Xcel Energy 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

Employee Benefits

Xcel Energy’s pension costs are based on an actuarial calculation that includes a number of key assumptions, most notably the

annual return level that pension investment assets will earn in the future and the interest rate used to discount future pension

benefit payments to a present value obligation for financial reporting. In addition, the actuarial calculation uses an asset-

smoothing methodology to reduce the volatility of varying investment performance over time. See Note 9 to the consolidated

financial statements for further discussion on the rate of return and discount rate used in the calculation of pension costs and

obligations.

Pension costs and funding requirements are expected to increase in the next few years. While investment returns exceeded the

assumed levels from 2004-2006 and during 2009-2010, investment returns in 2007 and 2008 were significantly below the

assumed levels. The investment gains or losses resulting from the difference between the expected pension returns and actual

returns earned are deferred in the year the difference arises and are recognized over the expected average remaining years of

service for active employees. Based on current assumptions and the recognition of past investment gains and losses, Xcel Energy

currently projects that the pension costs recognized for financial reporting purposes will increase from an expense of $12.9

million in 2009 and an expense of $47.8 million in 2010 to an expense of approximately $79.2 million in 2011 and expense of

approximately $113.1 million in 2012. The expected increase in the 2011 expense is due to the continued phase in of

unrecognized plan losses primarily resulting from the market decline in 2008.

Xcel Energy set the discount rate used to value the Dec. 31, 2010 pension and postretirement health care obligations at 5.5

percent, which is a 50 basis point decrease from Dec. 31, 2009. Xcel Energy uses multiple reference points in determining the

discount rate, including Citigroup Pension Liability Discount Curve, the Citigroup Above Median Curve and bond matching

studies. At Dec. 31, 2010, the above reference points supported the selected rate. In addition to the reference points utilized

above, Xcel Energy also reviews general survey data provided by our actuaries to assess the reasonableness of the discount rate

selected.

The Pension Protection Act changed the minimum funding requirements for defined benefit pension plans beginning in 2008.

● Xcel Energy accelerated its planned 2010 contribution of $100 million based on available liquidity, bringing its total

pension contributions to $200 million during 2009.

● In 2010, Xcel Energy voluntarily contributed $34 million to one of its pension plans.

● In January 2011, Xcel Energy contributed $134 million, allocated across three of its pension plans. The January 2011

contribution raised the overall funded status from 84 percent at Dec. 31, 2010 to 88 percent with all other pension

assumptions remaining constant. At this time, no additional contributions are planned for 2011.

● Projected pension funding contributions for 2012, which will be dependent on several factors including realized asset

performance, future discount rate, IRS and legislative initiatives as well as other actuarial assumptions, are estimated to

range between $150 million to $175 million.

● For future years, we anticipate contributions will be made to avoid benefit restrictions and at-risk status.

These expected contributions are summarized in Note 9 to the consolidated financial statements. These amounts are estimates and

may change based on actual market performance, changes in interest rates and any changes in governmental regulations.

Therefore, additional contributions could be required in the future. However, all pension costs are expected to be recoverable in

rates.

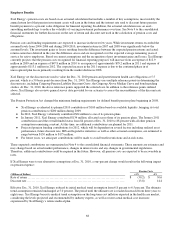

If Xcel Energy were to use alternative assumptions at Dec. 31, 2010, a one-percent change would result in the following impact

on pension expense:

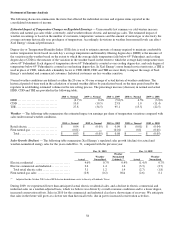

Pension Costs

(Millions of Dollars) +1% -1%

Rate of return ............................................................................ $ (30.2) $ 30.6

Discount rate ............................................................................. (13.8) 14.4

Effective Dec. 31, 2010, Xcel Energy reduced its initial medical trend assumption from 6.8 percent to 6.5 percent. The ultimate

trend assumption remained unchanged at 5.0 percent. The period until the ultimate rate is reached increased from three years to

eight years. Xcel Energy bases its medical trend assumption on the long-term cost inflation expected in the health care market,

considering the levels projected and recommended by industry experts, as well as recent actual medical cost increases

experienced by Xcel Energy’s retiree medical plan.