Xcel Energy 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

There were approximately 627,000 RSUs that vested during the year ended Dec. 31, 2010. The total fair value of RSUs vested

during the year ended 2010 was $14.8 million. There were approximately 41,000 RSUs that vested during the year ended Dec. 31,

2009. The total fair value of RSUs vested during the year ended 2009 was $0.8 million. No RSUs vested during the year ended

Dec. 31, 2008.

Stock Equivalent Unit Plan — Non-employee members of the Xcel Energy Board of Directors receive annual awards of stock

equivalent units, with each unit having a value equal to one share of Xcel Energy common stock. The annual grants are vested as

of the date of each member’s election to the board of directors; there is no further service or other condition attached to the annual

grants after the member has been elected to the board. Additionally, directors may elect to receive their fees in stock equivalent

units in lieu of cash, and similarly have no further service or other conditions attached. Dividends on Xcel Energy’s common

stock are converted to stock equivalent units and granted based on the number of stock equivalent units held by each participant

as of the dividend date. The stock equivalent units are payable as a distribution of Xcel Energy’s common stock upon a director’s

termination of service.

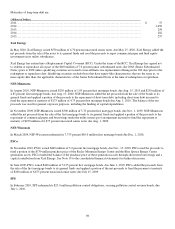

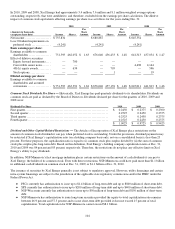

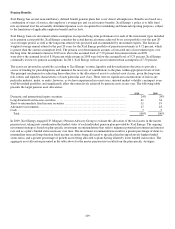

The stock equivalent units granted for the years ended Dec. 31 were as follows:

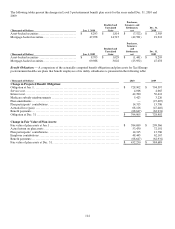

(Units in Thousands) 2010 2009 2008

Granted units .............................................................. 66 72 85

Grant date fair value ........................................................ $ 21.14 $ 17.87 $ 20.46

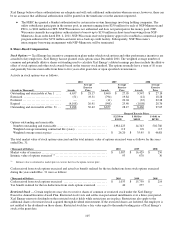

A summary of the stock equivalent unit changes for the year ended Dec. 31, 2010 are as follows:

(Units in Thousands) Units

Weighted

Average

Grant Date

Fair Value

Stock equivalent units at Jan. 1, 2010 ......................................................

.

622 $ 19.50

Granted .................................................................................

.

66 21.14

Units distributed .........................................................................

.

(241) 19.42

Dividend equivalents .....................................................................

.

24 22.04

Stock equivalent units at Dec. 31, 2010 ....................................................

.

471 19.90

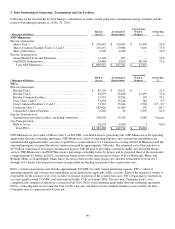

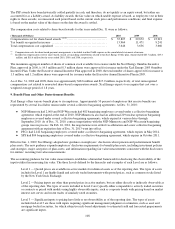

PSP Awards — Xcel Energy’s Board of Directors has granted PSP awards under the Xcel Energy Omnibus Incentive Plan

approved by the shareholders in 2000 and under the Xcel Energy 2005 Omnibus Incentive Plan. Both plans allow Xcel Energy to

attach various performance goals to the PSP awards granted. The PSP awards have been historically dependent on a single

measure of performance, Xcel Energy’s TSR measured over a three-year period. Xcel Energy’s TSR is compared to the TSR of

other companies in the EEI Investor-Owned Electrics index. At the end of the three-year period, potential payouts of the PSP

awards range from 0 percent to 200 percent, depending on Xcel Energy’s TSR compared to the peer group.

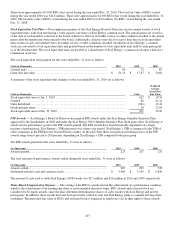

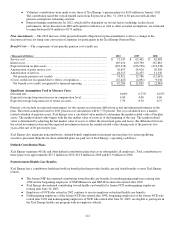

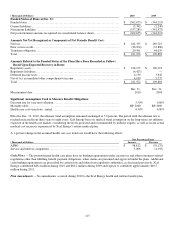

The PSP awards granted for the years ended Dec. 31 were as follows:

(In Thousands) 2010 2009 2008

Awards granted ............................................................ 225 207 216

The total amounts of performance awards settled during the years ended Dec. 31 were as follows:

(In Thousands) 2010 2009 2008

Awards settled ............................................................. 267 293 328

Settlement amount (cash and common stock) ................................. $ 5,460 $ 5,195 $ 6,826

The amount of cash used to settle Xcel Energy’s PSP awards was $2.7 million and $2.6 million in 2010 and 2009, respectively.

Share-Based Compensation Expense — The vesting of the RSUs is predicated on the achievement of a performance condition,

which is the achievement of an earnings per share or environmental measures target. RSU awards and restricted stock are

considered to be equity awards, since the plan settlement determination (shares or cash) resides with Xcel Energy and not the

participants. In addition, these awards have not been previously settled in cash and Xcel Energy plans to continue electing share

settlement. The grant date fair value of RSUs and restricted stock is expensed as employees vest in their rights to those awards.