Xcel Energy 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

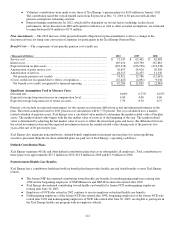

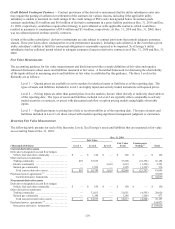

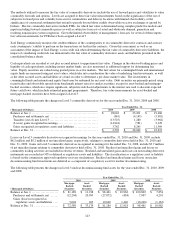

Credit Related Contingent Features — Contract provisions of the derivative instruments that the utility subsidiaries enter into

may require the posting of collateral or settlement of the contracts for various reasons, including if the applicable utility

subsidiary is unable to maintain its credit ratings. If the credit ratings of PSCo were downgraded below investment grade,

contracts underlying $5.6 million and $0.6 million of derivative instruments in a gross liability position at Dec. 31, 2010 and Dec.

31, 2009, respectively, would have required Xcel Energy to post collateral or settle applicable contracts, which would have

resulted in payments to counterparties of $9.8 million and $3.4 million, respectively. At Dec. 31, 2010 and Dec. 31, 2009, there

was no collateral posted on these specific contracts.

Certain of the utility subsidiaries’ derivative instruments are also subject to contract provisions that contain adequate assurance

clauses. These provisions allow counterparties to seek performance assurance, including cash collateral, in the event that a given

utility subsidiary’ s ability to fulfill its contractual obligations is reasonably expected to be impaired. Xcel Energy’ s utility

subsidiaries had no collateral posted related to adequate assurance clauses in derivative contracts as of Dec. 31, 2010 and Dec. 31,

2009.

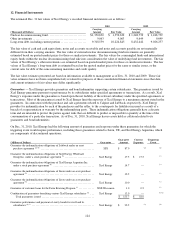

Fair Value Measurements

The accounting guidance for fair value measurements and disclosures provides a single definition of fair value and requires

enhanced disclosures about assets and liabilities measured at fair value. A hierarchal framework for disclosing the observability

of the inputs utilized in measuring assets and liabilities at fair value is established by this guidance. The three Levels in the

hierarchy are as follows:

Level 1 — Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. The

types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted prices.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as

of the reporting date. The types of assets and liabilities included in Level 2 are typically either comparable to actively

traded securities or contracts, or priced with discounted cash flow or option pricing models using highly observable

inputs.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets and

liabilities included in Level 3 are those valued with models requiring significant management judgment or estimation.

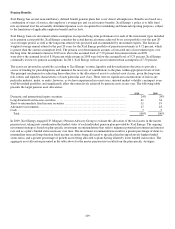

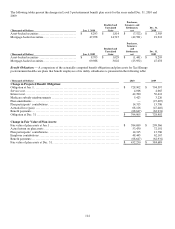

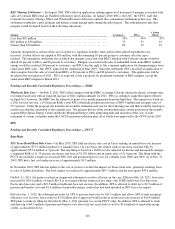

Recurring Fair Value Measurements

The following table presents for each of the hierarchy Levels, Xcel Energy’ s assets and liabilities that are measured at fair value

on a recurring basis at Dec. 31, 2010:

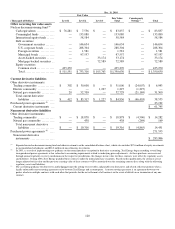

Dec. 31, 2010

Fair Value

(Thousands of Dollars) Level 1 Level 2 Level 3

Fair Value

Total

Counterparty

Netting (c) Total

Current derivative assets

Derivatives designated as cash flow hedges:

Vehicle fuel and other commodity . .. .. ........ $

—

$ 126 $

—

$ 126 $

—

$ 126

Other derivative instruments:

Trading commodity . .. .. .... ..... ......... .. 487 37,019

—

37,506 (21,352) 16,154

Electric commodity ... .. .. .. .......... ......

—

—

3,619 3,619 (1,226) 2,393

Natural gas commodity . .. .. .......... ..... ..

—

1,595

—

1,595 (1,219) 376

Total current derivative assets . .. .. .. ..... .. . $ 487 $ 38,740 $ 3,619 $ 42,846 $ (23,797) 19,049

Purchased power agreements

(b)

.. .. .. .... .... .. . 35,030

Current derivative instruments .. .. .......... $ 54,079

N

oncurrent derivative assets

Derivatives designated as cash flow hedges:

Vehicle fuel and other commodity . .. .. ........ $

—

$ 150 $

—

$ 150 $

—

$ 150

Other derivative instruments:

Trading commodity . .. .. .... ..... ......... ..

—

32,621

—

32,621 (4,595) 28,026

Natural gas commodity . .. .. .......... ..... ..

—

1,246

—

1,246 (269) 977

Total noncurrent derivative assets . .. .. ...... $

—

$ 34,017 $

—

$ 34,017 $ (4,864) 29,153

Purchased power agreements

(b)

. .. .. .. ..... ..... 154,873

Noncurrent derivative instruments ... ..... ..... $ 184,026