Xcel Energy 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

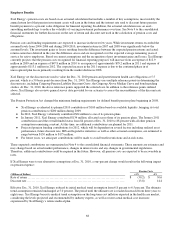

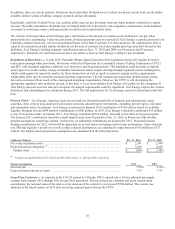

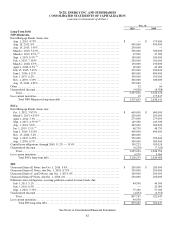

Credit Facilities — As of Feb. 14, 2011, Xcel Energy and its utility subsidiaries had the following committed credit facilities

available to meet its liquidity needs:

(Millions of Dollars) Facility (c) Drawn (a) Available Cash Liquidity

N

SP-Minnesota ..................... $ 482.2 $ 5.3 $ 476.9 $ 31.9 $ 508.8

PSCo .............................. 675.1 152.0 523.1 18.0 541.1

SPS ................................ 247.9 43.0 204.9 0.4 205.3

Xcel Energy — Holding Company ... 771.6 343.1 428.5 2.0 430.5

N

SP-Wisconsin(b) ...................

—

—

—

0.3 0.3

Total ............................. $ 2,176.8 $ 543.4 $ 1,633.4 $ 52.6 $ 1,686.0

(a) Includes direct borrowings, outstanding commercial paper and letters of credit.

(b) NSP-Wisconsin does not currently have a specific credit facility; however, it does have a borrowing agreement with NSP-Minnesota. For further discussion,

see Note 4 to the consolidated financial statements.

(c) These credit facilities expire in December 2011.

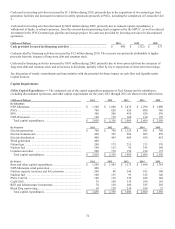

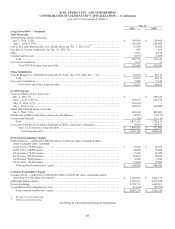

Xcel Energy plans to syndicate new credit agreements at the Holding Company, NSP-Minnesota, PSCo, SPS and NSP-Wisconsin

during the first quarter of 2011 to replace the existing agreements. The total anticipated size of the new credit facilities will be

approximately $2.45 billion.

Money Pool — Xcel Energy received FERC approval to establish a utility money pool arrangement with the utility subsidiaries,

subject to receipt of required state regulatory approvals. The utility money pool allows for short-term investments in and

borrowings from the utility subsidiaries and investments from the Holding Company to the utility subsidiaries at market-based

interest rates. The money pool balances are eliminated during consolidation.

The utility money pool arrangement does not allow the Holding Company to borrow from the utility subsidiaries. NSP-

Minnesota, PSCo and SPS participate in the money pool pursuant to approval from their respective state regulatory commissions.

NSP-Wisconsin does not participate in the money pool.

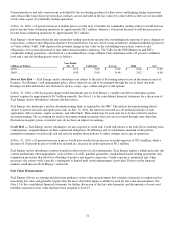

Equity Forward Instruments — In August 2010, Xcel Energy entered into equity forward agreements in connection with a public

offering of 21.85 million shares of Xcel Energy common stock. Under the forward agreements, Xcel Energy agreed to issue to the

banking counterparty 21.85 million shares of its common stock.

On Nov. 29, 2010, Xcel Energy settled the forward agreements by physically delivering 21.85 million shares of common equity

and receiving cash proceeds of $449.8 million. The price used to determine cash proceeds was calculated based on the August

2010 public offering price of Xcel Energy’s common stock, adjusted for underwriting fees, as well as a daily adjustment based on

the federal funds rate less a spread of 0.50 percent, and a decrease to reflect the dividend paid on Xcel Energy’s common stock in

October 2010.

Registration Statements — Xcel Energy’s articles of incorporation authorize the issuance of 1 billion shares of $2.50 par value

common stock. As of Dec. 31, 2010 and 2009, Xcel Energy had approximately 482 million shares and 458 million shares of

common stock outstanding, respectively. In addition, Xcel Energy’s articles of incorporation authorize the issuance of

seven million shares of $100 par value preferred stock. On Dec. 31, 2010 and 2009, Xcel Energy had approximately one million

shares of preferred stock outstanding. Xcel Energy and its subsidiaries have the following registration statements on file with the

SEC, pursuant to which they may sell, from time to time, securities:

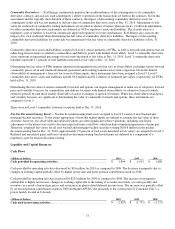

● Xcel Energy has an effective automatic shelf registration statement that does not contain a limit on issuance capacity.

However, Xcel Energy’s ability to issue securities is limited by authority granted by the Board of Directors, which

currently authorizes the issuance of up to an additional $480 million of debt and common equity securities.

● NSP-Minnesota has an automatic shelf registration statement filed in January 2011 that does not contain a limit on

issuance capacity. However, NSP-Minnesota’s ability to issue securities is limited by authority granted by its Board of

Directors, which currently authorizes the issuance of up to $1.5 billion of debt securities.

● PSCo has an automatic shelf registration statement filed in October 2010 that does not contain a limit on issuance

capacity. However, PSCo’s ability to issue securities is limited by authority granted by its Board of Directors, which

currently authorizes the issuance of up to $1.4 billion of debt securities.

● NSP-Wisconsin has $50 million of debt securities remaining under its currently effective registration statement.