Costs) credits not recognized due to effects of regulation ...................... (27,027) (2,891) 9,034

Net benefit cost (credit) recognized for financial reporting ................... $ 47,784 $ 12,895 $ (2,985)

Significant Assumptions Used to Measure Costs:

Discount rate ............................................................... 6.00% 6.75% 6.25

%

Expected average long-term increase in compensation level .................... 4.00 4.00 4.00

Expected average long-term rate of return on assets ............................ 7.79 8.50 8.75

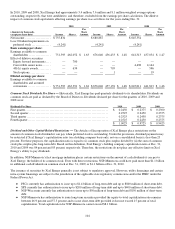

Pension costs include an expected return impact for the current year that may differ from actual investment performance in the

plan. The return assumption used for 2011 pension cost calculations will be 7.50 percent. The cost calculation uses a market-

related valuation of pension assets. Xcel Energy uses a calculated value method to determine the market-related value of the plan

assets. The market-related value begins with the fair market value of assets as of the beginning of the year. The market-related

value is determined by adjusting the fair market value of assets to reflect the investment gains and losses (the difference between

the actual investment return and the expected investment return on the market-related value) during each of the previous five

years at the rate of 20 percent per year.

Xcel Energy also maintains noncontributory, defined benefit supplemental retirement income plans for certain qualifying

executive personnel. Benefits for these unfunded plans are paid out of Xcel Energy’s operating cash flows.

Defined Contribution Plans

Xcel Energy maintains 401(k) and other defined contribution plans that cover substantially all employees. Total contributions to

these plans were approximately $27.3 million in 2010, $21.9 million in 2009 and $17.9 million in 2008.

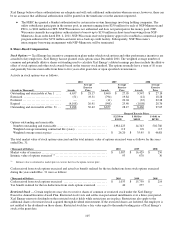

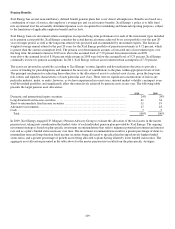

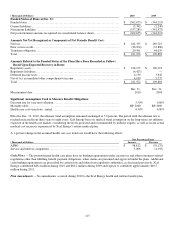

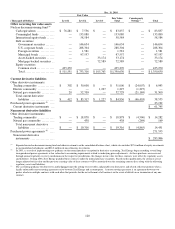

Postretirement Health Care Benefits

Xcel Energy has a contributory health and welfare benefit plan that provides health care and death benefits to most Xcel Energy

retirees.

● The former NSP discontinued contributing toward health care benefits for nonbargaining employees retiring after

1998 and for bargaining employees of NSP-Minnesota and NSP-Wisconsin who retired after 1999.

● Xcel Energy discontinued contributing toward health care benefits for former NCE nonbargaining employees

retiring after June 30, 2003.

● Employees of NCE who retired in 2002 continue to receive employer-subsidized health care benefits.

● Nonbargaining employees of the former NCE who retired after 1998, bargaining employees of the former NCE who

retired after 1999 and nonbargaining employees of NCE who retired after June 30, 2003, are eligible to participate in

the Xcel Energy health care program with no employer subsidy.