Xcel Energy 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.94

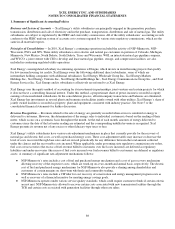

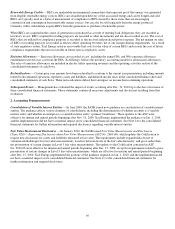

Restricted Cash — At Dec. 31, 2010 and 2009, Xcel Energy had restricted cash of $1 million. The restricted cash balances

primarily represent deposits held in conjunction with short-term wholesale and commodity trading activities. These balances are

presented as a component of other assets on the consolidated balance sheets.

Inventory — All inventory is recorded at average cost.

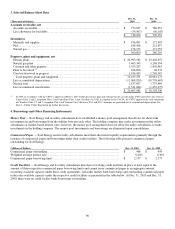

Regulatory Accounting — Our regulated utility subsidiaries account for certain income and expense items in accordance with

accounting guidance for regulated operations. Under this guidance:

● Certain costs, which would otherwise be charged to expense, are deferred as regulatory assets based on the expected

ability to recover the costs in future rates; and

● Certain credits, which would otherwise be reflected as income, are deferred as regulatory liabilities based on the

expectation the amounts will be returned to customers in future rates, or because the amounts were collected in rates

prior to the costs being incurred.

Estimates of recovering deferred costs and returning deferred credits are based on specific ratemaking decisions or precedent for

each item. Regulatory assets and liabilities are amortized consistent with the treatment in the rate setting process.

If restructuring or other changes in the regulatory environment occur, regulated utility subsidiaries may no longer be eligible to

apply this accounting treatment, and may be required to eliminate such regulatory assets and liabilities from their balance sheets.

Such changes could have a material effect on Xcel Energy’s results of operations in the period the write-offs are recorded. See

Note 16 to the consolidated financial statements for further discussion of regulatory assets and liabilities.

Conservation Programs — Xcel Energy’s utility subsidiaries have implemented programs in many of their retail jurisdictions to

assist customers in conserving energy and reducing peak demand on the electric and natural gas systems. These programs include,

but are not limited to, efficiency and redesign programs and rebates for the purchase of items such as compact fluorescent bulbs,

saver switches, and energy-efficient heating and cooling appliances.

The costs incurred for DSM and CIP programs are deferred if it is probable that future revenue, in an amount at least equal to the

deferred amount, will be provided to permit recovery of the previously incurred cost, rather than to provide for expected future

amounts of similar programs. For incentive programs designed to allow recovery of lost margins and/or conservation performance

incentives, recorded revenues are limited to those amounts expected to be collected within twenty four months following the end

of the annual period in which they are earned.

For PSCo, SPS and NSP-Minnesota, DSM and CIP program costs are recovered through a combination of base rate revenue and

rider mechanisms. The revenue billed to customers recovers incurred costs for conservation programs and also incentive amounts

that are designed to encourage Xcel Energy’s achievement of energy conservation goals and compensate for related lost sales

margin. For these utility subsidiaries, regulatory assets are recognized to reflect the amount of costs or earned incentives that have

not yet been collected from customers. NSP-Wisconsin recovers approved conservation program costs in base rate revenue,

without the use of rider mechanisms.

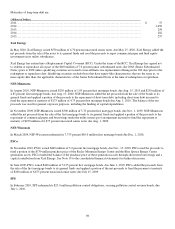

Deferred Financing Costs — Other assets included deferred financing costs of approximately $74 million and $69 million, net of

amortization, at Dec. 31, 2010 and 2009, respectively. Xcel Energy is amortizing these financing costs over the remaining

maturity periods of the related debt.

Debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums, discounts and expenses associated

with refinanced debt are deferred and amortized over the life of the related new issuance, in accordance with regulatory guidelines.

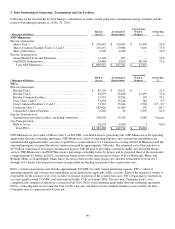

Guarantees — Xcel Energy and its subsidiaries recognize, upon issuance or modification of a guarantee, a liability for the fair

market value of the obligations that have been assumed in issuing the guarantee. This liability includes consideration of specific

triggering events and other conditions which may modify the ongoing obligation to perform under the guarantee.

The obligation recognized is reduced over the term of the guarantee as Xcel Energy is released from risk under the guarantee. See

Note 12 to the consolidated financial statements for specific details of issued guarantees.

Accounts Receivable and Allowance for Bad Debts — Accounts receivable are stated at the actual billed amount net of an

allowance for bad debts. Xcel Energy establishes an allowance for uncollectible receivables based on a policy that reflects its

expected exposure to the credit risk of customers.