Xcel Energy 2010 Annual Report Download - page 139

Download and view the complete annual report

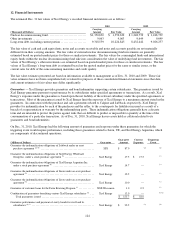

Please find page 139 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.129

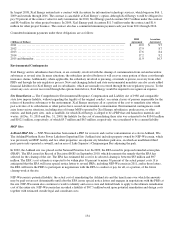

SPS agreed not to file another rate case until Sept. 15, 2012. In addition, SPS cannot file a TCRF until 2013, and if SPS files a

TCRF application before the effective date of rates in its next rate case, it must reduce the calculated TCRF revenue requirement

by $12.2 million.

Interim rates became effective on Feb. 16, 2011, subject to refund pending PUCT approval of the settlement. PUCT approval of

the settlement would result in no refund of interim rates. The PUCT is expected to consider the final order during the first half of

2011.

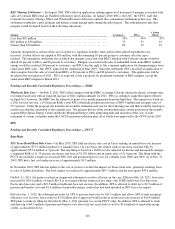

Pending and Recently Concluded Regulatory Proceedings — FERC

Wholesale Rate Complaints — In November 2004, Golden Spread Electric, Lyntegar Electric, Farmer’s Electric, Lea County

Electric, Central Valley Electric and Roosevelt County Electric, all wholesale cooperative customers of SPS, filed a rate

complaint with the FERC alleging that SPS’ rates for wholesale service were excessive and that SPS had incorrectly calculated

monthly fuel cost adjustment charges to such customers (the complaint). Cap Rock, another full-requirements customer of SPS,

Public Service Company of New Mexico (PNM) and Occidental Permian Ltd. and Occidental Power Marketing, L.P.

(Occidental), SPS’ largest retail customer, intervened in the proceeding.

In April 2008, the FERC issued its order on the complaint applied to the remaining non-settling parties. In July 2008, SPS

submitted its compliance report to the FERC and calculated the base rate refund for the 18-month period to be $6.1 million and

the fuel refund to be $4.4 million. Several wholesale customers protested these calculations. The status of various settlements and

the applicable regulatory approvals are discussed below. At this time, PNM, which filed a separate complaint, is the only party

that has not settled. As of Dec. 31, 2010, SPS has accrued an amount it believes is sufficient to cover the estimated refund

obligation related to the PNM complaint.

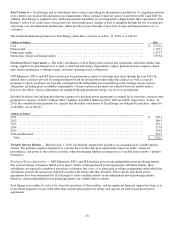

Golden Spread Complaint Settlement — SPS reached a settlement with Golden Spread (which included Lyntegar

Electric) and Occidental in December 2007 regarding base rate and fuel issues raised in the complaint described above as

well as a subsequent rate proceeding. The FERC approved the settlement in April 2008. The PUCT and NMPRC

approvals were obtained in the first quarter of 2010 eliminating the potential contingent payments by SPS resulting from

an adverse cost assignment decision or a failure to obtain state approvals.

New Mexico Cooperatives’ Complaint Settlement — In June 2010, the FERC approved the settlement with Farmers’

Electric Cooperative of New Mexico, Lea County Electric Cooperative, Central Valley Electric Cooperative and

Roosevelt County Electric Cooperative, and Occidental. The settlement resolves all issues arising from the complaint

docket and implements a replacement contract with a formula production rate at 10.5 percent ROE and extended the term

of its requirements sale to the four wholesale customers.

The four wholesale customers must reduce their power purchases by 90 to 100 MW in 2012, and implement staged

reductions in system average cost power purchases through the term of the agreement, which terminates in May 2026.

The settlement made the replacement contract contingent on certain state approvals, which were obtained by SPS. In the

event that all state regulatory approvals had not been received, the settlement included a one time contingent payment of

$12 million by SPS to these wholesale customers.

These wholesale customers agreed to hold SPS harmless from any future adverse regulatory treatment regarding the

proposed wholesale power sale. As a result of the FERC approval of the settlement and resolution of the complaint with

the New Mexico cooperatives, SPS released previously established reserves of $11.5 million in the second quarter of

2010.

The New Mexico parties and NMPRC staff filed a stipulation to resolve the NMPRC proceeding. The NMPRC issued a

final order approving the stipulation in August 2010. The PUCT approved the settlement replacement arrangement in

September 2010.

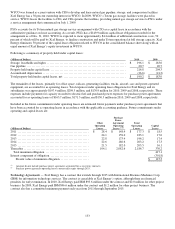

Cap Rock Complaint Settlement — In July 2010, SPS and Cap Rock filed a settlement agreement with the FERC. Cap

Rock agrees that its production base rates will be converted to a formula rate design. In December 2010, the FERC

approved the settlement. Pursuant to the settlement, SPS released previously established reserves of $3.3 million in the

fourth quarter of 2010 and paid Cap Rock $1 million.