Xcel Energy 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

The CPUC provided for recovery on CWIP in rate base in each rate case and deferred accounting of accelerated depreciation

costs. PSCo needs to make applications for detailed cost review before commencing each phase of the plan. The CPUC also

encouraged PSCo to hold stakeholder meetings to discuss issues around a multi-year rate plan. In January 2011, the AQCC

unanimously approved incorporation of the CACJA plan into Colorado’s regional haze SIP. See Note 14 to the consolidated

financial statements for discussion. The Colorado state legislature must review the SIP, which will contain provisions of the

CACJA approved by the CPUC. Unless changed by the legislature during its review process, the SIP (including the CACJA plan)

will be sent to the EPA for incorporation into federal CAA regulations. The total investment associated with the adopted plan is

approximately $1.0 billion over the next seven years. The rate impact of the proposed plan is expected to increase future bills on

average by 2 percent annually.

San Luis Valley-Calumet-Comanche Unit 3 Transmission Project — In May 2009, PSCo and Tri-State Generation and

Transmission Association filed a joint application with the CPUC for a project for 230 KV and 345 KV line and substation

construction. The line is intended to assist in bringing solar power in the San Luis Valley to load. The line was originally expected

to be placed in-service in 2013; however, that appears unlikely now due to delays in the siting and permitting of the line. Several

landowners oppose this transmission line, including two large ranches. In November 2010, the ALJ issued a recommended

decision granting the CPCN but proposing a significant refund obligation if the line was not heavily utilized ten years after it was

in service. Several parties, including PSCo, filed exceptions to the recommended decision. The CPUC deliberated on the

exceptions to the recommended decision and granted the CPCN without the refund obligation recommended by the ALJ. A

written decision will follow.

SmartGridCity™ CPCN — As part of the PSCo electric rate case, the CPUC included recovery of the revenue requirements

associated with $45 million of capital and $4 million of annual O&M costs incurred by PSCo to develop and operate

SmartGridCity™, subject to refund, and ordered PSCo to file for a CPCN for that project.

In February 2011, the CPUC approved the CPCN and allowed recovery of approximately $28 million of the capital cost and 100

percent of the O&M costs and ordered PSCo to file for a rate reduction in April 2011 to reflect the lower level of capital in rate

base. The CPUC seeks additional information regarding the future plans to utilize SmartGridCity™ in an application to recover

the additional capital. PSCo believes that it will be able to satisfy that requirement.

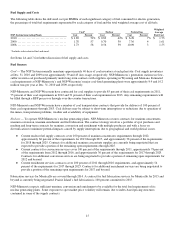

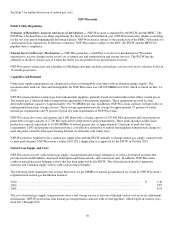

Fuel Supply and Costs

The following table shows the delivered cost per MMBtu of each significant category of fuel consumed for electric generation,

the percentage of total fuel requirements represented by each category of fuel and the total weighted average cost of all fuels.

Weighted

Average

Fuel Cost

Coal Natural Gas

PSCo Generating Plants Cost Percent Cost Percent

2010 ....................................................... $ 1.58 85% $ 5.05 15% $ 2.11

2009 ....................................................... 1.52 82 3.99 18 1.97

2008 ....................................................... 1.42 84 7.03 16 2.31

See Items IA and 7 for further discussion of fuel supply and costs.

Fuel Sources

Coal — Coal inventory levels may vary widely among plants. However, PSCo normally maintains approximately 41 days of coal

inventory at each plant site. Coal supply inventories at Dec. 31, 2010 and 2009 were approximately 34 and 68 days usage,

respectively, based on the maximum burn rate for all of PSCo’s coal-fired plants. PSCo’s generation stations use low-sulfur

western coal purchased primarily under contracts with suppliers operating in Colorado and Wyoming. During 2010 and 2009,

PSCo’s coal requirements for existing plants were approximately 11.2 million and 9.2 million tons, respectively.

PSCo has contracted for coal suppliers to supply 84 percent of its coal requirements in 2011, 53 percent of its coal requirements in

2012 and 22 percent of its coal requirements in 2013. Any remaining requirements will be filled through an RFP process or

through over-the-counter transactions.

PSCo has coal transportation contracts that provide for delivery of 100 percent of its coal requirements in 2011, 67 percent of its

coal requirements in 2012 and 66 percent of its coal requirements in 2013. Coal delivery may be subject to short-term

interruptions or reductions due to operation of the mines, transportation problems, weather, and availability of equipment.