Xcel Energy 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

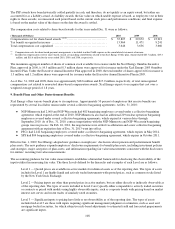

The federal carryforward periods expire between 2021 and 2030. The state carryforward periods expire between 2011 and 2030.

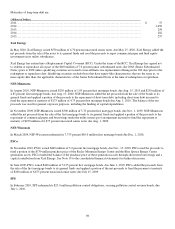

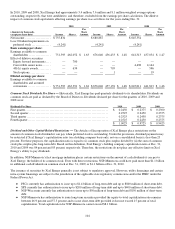

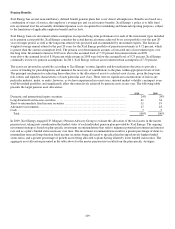

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income

tax rate to income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

2010 2009 2008

Federal statutory rate.................................................................. 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit................................... 3.9 4.0 4.4

Tax credits recognized, net of federal income tax expense.............................. (1.8) (2.0) (1.8)

Regulatory differences — utility plant items .......................................... (1.1) (2.0) (2.1)

Resolution of income tax audits and other ............................................ 0.6 0.8

—

Change in unrecognized tax benefits ................................................. 0.1 (0.5) (0.1)

Life insurance policies .............................................................. (0.8) (0.2) (0.2)

Previously recognized Medicare Part D subsidies ...................................... 1.4

—

—

Other, net .......................................................................... (0.6)

—

(0.8)

Effective income tax rate from continuing operations .................................... 36.7% 35.1% 34.4%

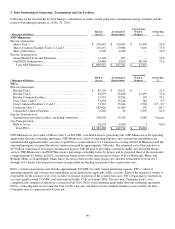

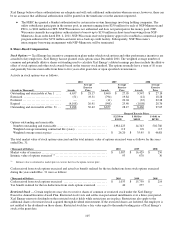

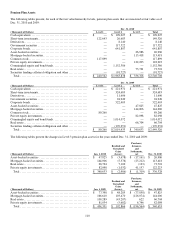

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2010 2009 2008

Current federal tax expense (benefit) .............................................

.

$ 16,657 $ (39,886) $ 56,044

Current state tax expense ........................................................

.

12,580 8,672 26,904

Current change in unrecognized tax expense (benefit) .............................

.

(2,982) (7,627) 3,891

Current tax credits ..............................................................

.

(944)

—

—

Deferred federal tax expense.....................................................

.

376,073 360,252 236,307

Deferred state tax expense .......................................................

.

52,543 69,947 38,758

Deferred change in unrecognized tax expense (benefit) ...........................

.

4,641 2,387 (4,535)

Deferred tax credits .............................................................

.

(15,580) (16,005) (11,485)

Deferred investment tax credits ..................................................

.

(6,353) (6,426) (7,198)

Total income tax expense from continuing operations..............................

.

$ 436,635 $ 371,314 $ 338,686

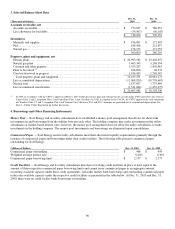

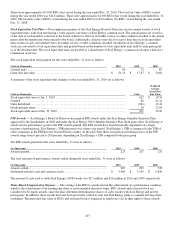

The components of Xcel Energy’s net deferred tax liability (current and noncurrent) at Dec. 31 were as follows:

(Thousands of Dollars) 2010 2009

Deferred tax liabilities:

Differences between book and tax bases of property ........................................ $ 3,853,425 $ 3,224,842

Regulatory assets ........................................................................ 242,760 232,887

Other ................................................................................... 219,035 198,912

Total deferred tax liabilities ............................................................ $ 4,315,220 $ 3,656,641

Deferred tax assets:

NOL carryforward ....................................................................... $ 423,728 $ 251,089

Tax credit carryforward .................................................................. 226,022 196,475

Unbilled revenue - fuel costs ............................................................. 69,358 62,056

Regulatory liabilities ..................................................................... 51,600 48,426

Environmental remediation ............................................................... 41,696 40,874

Deferred investment tax credits ........................................................... 39,916 39,968

Rate refund ............................................................................. 8,971 40,956

Accrued liabilities and other .............................................................. 58,891 43,507

Total deferred tax assets ................................................................ $ 920,182 $ 723,351

N

et deferred tax liability ................................................................... $ 3,395,038 $ 2,933,290