Xcel Energy 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.148

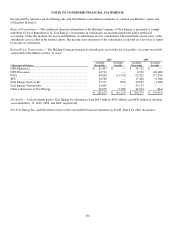

The purchase agreement allows PSCo 90 days to review and approve the working capital adjustment based on an examination of

the plants’ books and records. If subsequent to the acquisition date, information is obtained about conditions that existed at the

acquisition date that indicate the initial recorded amounts should be adjusted, adjustments may be recorded in 2011 to the assets

acquired and liabilities assumed in the acquisition.

Operating results for the plants subsequent to the date of acquisition are included in the Consolidated Statement of Income for the

Year Ended Dec. 31, 2010. PSCo incurred approximately $1.2 million of recoverable acquisition-related legal and consulting

costs that are deferred as a regulatory asset as of Dec. 31, 2010.

Sale of Lubbock Electric Distribution Assets — In November 2009, SPS entered into an asset purchase agreement with the city

of Lubbock, Texas. This agreement had set forth that SPS would sell its electric distribution system assets within the city limits to

LP&L for approximately $87 million. The sale and related transactions eliminate the inefficiencies of maintaining duplicate

distribution systems, one by SPS and the other by the city-owned LP&L. SPS has provided indemnification to Lubbock for losses

arising out of any breach of the representations, warranties and covenants under the related asset purchase agreement and for

losses arising out of certain other matters, including pre-closing unknown liabilities. See Note 12 to the consolidated financial

statements for further discussion of guarantees.

SPS served about 24,000 customers within Lubbock, representing about 25 percent of the total customers in the dually certified

service area. As part of this transaction, SPS will continue to provide wholesale power to meet the electric load for these

customers, initially by amending the current wholesale full-requirements contract with WTMPA, which provides service to LP&L

through 2019 and then for an additional 25 years under a new contract directly with LP&L when the WTMPA contract

terminates. Both of these wholesale power agreements provide for formula rates that change annually based on the actual cost of

service. The formula rate with WTMPA reflects an initial 10.5 percent ROE. All or portions of this transaction were reviewed and

approved by the PUCT, the NMPRC and the FERC.

Additionally, SPS and the city of Lubbock entered into an amended long-term treated sewage effluent water agreement under

which SPS will continue to purchase waste water from the city for cooling SPS’ Jones Station southeast of Lubbock.

In October 2010, the transaction closed resulting in a pre-tax gain of approximately $20 million which will be shared with retail

customers in Texas, and has been deferred as a regulatory liability pending the determination of the sharing by the PUCT.

Item 9 — Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A — Controls and Procedures

Disclosure Controls and Procedures

Xcel Energy maintains a set of disclosure controls and procedures designed to ensure that information required to be disclosed in

reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized, and reported within

the time periods specified in SEC rules and forms. In addition, the disclosure controls and procedures ensure that information

required to be disclosed is accumulated and communicated to management, including the chief executive officer (CEO) and chief

financial officer (CFO), allowing timely decisions regarding required disclosure. As of Dec. 31, 2010, based on an evaluation

carried out under the supervision and with the participation of Xcel Energy’s management, including the CEO and CFO, of the

effectiveness of its disclosure controls and the procedures, the CEO and CFO have concluded that Xcel Energy’s disclosure

controls and procedures were effective.

Internal Controls Over Financial Reporting

No change in Xcel Energy’s internal control over financial reporting has occurred during the most recent fiscal quarter that has

materially affected, or is reasonably likely to materially affect, Xcel Energy’s internal control over financial reporting. Xcel

Energy maintains internal control over financial reporting to provide reasonable assurance regarding the reliability of the financial

reporting. Xcel Energy has evaluated and documented its controls in process activities, in general computer activities, and on an

entity-wide level. During the year and in preparation for issuing its report for the year ended Dec. 31, 2010 on internal controls

under section 404 of the Sarbanes-Oxley Act of 2002, Xcel Energy conducted testing and monitoring of its internal control over

financial reporting. Based on the control evaluation, testing and remediation performed, Xcel Energy did not identify any material

control weaknesses, as defined under the standards and rules issued by the Public Company Accounting Oversight Board and as

approved by the SEC and as indicated in Management Report on Internal Controls herein.